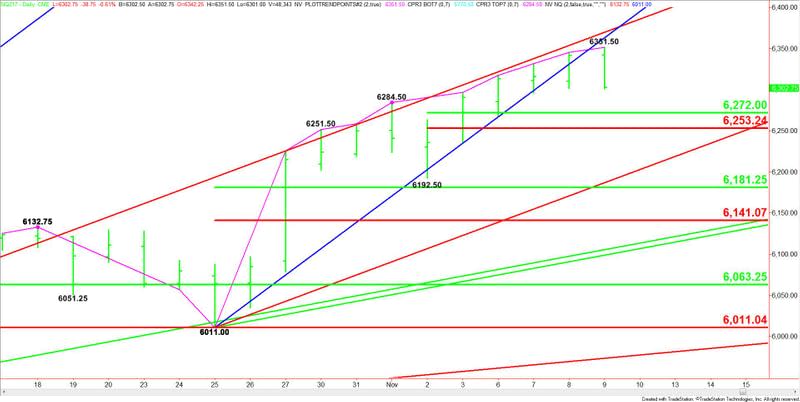

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – November 9, 2017 Forecast

December E-mini NASDAQ-100 Index futures are trading lower. The early price action has put the index in a position to post a potentially closing price reversal top on the daily chart. The market is also very close to turning lower for the week.

Daily Technical Analysis

The main trend is up according to the daily swing chart. Today’s steep sell-off may look like a shift in momentum to down, but it is only one session so it’s too early to tell.

A trade through 6351.50 will signal a resumption of the uptrend.

The nearest minor bottom is 6192.50.

The short-term minor range is 6192.50 to 6351.50. Its retracement zone at 6272.00 to 6252.25 is the first downside target. Since the main trend is up, we could see a technical bounce on the first test of this zone. Buyers are going to try to form a secondary higher top.

The main range is 6011.00 to 6351.50. If there is an acceleration to the downside, its retracement zone at 6181.25 to 6141.00 will become the next major target.

Daily Technical Forecast

If the downside momentum continues then look for a possible break into the short-term retracement zone at 6272.00 to 6253.25. We’re looking for buyers to show up on a test of this zone.

If 6253.25 fails as support then look for a possible acceleration to the downside with the next targets coming in at 6187.00 and 6181.25.

Additional targets are the main Fibonacci level at 6141.00 and a pair of uptrending Gann angles at 6106.00 and 6098.50.

On the upside, the targets are today’s high at 6351.50 and a pair of uptrending angles at 6363.00 and 6370.00. Crossing to the strong side of 6370.00 will put the index in a bullish position.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance