Should You Dump Ericsson (ERIC) From Your Portfolio Now?

A lot has been happening in the network infrastructure and 4G deployment field, and Ericsson ERIC has, no doubt, been quite in the thick of things. Even so, the company has been in a tough spot in recent times, dragged by low investments in mobile broadband and weak demand.

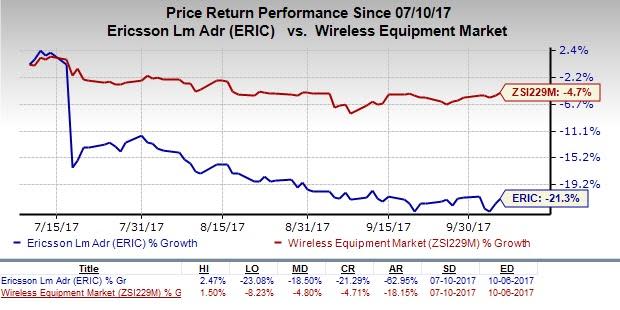

The beleaguered infrastructure giant’s repeated earnings misses, eroding profitability and precipitous revenue decline have left investors high and dry. The stock has lost 21.3% in the past three months, much wider than the industry’s average decline of 4.7%.

Most of the company’s troubles have stemmed from drying-up investments by major telecom equipment makers across the world. Particularly, uncertainty in the financial markets, reduced consumer telecom spending and delayed auctions of spectrums pose significant threats for Ericsson. The company’s revenues and margins in the Networks and IT & Cloud segments continue to take a grave beating from adverse industry trends.

Further, in the second-quarter 2017 earnings report, Ericsson said that it expects a “high single-digit percentage” drop in the market for radio access networks this year, which is worse than previously projected. Network equipment sales, particularly in the North America and Europe markets, continue to contract.Europe and Latin America — the markets with the biggest impact — are likely to have an increasingly challenging investment environment in the quarters to come.

Overall, the company expects the negative industry trends and business mix in mobile broadband to prevail this year as well.

We believe the only potential upside to earnings in the near future depends mostly on expense management. Ericsson had earlier announced a restructuring plan to cut costs and streamline the company’s focus areas, as well as explore options for the media business. The company now plans to reduce capitalization of its product platform, software-release development costs and hardware costs, which could cut operating income for the second half of 2017 by SEK 2.9 billion.

Ericsson further intends to implement cost savings with an annual run rate effect of at least SEK 10 billion ($1.2 billion) by mid-2018. Thus, more restructuring charges are knocking on Ericsson’s door and we have a subdued view of operator spending and investments in R&D. Currently, it appears the company’s savings plans and job reductions are not nearly enough to counter macroeconomic woes and swiftly declining product demand.

There is also an elevated risk of market and customer project adjustments, which can have a negative impact of SEK 3-5 billion on the operating income in the coming 12 months. In the last quarterly report, Ericsson’s CEO warned that an uncertain market could wipe out as much as SEK 5 billion of operating income over the next year.

Ericsson plans to accelerate its planned cost cuts and scale back expansion plans that aren’t moving as anticipated, and refocus on the company’s core business of selling networking equipment prior to the anticipated roll-out of 5G networks.

In view of the numerous headwinds, several analysts have downgraded Ericsson since September, as they have a bleak view of the company's revenues and margins. They believe that a rollout of the 5G technology won't provide enough of a boost to the company's revenue base. Investors who are looking for exposure to the upcoming 5G upgrade cycle or Internet of Things might look at players like Nokia Corporation NOK and Cisco Systems, Inc. CSCO.

The consensus analyst community is showing no favor toward the stock either, as earnings estimates continue the steep downward trend. The Zacks Consensus Estimate for full-year 2017 has fallen from earnings of 4 cents to a loss of 1 penny in the past 60 days, dragged by three downward estimate revisions versus none upward.

Ericsson Price and Consensus

Ericsson Price and Consensus | Ericsson Quote

Nevertheless, Ericsson still expects to stabilize its operations amid a difficult market next year and remains hopeful of reaching its targeted operating margin of 12% beyond 2018.Its restructuring plan will help streamline Ericsson’s focus areas, improve profitability, and revitalize its technology and market leadership. Ericsson also plans to explore options for the company’s media business and review “low-performing” contracts in its managed service business.

Whether these steps will allow Ericsson to jump back on the growth track, remains to be seen. However, as of now, we have a Zacks Rank #5 (Strong Sell) on the stock, as we are deeply concerned over the effect of the restructuring and tough market conditions on the company’s profits and share price in the near term.

Stocks to Consider

A better-ranked stock in the broader sector is Red Hat, Inc. RHT, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Red Hat has a robust earnings surprise history, with an average positive surprise of 7%, driven by three earnings beats over the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Ericsson (ERIC) : Free Stock Analysis Report

Nokia Corporation (NOK) : Free Stock Analysis Report

Red Hat, Inc. (RHT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance