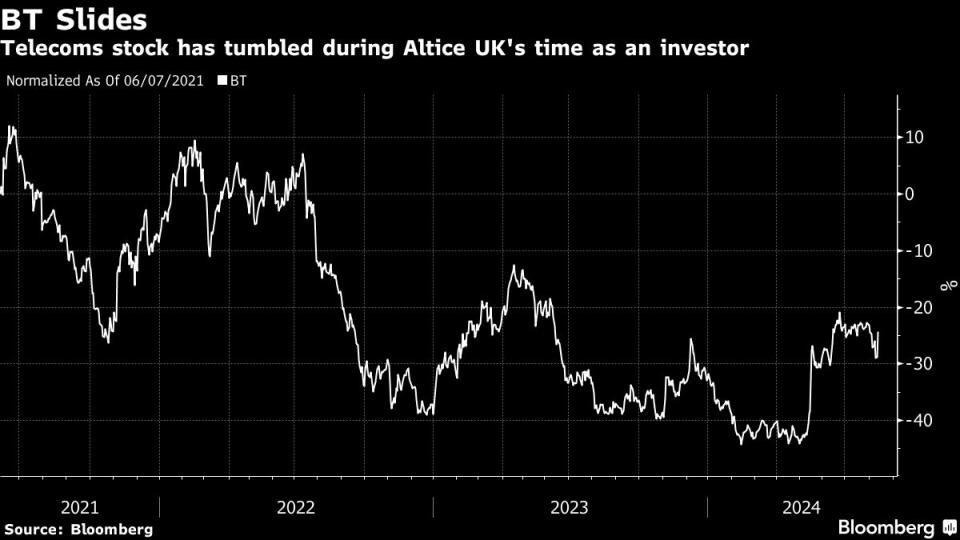

Drahi’s BT Exit Follows $1.3 Billion Drop in Stake’s Value

(Bloomberg) -- Patrick Drahi is selling out of BT Group Plc after his stake in the UK telecom company lost almost £1 billion ($1.3 billion) in value since he started building it more than three years ago.

Drahi’s Altice UK will sell the 24.5% holding to Bharti Global, an interest worth £3.18 billion as of Friday’s close. Altice acquired about 2.44 billion BT shares between June 2021 and May 2023, according to three stock exchange filings. The stock was valued at about £4.17 billion pounds based on the closing prices on the dates of the dealings.

Altice UK has been contacted for comment.

Read: India’s Bharti Swoops In to Buy 24.5% of BT From Troubled Altice

BT shares have slumped as the group faced heavy competition from smaller fiber-network builders such as CityFibre Ltd. BT’s network division, Openreach, lost almost 200,000 broadband lines in the quarter ending June as the pace of declines picked up.

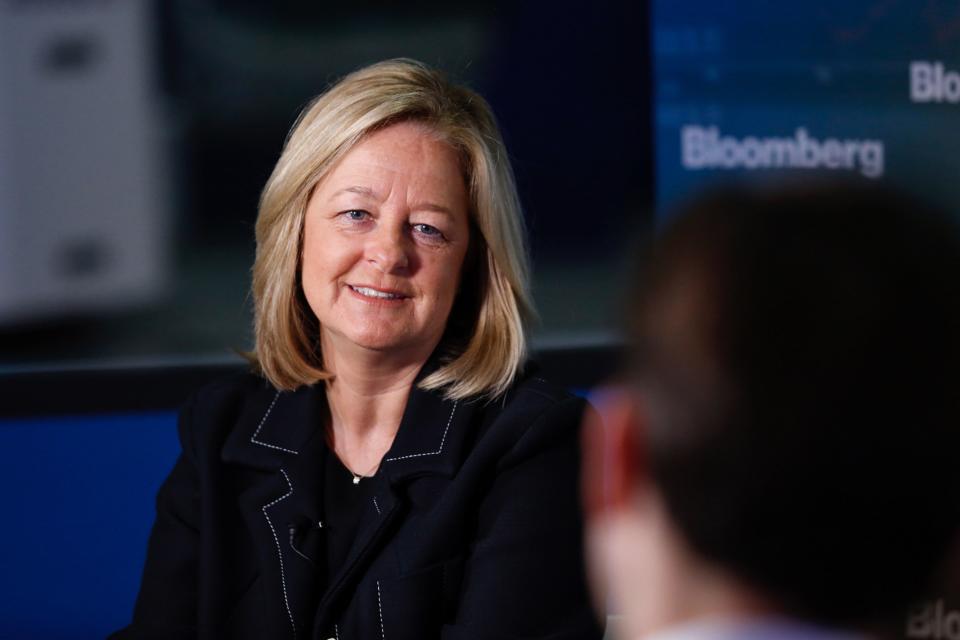

Still, the stock has risen about 36% from an April low after BT raised its dividend, ending a period of uncertainty after Allison Kirkby replaced Philip Jansen as chief executive officer.

To be sure, BT has declared a total of 23.4 pence a share in dividends during Altice’s time as an investor, softening the blow of the decline in stake value.

The shares rose 7.1% to 139.80 pence at 2:27 p.m.

--With assistance from Henry Ren.

(Updates stock price in last paragraph.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.