Duke Energy's (DUK) Arm to Reduce Energy Bills in Florida

Duke Energy Corp’s DUK subsidiary, Duke Energy Florida, recently unveiled its plans to reduce new rate increase impact on bills by 33% for 2022. This move might attract more customers, thereby resulting in a modest customer growth for the company.

Duke Energy Florida, in collaboration with other customer groups, has chalked out a strategy to spread approximately $247 million in unrecovered fuel costs over a period of two years for its customers. Per the deal, immediate recovery of costs related to recent storms will also be waived-off.

Customers to Benefit from Rate Reduction

The aforementioned rate reduction measures will effectively result in a residential customer of Duke Energy Florida, using 1,000 kilowatt-hours (kWh), to witness a decrease of up to $4.67 in the monthly bill, beginning January 2022.

Duke Energy Florida has been focusing on helping customers struggling financially due to the pandemic, by providing assistance to reduce their energy bills. As part of the measures announced by Duke Energy, a $30 assistance incentive will be provided to lower-income customers in the form of a gift card. The company intends to remove the fees for residential homeowners who pay their bills by credit card beginning in 2022.

Looking Ahead

Duke Energy’s long-standing plans include expansion of its scale of operations and implementation of modern technologies at the utility’s facilities, by investing heavily in infrastructure and expansion projects. To this end, it is worth mentioning that the company has a robust five-year capital plan and currently intends to invest $59 billion in its overall growth projects during the 2020-2025-time period. Such investments are anticipated to boost Duke Energy’s utilization of new technology in generation and distribution systems, thereby enabling the utility to further reduce rates for its customers.

Peer Moves

Alongside Duke Energy, other major utility companies such as Public Service Enterprise Group PEG and PPL Corporation PPL have announced their plans to reduce electric rates for their customers.

In July, Public Service Enterprise’s subsidiary, PSE&G, teamed up with the New Jersey Board of Public Utilities and the New Jersey Division of Rate Counsel to lower transmission rates for customers. Per the agreement, the rate for the typical residential customer bill is supposed to have decreased by 3% in monthly bills, effective from Aug 1, on being approved.

Likewise, PPL Corp.’s subsidiary, PPL Electric Utilities, proposed in August to reduce the transmission rates effective from December 2021. The rate reduction will result in savings of $1.54 for residential customers and $2.15 for business customers on a monthly basis for a one-year period, if approved.

Price Movement

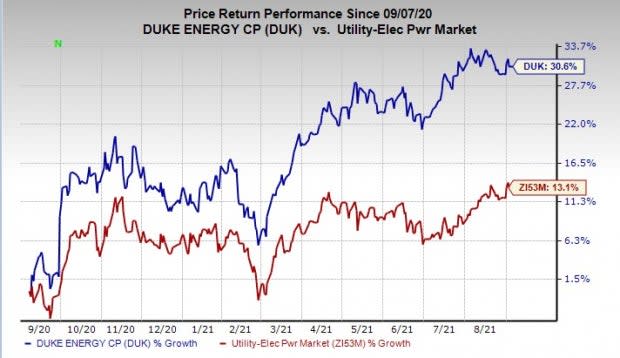

In the year-to-date period, Duke Energy’s shares have gained 30.6% compared with the industry’s growth of 13.1%.

Image Source: Zacks Investment Research

Zacks Rank & a Key Pick

Duke Energy currently carries a Zacks Rank #3 (Hold). A better-ranked stock from the same space is Exelon EXC, which currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Exelon’s long-term earnings growth rate currently stands at 3%. The Zacks Consensus Estimate for 2021 earnings has moved north by 1.1% to $2.81 in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelon Corporation (EXC) : Free Stock Analysis Report

PPL Corporation (PPL) : Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance