Earnings growth of 123% over 1 year hasn't been enough to translate into positive returns for Envista Holdings (NYSE:NVST) shareholders

Most people feel a little frustrated if a stock they own goes down in price. But sometimes a share price fall can have more to do with market conditions than the performance of the specific business. Over the year the Envista Holdings Corporation (NYSE:NVST) share price fell 12%. But that actually beats the market decline of 18%. We wouldn't rush to judgement on Envista Holdings because we don't have a long term history to look at. It's down 18% in about a quarter. However, one could argue that the price has been influenced by the general market, which is down 15% in the same timeframe.

If the past week is anything to go by, investor sentiment for Envista Holdings isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Envista Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate twelve months during which the Envista Holdings share price fell, it actually saw its earnings per share (EPS) improve by 123%. Of course, the situation might betray previous over-optimism about growth.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Envista Holdings' revenue is actually up 27% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

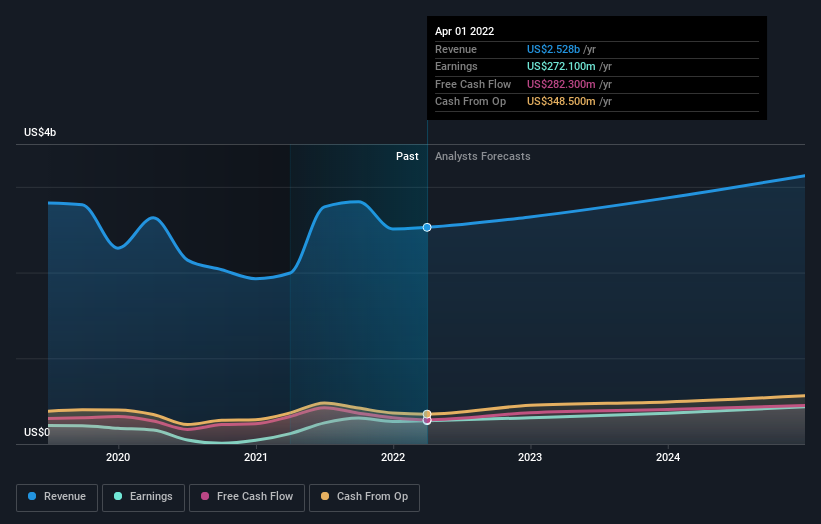

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Envista Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Envista Holdings in this interactive graph of future profit estimates.

A Different Perspective

Given that the broader market dropped 18% over the year, the fact that Envista Holdings shareholders were down 12% isn't so bad. However, the problem arose in the last three months, which saw the share price drop 18%. It's always a worry to see a share price decline like that, but at the same time, it is an unavoidable part of investing. In times of uncertainty we usually try to focus on the long term fundamental business metrics. It's always interesting to track share price performance over the longer term. But to understand Envista Holdings better, we need to consider many other factors. For instance, we've identified 1 warning sign for Envista Holdings that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance