E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – November 14, 2017 Forecast

December E-mini NASDAQ-100 Index futures are under pressure early Tuesday. The price action the last three days suggests investors are still waiting for clarity over take reform. The current uncertainty is keeping bullish investors on the sidelines while encouraging long investors to pare positions.

Daily Technical Analysis

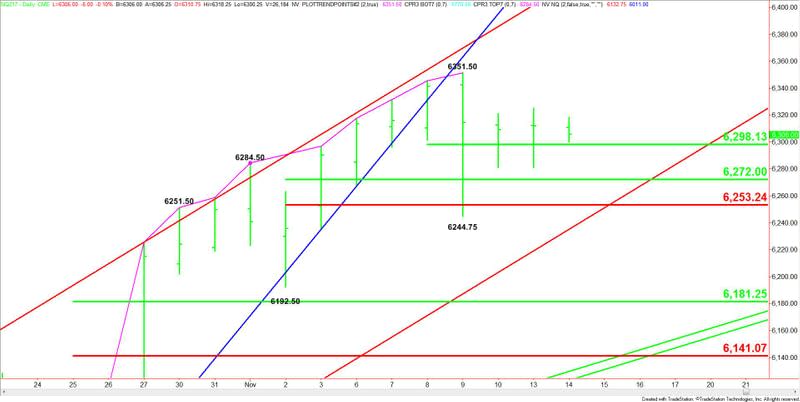

The main trend is up according to the daily swing chart. A trade through 6351.50 will signal a resumption of the uptrend. A move through 6244.75 will indicate the selling is getting stronger. This could trigger a further decline into the next minor bottom at 6192.50.

The short-term range is 6351.50 to 6244.75. The market is currently straddling its pivot at 6298.00 for a third day.

The intermediate range is 6192.50 to 6351.50. Its retracement zone at 6272.00 to 6253.25 provided support last week.

The main range is 6011.00 to 6351.50. If the selling pressure continues then its retracement zone at 6181.25 to 6141.00 will become the primary downside target.

Daily Technical Forecast

Based on the earlier price action, the direction of the index today is likely to be determined by trader reaction to the short-term pivot at 6298.00.

A sustained move over 6298.00 will signal the presence of buyers. If this creates enough upside momentum, we could see a rally back to 6351.50.

A sustained move under 6298.00 will indicate the presence of sellers. This could create a labored break into a 50% level at 6272.00, a Fibonacci level at 6253.25 and an uptrending angle at 6235.00. Since the trend is up, anyone of these prices is capable of providing support.

If 6235.00 is taken out with conviction, we could see an acceleration to the downside with the next potential target 6181.25.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance