Earnings Release: Here's Why Analysts Cut Their John Menzies plc Price Target To UK£5.40

There's been a major selloff in John Menzies plc (LON:MNZS) shares in the week since it released its full-year report, with the stock down 42% to UK£1.61. It was an okay report, and revenues came in at UK£1.3b, approximately in line with analyst estimates leading up to the results announcement. Analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. With this in mind, we've gathered the latest statutory forecasts to see what analysts are expecting for next year.

View our latest analysis for John Menzies

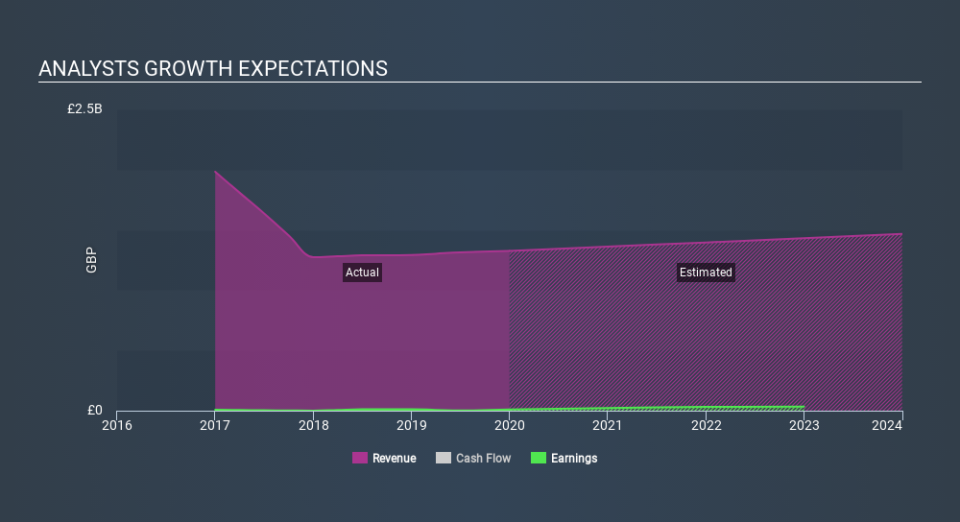

After the latest results, the lone analyst covering John Menzies are now predicting revenues of UK£1.36b in 2020. If met, this would reflect an okay 2.7% improvement in sales compared to the last 12 months. Statutory earnings per share are expected to surge 147% to UK£0.27. In the lead-up to this report, analysts had been modelling revenues of UK£1.37b and earnings per share (EPS) of UK£0.44 in 2020. So there's definitely been a decline in analyst sentiment after the latest results, noting the large cut to new EPS forecasts.

The average analyst price target fell 13% to UK£5.40, with reduced earnings forecasts clearly tied to a lower valuation estimate.

In addition, we can look to John Menzies's past performance and see whether business is expected to improve, and if the company is expected to perform better than wider market. For example, we noticed that John Menzies's rate of growth is expected to accelerate meaningfully, with revenues forecast to grow at 2.7%, well above its historical decline of 11% a year over the past five years. Compare this against analyst estimates for the wider market, which suggest that (in aggregate) market revenues are expected to grow 3.6% next year. So although John Menzies's revenue growth is expected to improve, it is still expected to grow slower than the market.

The Bottom Line

The biggest concern with the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds could lay ahead for John Menzies. On the plus side, there were no major changes to revenue estimates; although analyst forecasts imply revenues will perform worse than the wider market. Analysts also downgraded their price target, suggesting that the latest news has led analysts to become more pessimistic about the intrinsic value of the business.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have analyst estimates for John Menzies going out as far as 2023, and you can see them free on our platform here.

You can also view our analysis of John Menzies's balance sheet, and whether we think John Menzies is carrying too much debt, for free on our platform here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance