Dow plunges 1,100 points in biggest fall for six years

Wall street suffered its worst one day fall in six years on Monday as stocks plunged in the final hour of volatile trading, wiping out gains for this year and leaving the benchmark Dow Jones index down 1,175.2 points or 4.6pc.

This left the blue-chip US index closing down 8.5pc from the all-time of high of 26,616.7, which it hit just ten days ago, at 24,345.8.

The sell-off extended sharp losses seen in New York on Friday, which were fuelled by jobs data from the US that showed wage growth surged well ahead of economists’ expectations to 2.9pc in the US in January.

This stoked concerns that the Federal Reserve, the US central bank, will have to hike rates to keep a lid on inflation, with economists pencilling in the prospect of extra rate rises by the US Federal Reserve this year.

The yield on 10-year US government bonds or Treasuries – a proxy for the cost of borrowing over the medium term – pushed past 2.80pc, but eased back to 2.71pc today.

Major markets around the world closed in the red on Monday as Asian and European markets took their cue from Friday’s sour mood in New York, with only the Shanghai Composite bucking the trend to end in the black, up 0.7pc.

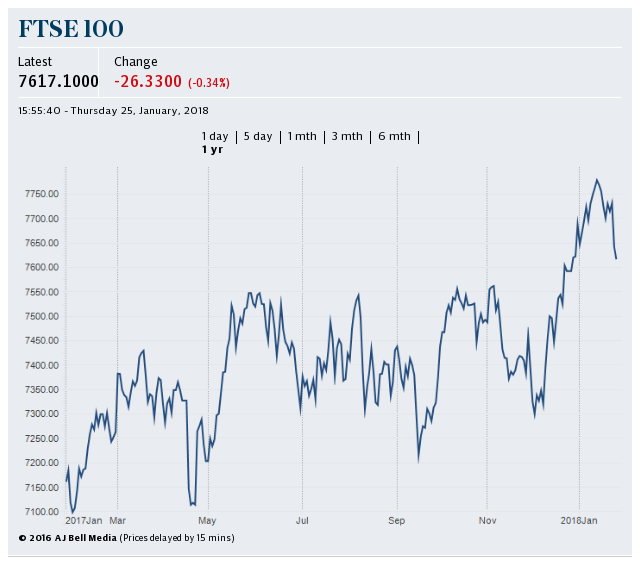

The UK’s benchmark FTSE 100 index suffered its sharpest drop in 10 months, closing down 1.5pc, as investors became gripped by the prospect of higher borrowing costs and monetary stimulus around the world being pulled away sooner than had been anticipated. Across Europe, with Frankfurt’s Dax off 0.8pc and the CAC in Paris down 1.5pc.

The sell-off on Wall Street accelerated after European markets closed, with losses more than doubling in the final hour, which analysts attritubed to the impact of computer-driven trading

Jeffrey Kleintop of Charles Schwab said: “I certainly don’t see anything fundamental. It wasn’t driven by any macro event, rather it appears to be computer driven trading that led to an order imbalance. These things can happen quickly and tend to be corrected quickly… As long as growth remains intact, and we believe it will, stocks should rebound.”

Dennis Dick, a proprietary trader at Bright Trading in Las Vegas, said: “You’ve got to be prepared for all types of markets, and a lot of people who have been in this market for the past three or four years have never seen this before... The psychology of the market changed today. It’ll take a while to get that psychology back.”

Markets first wobbled on Wednesday evening when the Fed adopted a more relaxed tone on inflation, saying that it expected inflationary pressures to build during 2018.

“The fundamentals tell us that this should not be a prolonged sell-off in markets,” said Nandini Ramakrishnan of JPMorgan Asset Management. “Growth is still very strong and inflation is still somewhat in check.”

Policymakers at the central bank were concerned that raising rates too quickly could smother sluggish inflation but it dropped its gloomy outlook on inflation last week.

The fundamentals tell us that this should not be a prolonged sell-off in markets

Nandini Ramakrishnan of JPMorgan Asset Management

“Whether you’re an institution, a big investor or even a personal investor, you have less money to play around with if interest rates are higher at central banks across the world or just in your local economy,” explained Ms Ramakrishnan on why stocks are dropping.

The president of the European Central Bank, Mario Draghi, in its latest policy meeting failed to convince markets that it would not tighten monetary policy quicker than initially planned amid buoyant economic growth on the Continent and markets are beginning to price in the prospect of an early rate rise in May or June in the UK.

Yahoo Finance

Yahoo Finance