Duke Energy (DUK) Commences Operations of Ledyard Project

Duke Energy Corporation’s DUK non-regulated commercial brand, Duke Energy Sustainable Solutions, recently announced the commencement of the operations of its Ledyard Windpower project in Kossuth County, Iowa.

Details of the Project

The Ledyard Windpower project has 46 Vestas V150 4.5-MW turbines. These have the capability to provide electricity to more than 75,000 U.S. homes.

Moreover, the project, which boasts a generation capacity of 207 megawatts (MW), has obtained a 15-year virtual power purchase agreement with Verizon. Per the agreement, Duke Energy will supply 180 MW of power from the Ledyard project to Verizon. This entails steady revenue generation prospects for DUK from the project in the long term.

Duke Energy’s Growth Prospects in Iowa

Per the report from the Iowa Environmental Council, wind acts as the main source of electricity generation in Iowa. Also, more than 14,700 MW are expected to get added in the next few years.

Moreover, buoyed by its cost-effective feature, even without incentives, electricity generation from wind is expected to increase by leaps & bounds in the region. Hence, the recent addition of the wind power project by Duke Energy in Iowa may prove to be prudent and open avenues for more such capacity additions in the region by the company.

Duke Energy’s Investments in Renewables

The latest report from the EIA suggests that 18% of the U.S. electricity generation in 2024 will be from combined utility-scale solar and wind generation. This signifies an increase from 16% of the U.S. electricity generation in 2023. This entails opportunities for utilities like Duke Energy to expand their footprint in the U.S. renewable energy market.

To expand in the renewable energy market, Duke Energy has already been significantly investing in renewable projects. DUK’s solar and wind power businesses boast an investment of $5 billion, while it owns and operates approximately 500 MW of photovoltaic solar power projects at more than 50 solar plants across the country as of Sep 30, 2022.

The recent project in Iowa by the company enhances its presence in the renewable landscape and adds to its commitment to duly meet its target in 2050.

Peer Moves

Utilities that have been boosting their renewable portfolio to steadily expand in the renewable space are as follows:

American Electric Power Company’s AEP plans include growing its renewable generation portfolio to approximately 50% of the total capacity by 2030. Its 2023-2027 capital investment forecast includes $8.6 billion in the regulated renewable plan.

American Electric’s long-term earnings growth rate is pegged at 6.1%. AEP shares have increased 7.5% in the past year.

Ameren AEE targets to expand its renewable portfolio by adding 2,800 MW of renewable generation by the end of 2030 and a total of 4,700 MW of renewable generation by 2040 and 800 MW of battery storage by 2040.

Ameren has a long-term earnings growth rate of 6.9%. AEE shares have returned 1.9% in the past year.

CMS Energy CMS aims at spending $2.8 billion on renewables, which includes investments in wind, solar and hydroelectric generation resources in the 2022-2026 period. The company aims at achieving net-zero methane emissions by 2030 and net-zero carbon emissions by 2040.

CMS Energy boasts a long-term earnings growth rate of 8.2%. CMS shares have returned 1.6% to its investors in the past year.

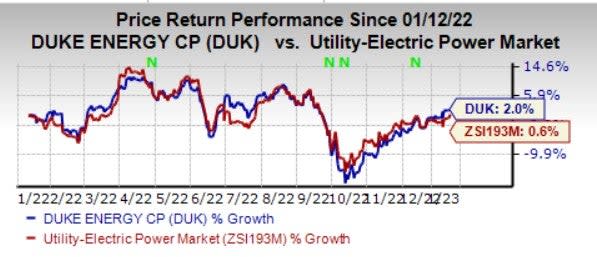

Price Movement

In the past year, shares of Duke Energy have increased 2.0% compared with the industry’s rise of 0.6%.

Image Source: Zacks Investment Research

Zacks Rank

Duke Energy currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance