DraftKings (NASDAQ:DKNG) Beats Expectations in Strong Q1, Full-Year Sales Guidance Is Optimistic

Fantasy sports and betting company DraftKings (NASDAQ:DKNG) announced better-than-expected results in Q1 CY2024, with revenue up 52.7% year on year to $1.17 billion. The company's full-year revenue guidance of $4.9 billion at the midpoint also came in 1.7% above analysts' estimates. It made a non-GAAP profit of $0.03 per share, improving from its loss of $0.51 per share in the same quarter last year.

Is now the time to buy DraftKings? Find out in our full research report.

DraftKings (DKNG) Q1 CY2024 Highlights:

Revenue: $1.17 billion vs analyst estimates of $1.12 billion (4.6% beat)

EPS (non-GAAP): $0.03 vs analyst estimates of -$0.11 ($0.14 beat)

The company lifted its revenue guidance for the full year from $4.78 billion to $4.9 billion at the midpoint, a 2.6% increase

Gross Margin (GAAP): 39.6%, up from 32.2% in the same quarter last year

Free Cash Flow was -$73.42 million, down from $71.05 million in the previous quarter

Market Capitalization: $19.89 billion

“DraftKings’ performance in the first quarter of 2024 was outstanding, reflecting healthy revenue growth and a scaled fixed cost structure that positions us to drive rapidly improving Adjusted EBITDA,” said Jason Robins, DraftKings’ Chief Executive Officer and Co-founder.

Getting its start in daily fantasy sports, DraftKings (NASDAQ:DKNG) is a digital sports entertainment and gaming company.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Sales Growth

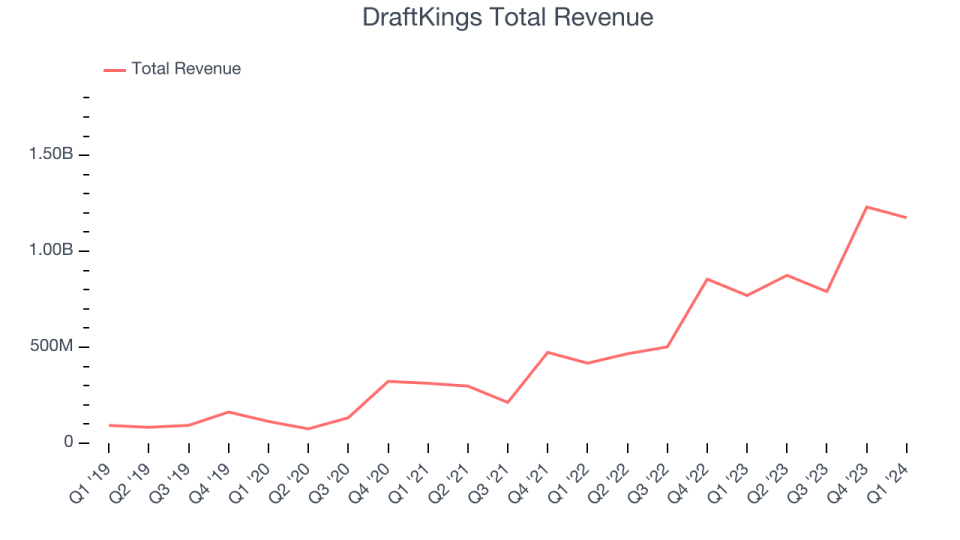

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. DraftKings's annualized revenue growth rate of 71.8% over the last five years was incredible for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. DraftKings's recent history shows its momentum has slowed as its annualized revenue growth of 70.5% over the last two years is below its five-year trend.

This quarter, DraftKings reported magnificent year-on-year revenue growth of 52.7%, and its $1.17 billion of revenue beat Wall Street's estimates by 4.6%. Looking ahead, Wall Street expects sales to grow 23.8% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

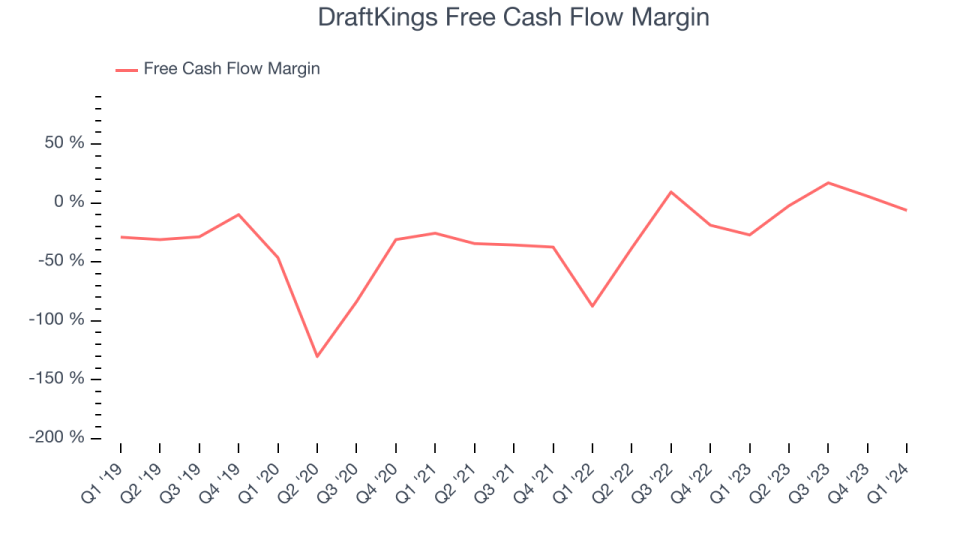

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, DraftKings's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 5.8%.

DraftKings burned through $73.42 million of cash in Q1, equivalent to a negative 6.2% margin, increasing its cash burn by 64.8% year on year.

Key Takeaways from DraftKings's Q1 Results

We were impressed by how significantly DraftKings blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed as its average revenue per monthly unique payer beat Wall Street's estimates ($114 vs estimates of $105).

During the quarter, DraftKings launched its sportsbook in Vermont and North Carolina. Looking ahead, the company raised its full-year revenue and EBITDA guidance to $4.9 billion and $500 million at the midpoint, both of which beat Wall Street's projections.

Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 1.8% after reporting and currently trades at $43.8 per share.

DraftKings may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance