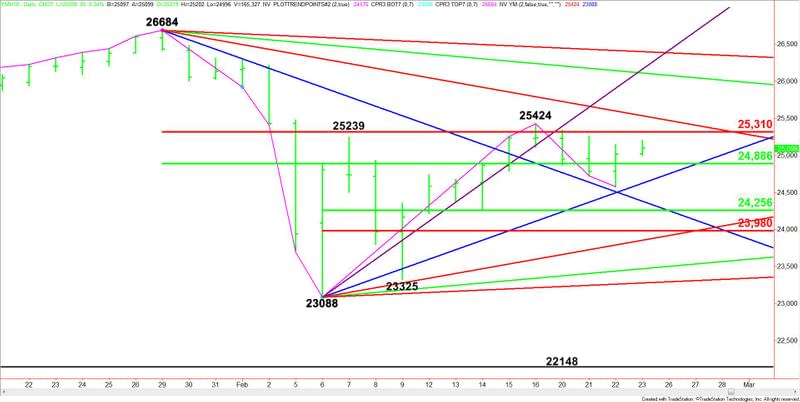

E-mini Dow Jones Industrial Average (YM) Futures Analysis – Trading Inside Main Retracement Zone on Low Volume

March E-mini Dow Jones Industrial Average futures are trading higher, but giving back most of its gains shortly before the close. The range is tight and the volume is average to below-average.

At 1945 GMT, the Dow is trading 25124, up 111 or +0.45%.

Daily Technical Analysis

The main trend is down according to the daily swing chart. A trade through 25424 will change the main trend to up. A move through 24576 will signal that the selling is getting stronger.

The main range is 26684 to 23088. The market is currently trading inside its retracement zone at 24886 to 25310. Trader reaction to this zone will determine the longer-term direction of the Dow.

The short-term range is 23088 to 25424. If there is a break then its retracement zone at 24256 to 23980 will become the primary downside target.

Daily Technical Forecast

Based on the current trade, the direction of the Dow into the close is likely to be determined by trader reaction to the retracement zone at 24886 to 25310.

A sustained move over 25310 will indicate the presence of buyers. This could trigger a change in trend through 25424 then a move into a steep downtrending Gann angle at 25532. This is the trigger point for an acceleration to the downside, however, we need volume to pick up.

A sustained move under 24886 will signal the presence of sellers. The next target is the steep uptrending Gann angle at 24624.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance