E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – Tone Still Bullish Despite Technology Sector Weakness

September E-mini Dow Jones Industrial Average futures are trading slightly lower shortly before the close on Tuesday. The weakness is not a surprise since the market is up 10 days from its last main bottom, which usually produces a counter-trend move.

Investors remain optimistic over U.S.-China trade relations, but problems in the technology sector are weighing on the market. There are also concerns over a rotation away from growth stocks, which some say could lead to a broad-market decline. Recent strength in the energy and financial sectors could be a sign that investors are switching from growth to value stocks.

At 19:28 GMT, September E-mini Dow Jones Industrial Average futures are trading 26798, down 42 or -0.15%. This is up from the session low of 26717.

Daily Technical Analysis

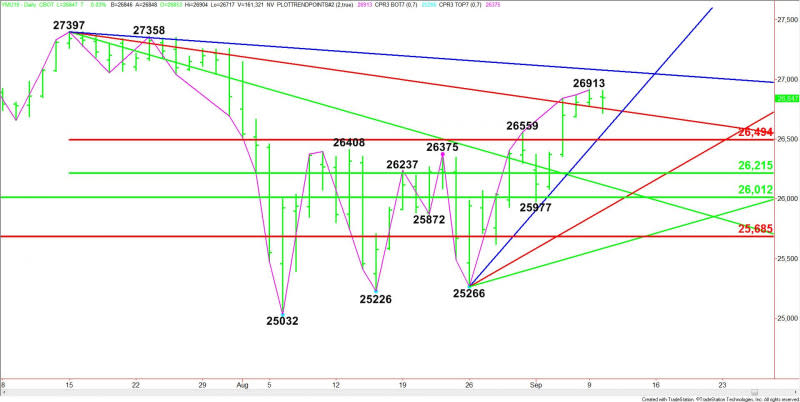

The main trend is up according to the daily swing chart. A trade through 26913 will signal a resumption of the uptrend. The main trend will change to down on a move through 25266. This is highly unlikely, but there is room for a short-term correction.

The minor trend is also up. A trade through 25977 will change the minor trend to down. This will also shift momentum to the downside.

The short-term range is 27397 to 25032. Its retracement zone at 26494 to 26215 is the first support zone. The second retracement zone target is 26012 to 25685.

Daily Technical Forecast

Based on Tuesday’s price action and the current price at 26798, the direction of the September E-mini Dow Jones Industrial Average into the close is likely to be determined by trader reaction to the downtrending Gann angle at 26757.

Bullish Scenario

The September E-mini Dow Jones Industrial Average futures contract has a chance to close higher for the session as long as it holds above the downtrending Gann angle at 26757. Taking out 26913 will signal a resumption of the uptrend with the next target angle coming in at 27077.

Bearish Scenario

A sustained move under 26757 will signal that the selling pressure is getting stronger. The first downside target angle comes in at 26546. This angle, moving up at a rate of 128 points per day from the 25266 main bottom, has been controlling the direction of the futures contract since August 26. If it fails then look for the selling to possibly extend into the short-term Fibonacci level at 26494.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance