DS Smith Plc's (LON:SMDS) CEO Will Probably Struggle To See A Pay Rise This Year

Performance at DS Smith Plc (LON:SMDS) has not been particularly rosy recently and shareholders will likely be holding CEO Miles Roberts and the board accountable for this. At the upcoming AGM on 07 September 2021, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. The data we gathered below shows that CEO compensation looks acceptable for now.

See our latest analysis for DS Smith

How Does Total Compensation For Miles Roberts Compare With Other Companies In The Industry?

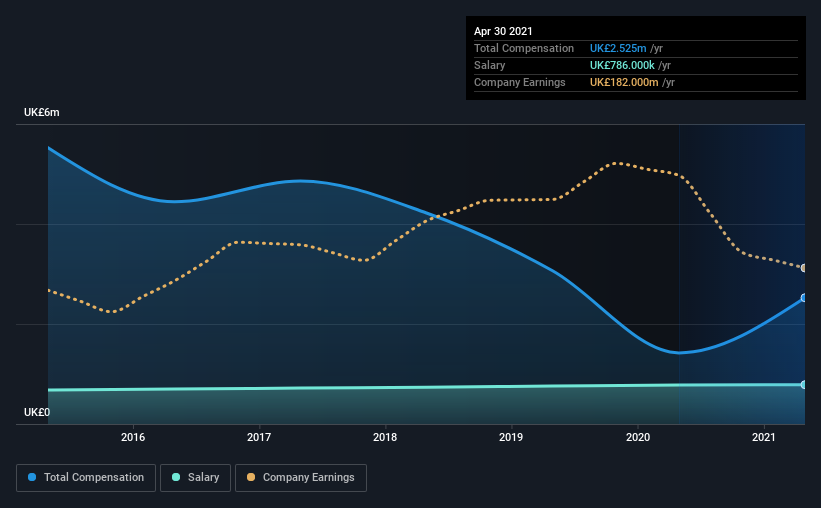

Our data indicates that DS Smith Plc has a market capitalization of UK£6.1b, and total annual CEO compensation was reported as UK£2.5m for the year to April 2021. That's a notable increase of 78% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at UK£786k.

On comparing similar companies from the same industry with market caps ranging from UK£2.9b to UK£8.7b, we found that the median CEO total compensation was UK£3.8m. In other words, DS Smith pays its CEO lower than the industry median. Moreover, Miles Roberts also holds UK£9.4m worth of DS Smith stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Component | 2021 | 2020 | Proportion (2021) |

Salary | UK£786k | UK£778k | 31% |

Other | UK£1.7m | UK£644k | 69% |

Total Compensation | UK£2.5m | UK£1.4m | 100% |

Talking in terms of the industry, salary represented approximately 73% of total compensation out of all the companies we analyzed, while other remuneration made up 27% of the pie. In DS Smith's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at DS Smith Plc's Growth Numbers

Over the last three years, DS Smith Plc has shrunk its earnings per share by 17% per year. Its revenue is down 1.1% over the previous year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has DS Smith Plc Been A Good Investment?

With a three year total loss of 3.2% for the shareholders, DS Smith Plc would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 4 warning signs for DS Smith that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance