Duke Realty (DRE) Tops Q2 FFO Estimates, Raises '21 View

Duke Realty Corporation’s DRE second-quarter 2021 core funds from operations (FFO) per share of 44 cents surpassed the Zacks Consensus Estimate of 43 cents. The figure also increased 15.8% from the year-ago tally of 38 cents.

Results reflect improved occupancy, rental rate growth and new developments being leased. The company recorded its highest quarterly rent growth ever on second generation leasing activity. Moreover, backed by the impressive second-quarter performance and improved outlook for the rest of the year, Duke Realty raised the 2021 earnings and development guidance.

Revenues of $271.7 million climbed 13.9% on a year-over-year basis. The figure also surpassed the Zacks Consensus Estimate of $256.3 million.

Quarter in Detail

Duke Realty leased 7.6 million square feet of space during the June-end quarter. Tenant retention was 77.5% for the reported quarter and 93.9% after considering immediate backfills.

Additionally, the company registered same-property net operating income (NOI) growth of 5.5%, year over year. This upside was backed by rental rate growth and the expiration of free rent periods, partially offset by a 30-basis point contraction in occupancy within the company’s same-property portfolio.

Duke Realty reported overall cash and annualized net effective rent growth on new and renewal leases of 19.2% and 36.2%, respectively, during the second quarter.

As of Jun 30, 2021, the company’s total portfolio, including properties under development, was 94.6% leased, shrinking 90 basis points (bps) from the end of the previous quarter and 70 bps from end of the prior-year quarter. Stabilized in-service portfolio was 98.2% leased as of Jun 30, 2021, up 10 basis points sequentially and 90 bps from the prior-year quarter end.

Duke Realty exited second-quarter 2021 with $8.25 million of cash and cash equivalents, up from $6.3 million as of Dec 31, 2020.

The company issued 3.4 million shares during the quarter, reaping $156 million of net proceeds, under its ATM program at an average price of $46.35 per share.

Portfolio Activity

During the April-June period, Duke Realty’s income producing real estate acquisitions totaled $260 million, while building dispositions aggregated $183 million.

The company started five new speculative development projects with expected costs of $197 million during the quarter. As of Jun 30, 2021, its development projects under construction were 49% leased, while 97% of the undeveloped land inventory was concentrated in coastal Tier One markets.

Dividend Update

Duke Realty announced aquarterly cash dividend on common stock of 25.50 cents per share. The dividend for the second quarter will be paid out on Aug 31, to shareholders on record as of Aug 16, 2021.

2021 Guidance

Duke Realty has revised the 2021 guidance for core FFO per share to $1.69-$1.73 from the $1.65-$1.71 provided earlier. At the mid-point, this projects a 12.5% increase year on year. The Zacks Consensus Estimate for the same is currently pinned at $1.69.

For the remainder of the year, the company anticipates continued strong leasing activity, and minimal bad debt expense and tenant defaults.

On anticipations of solid operational results, the company has revised the guidance for average percentage leased of its stabilized portfolio to 97.8-98.6% compared with the previous band of 97.2-98.6%.

Backed by these factors and along with strong rental rate growth on the recently-executed leases, management revised the same-property NOI growth estimates, on a cash basis, to 4.75-5.25% from 4.1-4.9%.

Property dispositions are projected in the range of $1-$1.2 billion compared with the previous outlook of $900 million-$1.10 billion, highlighting better-than-expected pricing. Property acquisitions are expected to be $350-$550 million compared with the $300-$500 million estimated earlier, focused on coastal in-fill markets.

Development starts for 2021 are now projected at $1.1-$1.3 billion compared with the prior guidance of $950 million-$1.15 billion.

Currently, Duke Realty carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

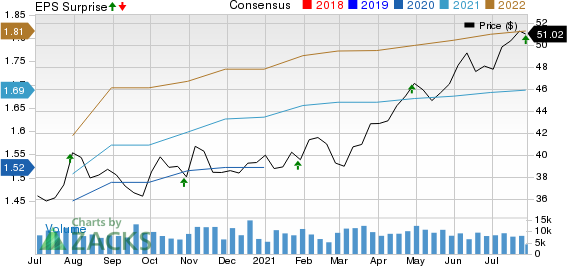

Duke Realty Corporation Price, Consensus and EPS Surprise

Duke Realty Corporation price-consensus-eps-surprise-chart | Duke Realty Corporation Quote

Performance of Another Industrial REIT

Prologis, Inc. PLD reported second-quarter 2021 core FFO per share of $1.01, beating the Zacks Consensus Estimate of 99 cents. Results reflected all-time low vacancies in its markets that aided rent growth and valuation increases. Further, the industrial REIT raised the 2021 outlook. (Read more: Prologis Beats Q2 FFO Estimates, Raises 2021 Guidance)

We now look forward to the earnings releases of other two REITs — Vornado Realty Trust VNO and Realty Income Corporation O — both of which are slated to release second-quarter results on Aug 2.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prologis, Inc. (PLD) : Free Stock Analysis Report

Duke Realty Corporation (DRE) : Free Stock Analysis Report

Vornado Realty Trust (VNO) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance