Duolingo (NASDAQ:DUOL) Exceeds Q1 Expectations But Stock Drops 14.7%

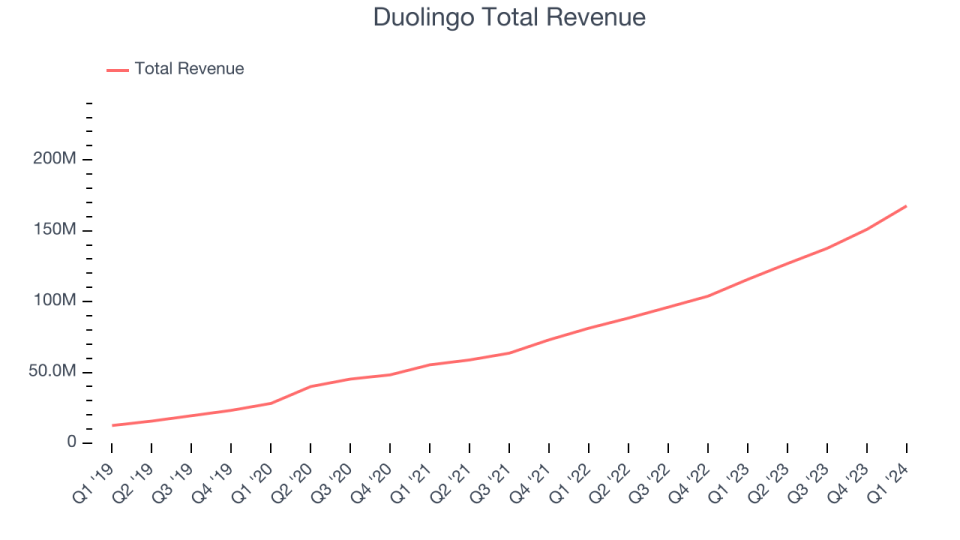

Language-learning app Duolingo (NASDAQ:DUOL) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 44.9% year on year to $167.6 million. The company expects next quarter's revenue to be around $176.3 million, in line with analysts' estimates. It made a GAAP profit of $0.57 per share, improving from its loss of $0.06 per share in the same quarter last year.

Is now the time to buy Duolingo? Find out in our full research report.

Duolingo (DUOL) Q1 CY2024 Highlights:

Revenue: $167.6 million vs analyst estimates of $165.7 million (1.1% beat)

EPS: $0.57 vs analyst estimates of $0.26 (117% beat)

Revenue Guidance for Q2 CY2024 is $176.3 million at the midpoint, roughly in line with what analysts were expecting

The company lifted its revenue guidance for the full year from $723.5 million to $731 million at the midpoint, a 1% increase

Gross Margin (GAAP): 73%, in line with the same quarter last year

Free Cash Flow of $79.62 million, up 67% from the previous quarter

Paid Subscribers: 7.4 million

Market Capitalization: $10.72 billion

“We are pleased to report another quarter of stellar performance, with strong bookings and revenue growth, alongside record profitability,” said Luis von Ahn, Co-Founder and CEO of Duolingo.

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ:DUOL) is a mobile app helping people learn new languages.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Sales Growth

Duolingo's revenue growth over the last three years has been impressive, averaging 45.7% annually. This quarter, Duolingo beat analysts' estimates and reported excellent 44.9% year-on-year revenue growth.

Guidance for the next quarter indicates Duolingo is expecting revenue to grow 39% year on year to $176.3 million, slowing from the 43.5% year-on-year increase it recorded in the comparable quarter last year. Ahead of the earnings results, analysts were projecting sales to grow 33.4% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Key Takeaways from Duolingo's Q1 Results

We were impressed by Duolingo's exceptional revenue growth this quarter, driven by more paid subscriber additions than expected. We were also glad its EPS blew past analysts' estimates. On the other hand, its revenue guidance for next quarter was underwhelming, though it upgraded its full-year revenue and EBITDA outlook, topping projections. Zooming out, we think this was a decent quarter, showing the company is staying on track. Investors were likely disappointed by the quarterly guidance, however, and the stock is down 14.7% after reporting. It currently trades at $208.75 per share.

So should you invest in Duolingo right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance