DTE Energy (DTE) to Build 220MW Michigan Energy Storage Center

DTE Energy Company DTE has revealed that it is set to construct a 220-megawatt (MW) battery energy storage complex at the site of its former coal power plant in Trenton Channel, MI. This should expand DTE’s footprint in the rapidly expanding energy storage market.

Once completed, which is projected in 2026, the energy storage center is anticipated to be the largest stand-alone battery energy storage project in the Great Lakes region of Michigan.

Benefits of the Project

The new storage plant will stock excess electricity generation and deliver the same to DTE Energy’s customers in times of increased electricity demand. This will bring down the grid's load, eliminate the need to start and stop generating in response to demand fluctuations, and extend DTE's fleet of renewable energy sources. Such acceleration in clean energy supply might attract more consumers to choose DTE Energy as their preferred utility provider, thereby boosting its top-line results.

Almost 40,000 houses will be powered by 880 megawatt-hours of electricity that the new Trenton Channel Energy Center is expected to store. This, in turn, will put DTE a step ahead of achieving its target of more than doubling the overall energy storage capacity by 2042.

The energy storage center, on completion, will also play a critical role in DTE Energy meeting its net zero carbon emissions goal by 2050.

DTE’s Growing Prospects

With the entire globe progressing toward a greener future, there is a noticeable shift in the utility sector as more renewable energy sources are being added by corporations to their generation portfolio. This, in turn, has been boosting the need for battery storage solutions, which enable efficient energy management, grid stability and reliability, thereby ensuring a consistent power supply.

To this end, the Mordor Intelligence firm expects the global Battery Energy Storage market to witness a CAGR of 8.7% over the 2024-2029 period. Hence, to reap the benefits of this expanding market, DTE Energy is steadily enhancing its footprint in this space. The latest project in the Great Lakes region bears an example of DTE’s efforts to gain traction in the battery energy storage market.

To this end, it is imperative to mention that DTE Energy aims to invest $7 billion in cleaner generation, including renewables, over 2024-2028. DTE plans to retire its remaining six coal-fired generating units and expects to convert them with a combination of renewables, energy waste reduction, demand response, battery storage and natural gas-fueled generation. Therefore, we may expect the company to come up with more energy storage projects in the near future.

Peers to Benefit

Apart from DTE, prominent utility players like CMS Energy Corporation CMS, Alliant Energy Corp. LNT and NextEra Energy, Inc. NEE are expanding their footprint to reap the benefits of the expanding Battery Storage Market.

CMS Energy plans to deploy battery storage beginning in 2024, with 75 MW of energy storage by 2027 and an additional 475 MW by 2040. The company aims to add 800 MW of battery storage by 2030.

CMS’s long-term earnings growth rate is 7.6%. The Zacks Consensus Estimate for 2024 sales implies a rise of 9.4% over the 2023 reported figure.

Alliant Energy is working to integrate emerging technologies and optimize energy resources, such as wind and solar power, as well as battery storage. In August 2023, the company received approval from the Public Service Commission of Wisconsin to construct utility-scale battery storage facilities co-located at two of its solar sites. The two storage projects, the 100-MW battery project at Grant County Solar and the 75-MW battery project at Wood County Solar, are expected to be completed by the fall of 2025.

Alliant Energy’s long-term earnings growth rate is 6.1%. The Zacks Consensus Estimate for LNT’s 2024 sales implies an improvement of 11% from the prior-year figure.

NextEra Energy’s subsidiary, NextEra Energy Resources, added approximately 1,025 MW of storage to its backlog in the first quarter of 2024. In June 2024, NextEra Energy Resources and Entergy announced a joint development agreement that would accelerate the development of up to 4.5 gigawatts of solar generation and energy storage projects.

NEE’s long-term earnings growth rate is 8%. The Zacks Consensus Estimate for the company’s 2024 sales implies an improvement of 3.3% from the prior-year reported figure.

Price Movement

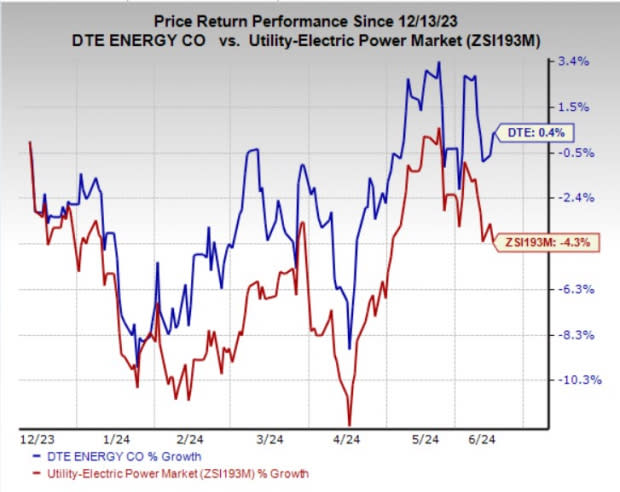

In the past six months, shares of DTE Energy have risen 0.4% compared with the industry’s decline of 4.3%.

Image Source: Zacks Investment Research

Zacks Rank

DTE Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance