DXP Enterprises Inc (DXPE) Reports Q1 2024 Earnings: Misses Revenue and Earnings Projections

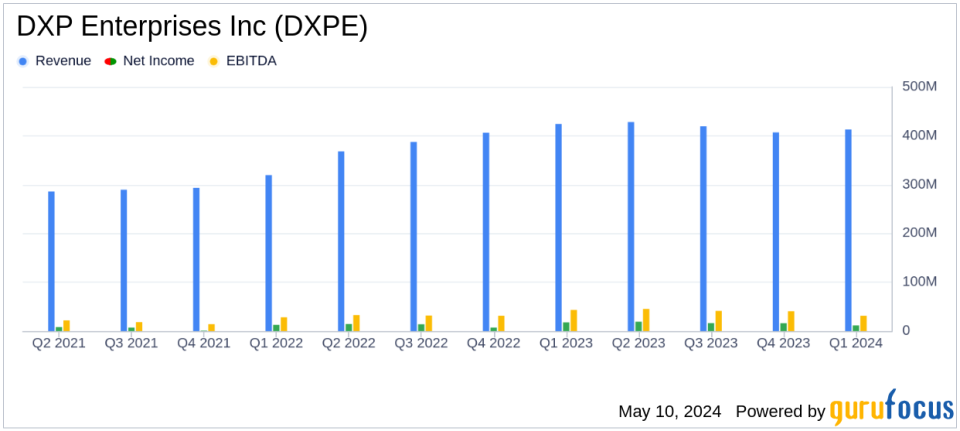

Revenue: $412.6 million, down 2.7% year-over-year from $424.3 million, below estimates of $457.0 million.

Net Income: $11.3 million, down significantly from $17.6 million in the prior year, below the estimated $16.0 million.

EPS (Non-GAAP diluted): $0.74, compared to $0.95 year-over-year, below the estimated $0.94.

Free Cash Flow: Increased to $24.1 million, up 6.4% from $22.6 million in the previous year.

Adjusted EBITDA: $40.3 million, down from $43.1 million year-over-year, with a margin decrease to 9.8% from 10.2%.

Acquisitions: Completed the acquisitions of Hennesy Mechanical Sales, Kappe Associates, and Pro-Seal, Inc., enhancing service offerings and market reach.

Cash Position: Ended the quarter with $139.7 million in cash, supporting strategic initiatives and operational needs.

DXP Enterprises Inc (NASDAQ:DXPE), a prominent distributor of products and services to industrial customers, released its 8-K filing on May 8, 2024, detailing the financial outcomes for the first quarter ended March 31, 2024. The Houston-based company reported a decrease in sales and earnings per share compared to the previous year, alongside the execution of strategic acquisitions aimed at bolstering its market position.

Company Overview

DXP Enterprises operates through three main segments: Service Centers, Innovative Pumping Solutions, and Supply Chain Services, with the majority of its revenue generated from the Service Centers segment. The company offers a comprehensive range of products and services including pumping solutions, supply chain services, and maintenance for various industrial applications. Its broad market reach spans across sectors such as General Industrial, Oil & Gas, and more.

Financial Performance Insights

For Q1 2024, DXP reported sales of $412.6 million, a slight increase of 1.4% sequentially from $407.0 million in Q4 2023 but a decrease of 2.7% from $424.3 million in Q1 2023. The company's net income stood at $11.3 million, significantly lower than the $17.6 million recorded in the same quarter the previous year. Earnings per diluted share were reported at $0.67, down from $0.95 in Q1 2023, with adjusted EPS at $0.74.

The company's Adjusted EBITDA for the quarter was $40.3 million, reflecting a decrease from $43.1 million year-over-year. The Adjusted EBITDA margin also saw a slight contraction from 10.2% to 9.8%. Despite these challenges, DXP achieved a 6.4% year-over-year increase in free cash flow, amounting to $24.1 million, and completed three strategic acquisitions, enhancing its service capabilities and market reach.

Strategic Moves and Market Position

David R. Little, Chairman and CEO of DXP, emphasized the company's sequential sales growth and robust free cash flow generation. He noted the positive impact of recent acquisitions and expressed optimism about the company's performance trajectory for the remainder of 2024. CFO Kent Yee highlighted the importance of the acquisitions and the company's strong free cash flow, which supports its growth initiatives.

The balance sheet remains solid with $139.7 million in cash and a secured leverage ratio of 2.3:1.0. This financial stability is crucial as DXP aims to drive both organic and acquisition-driven growth throughout the fiscal year.

Segment Performance

Performance varied across DXP's business segments. The Service Centers segment saw a revenue decrease of 5.7% year-over-year, while the Innovative Pumping Solutions segment grew by 21.0%. The Supply Chain Services segment experienced a 7.5% decline in revenue. These mixed results reflect the diverse challenges and opportunities within the different areas of DXP's operations.

Conclusion

Despite falling short of analyst expectations for both revenue and earnings per share, DXP Enterprises Inc (NASDAQ:DXPE) is taking strategic steps to strengthen its market position through acquisitions and capitalizing on its robust free cash flow. The company's diversified service offerings and strategic focus on growth areas position it to potentially rebound and capitalize on market opportunities in the upcoming quarters.

Explore the complete 8-K earnings release (here) from DXP Enterprises Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance