Easy Come, Easy Go: How Aratana Therapeutics (NASDAQ:PETX) Shareholders Got Unlucky And Saw 77% Of Their Cash Evaporate

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. Imagine if you held Aratana Therapeutics, Inc. (NASDAQ:PETX) for half a decade as the share price tanked 77%. And it's not just long term holders hurting, because the stock is down 26% in the last year. Shareholders have had an even rougher run lately, with the share price down 41% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Check out our latest analysis for Aratana Therapeutics

Because Aratana Therapeutics is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

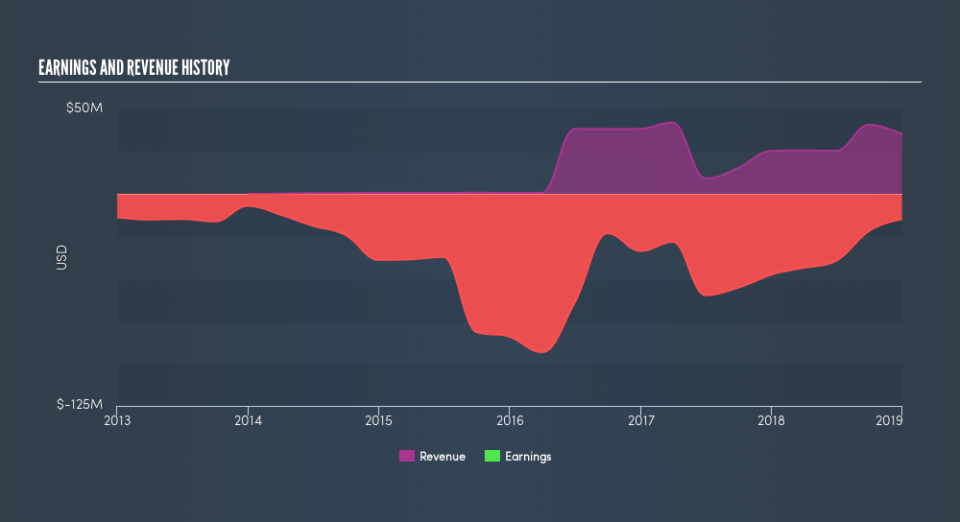

In the last half decade, Aratana Therapeutics saw its revenue increase by 51% per year. That's better than most loss-making companies. So it's not at all clear to us why the share price sunk 25% throughout that time. You'd have to assume the market is worried that profits won't come soon enough. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in Aratana Therapeutics had a tough year, with a total loss of 26%, against a market gain of about 10%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 25% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance