E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – Trade Deal Concerns Likely to Encourage More Profit-Taking

December E-mini Dow Jones Industrial Average futures closed lower on Friday in a lackluster post-holiday trade. Volume was extremely light with many of the major players on the sidelines. There wasn’t any major news per se, but investors did express some concerns over a possible retaliation from China after President Trump signed a pair of bills late Wednesday supporting the pro-democracy protesters in Hong Kong.

On Friday, December E-mini Dow Jones Industrial Average futures settled at 28073, down 75 or -0.27%.

Daily Technical Analysis

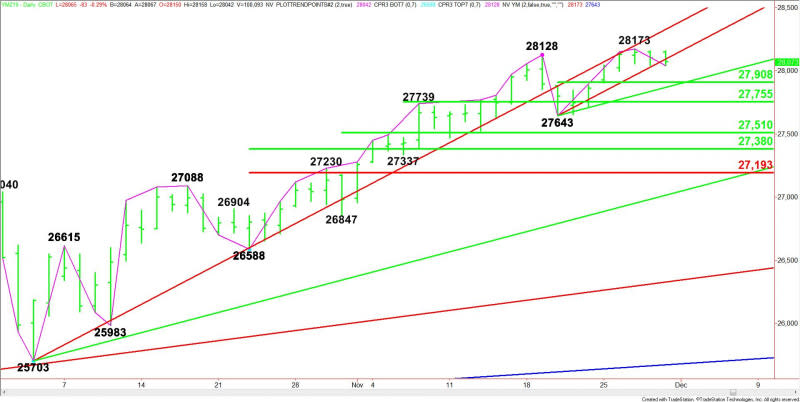

The main trend is up according to the daily swing chart. A trade through 28173 will signal a resumption of the uptrend. The main trend will change to down on a move through the last swing bottom at 27643.

The short-term range is 27643 to 28173. Its 50% level at 27908 is the first downside target.

The minor range is 27337 to 28173. Its 50% level at 27755 is the second downside target.

The second minor range is 26847 to 28173. Its 50% level is 27510.

Short-Term Outlook

The market closed lower on Friday. The move was likely fueled by a combination of position-squaring, profit-taking and the lack of buyers.

The Dow also closed on the weak side of an uptrending Gann angle at 28091. This could be the first sign of a top. If it continues then look for the selling to possibly extend into the 50% level at 27908 and the next uptrending Gann angle at 27867.

The selling could start to open up to the downside under 27867 with the next target the 50% level at 27755. This is the last potential support level before the 27643.

The last leg up from 27643 was primarily fueled by optimism over a trade deal between the United States and China. It makes sense that if we take away this optimism, the market may retrace the entire rally.

Furthermore, investors seem to be buying without any concern over value. So if the buying dries up and investors begin to book profits then we can expect a pullback into a support zone or value area.

With investors renewing concerns over U.S.-China trade relations, we expect them to use this as an excuse to continue to trim positions until the news turns positive again or the market retreats into a support or value area.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance