Down over 40%, analysts expect fast growth from these UK shares

I’m very selective about the companies I choose to invest in. There are only about 10 companies in my portfolio at any given time, these UK shares included.

What I love about RS Group (LSE:RS1) is that it seems to offer the two critical elements I look for when investing. The first is good value for money. The second is good future growth expectations.

Supplying the world’s engineers

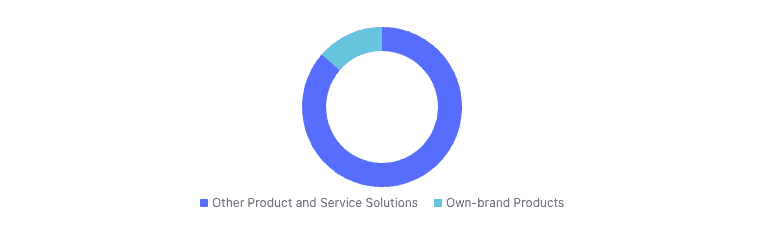

RS Group is a distributor of industrial and electronic products, and most of its revenue doesn’t come from its own-brand products. Instead, it sources and resells components, with its main customers being engineers and machine builders.

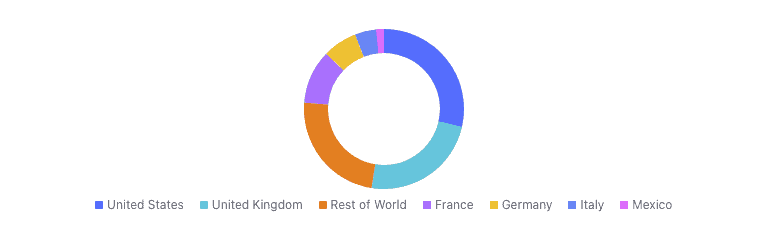

What I love about this business is that it’s well-diversified around the world. That means a lot to me because I don’t want all my money tied up in one economy in case something goes wrong in that country.

It has over 2,500 suppliers, and its largest distribution channel is e-commerce. I like that; as a techie myself, I see massive financial benefits to harnessing digital points of sale.

The financials that sold me

First of all, with the shares down over 40%, I already knew this could be an opportunity for me.

But the price isn’t enough. I also need to know if the market has fairly valued it.

And based on a model called discounted earnings, the firm looks to be selling at a 20% discount or more. That’s if I forecast 10% annual growth in its earnings over the next decade. Over the past 10 years, it’s managed 17% a year.

But what’s more, from 2024 onwards, analysts are expecting the business to grow its net income at 12.5% a year. That’s after a -28.6% decline expected this year.

I love the decline, because it’s sending the share price down for me to buy a bigger stake before the growth resumes.

As Warren Buffett said: “When it [a stock] goes down we love it, because we’ll buy more. And if it goes up, it kills us to buy more.”

What about the risks?

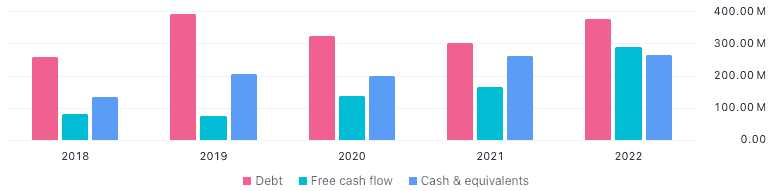

One of the elements of the business I would like to be better is its balance sheet. With more liabilities than equity, it should be careful how it spends its earnings, in my opinion.

With quite a bit more debt than cash on its books right now, it can’t pay off all its obligations immediately. And if some crisis occurs that causes it to take on even more leverage, that would be a problem for me as a shareholder.

Also, with the advent of AI, I don’t think it’s unlikely eventually for a competitor to arise similar to Amazon, offering a more efficient, more profitable, automated delivery and selection service.

It’s in my portfolio

As you can see, I’ve fully researched the risks and rewards of this one. I think it’s important to get a balanced perspective because, after all, knowing the downsides as well as the positives is how I protect myself from big losses.

In my opinion, the strengths outweigh the negatives here. So, I plan on holding my stake in RS Group for as long as the company remains strong. I might even add to my position soon.

The post Down over 40%, analysts expect fast growth from these UK shares appeared first on The Motley Fool UK.

More reading

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Oliver Rodzianko has positions in Amazon and Rs Group Plc. The Motley Fool UK has recommended Amazon and Rs Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance