E.W. Scripps Co (SSP) Q1 2024 Earnings: Navigating Challenges Amidst Modest Revenue Growth

Revenue: Reported $561 million, up from $527.78 million in the previous year, falling short of estimates of $566.43 million.

Net Loss: Posted a net loss of $12.8 million, an improvement from a loss of $31.1 million year-over-year, yet above the estimated net loss of $11 million.

Earnings Per Share: Loss of $0.15 per share, compared to a loss of $0.37 per share in the prior year, exceeding the estimated loss of $0.17 per share.

Political Advertising Revenue: Raised full-year guidance for political advertising revenue to $240 million-$270 million, driven by U.S. Senate races and ballot issues.

Bounce TV Network: Exploring sale after significant growth and interest from potential buyers, with revenue up 14% on linear platforms.

Local Media: Revenue increased by 13% to $353 million, bolstered by strong political advertising and distribution revenues.

Debt Management: Reduced revolving credit facility by $40 million and made mandatory principal payments of $3.9 million, aiming to decrease debt levels by year-end.

The E.W. Scripps Company (NASDAQ: SSP) disclosed its financial outcomes for the first quarter of 2024 on May 9, revealing a complex picture of modest revenue growth paired with a net loss. The company announced these details through its 8-K filing. SSP, a diversified media enterprise, operates across various segments with a strong focus on local media and national networks, including popular platforms like Bounce and Scripps News.

Financial Performance Overview

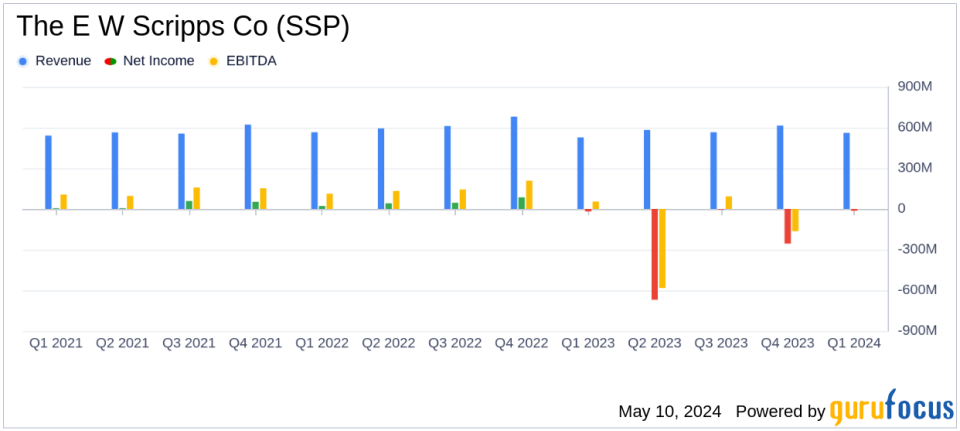

In Q1 2024, SSP generated $561 million in revenue, a 6.4% increase from the previous year, driven by strong political advertising and distribution revenues in its Local Media segment. Despite this growth, the company faced a net loss of $12.8 million, or $0.15 per share, which includes the impacts of a $18.1 million investment gain and $5 million in restructuring costs. This loss marks an improvement over the prior year's loss of $31.1 million, or $0.37 per share, which included higher restructuring costs of $16.5 million.

Strategic Developments and Operational Highlights

SSP is actively exploring the sale of its Bounce television network, which has seen significant growth under its ownership since 2017. This decision follows substantial interest from potential buyers and is part of SSP's broader strategy to optimize its asset portfolio and reduce debt levels. The company has also raised its full-year guidance for political advertising revenues to $240 million-$270 million, buoyed by strong spending in key U.S. Senate races and controversial ballot issues.

Segment Performance

The Local Media segment reported a 13% increase in revenue to $353 million, with notable rises in political and distribution revenue, although core advertising revenue declined slightly by 3.4%. Conversely, the Scripps Networks segment experienced a slight decline in revenue by 3.3% to $209 million, reflecting the sunset of a programmatic product initiated last year.

Financial Position and Future Outlook

As of March 31, SSP's cash and cash equivalents stood at $30.2 million, with total debt at $2.9 billion. The company is focused on reducing its debt, having already decreased its revolving credit facility by $40 million during the quarter. Looking ahead, SSP anticipates revenue growth in the Local Media segment and a decrease in Scripps Networks revenue for Q2 2024.

Management Commentary

"In the first quarter, we were pleased to deliver strong operating results that exceeded our expectations due to our close expense management. Local political is coming on strong. We also are seeing green shoots in the national direct response advertising marketplace while scatter market pricing improved in Q1 2024 over Q1 2023," said Adam Symson, President and CEO of SSP.

SSP's first-quarter results reflect a media company navigating a challenging economic landscape with strategic asset management and cost control. The potential sale of Bounce and the increased political ad revenue outlook highlight management's proactive steps to stabilize and grow the business amidst ongoing industry transformations.

For more detailed information, investors and interested parties are encouraged to access the full earnings call and additional documents through the SSP investor relations webpage.

Explore the complete 8-K earnings release (here) from The E W Scripps Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance