Easy Come, Easy Go: How Cyanotech (NASDAQ:CYAN) Shareholders Got Unlucky And Saw 77% Of Their Cash Evaporate

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We don't wish catastrophic capital loss on anyone. Imagine if you held Cyanotech Corporation (NASDAQ:CYAN) for half a decade as the share price tanked 77%. We also note that the stock has performed poorly over the last year, with the share price down 32%. On the other hand the share price has bounced 6.9% over the last week.

Check out our latest analysis for Cyanotech

Cyanotech isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last five years Cyanotech saw its revenue shrink by 1.4% per year. That's not what investors generally want to see. The share price fall of 25% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. Fear of becoming a 'bagholder' may be keeping people away from this stock.

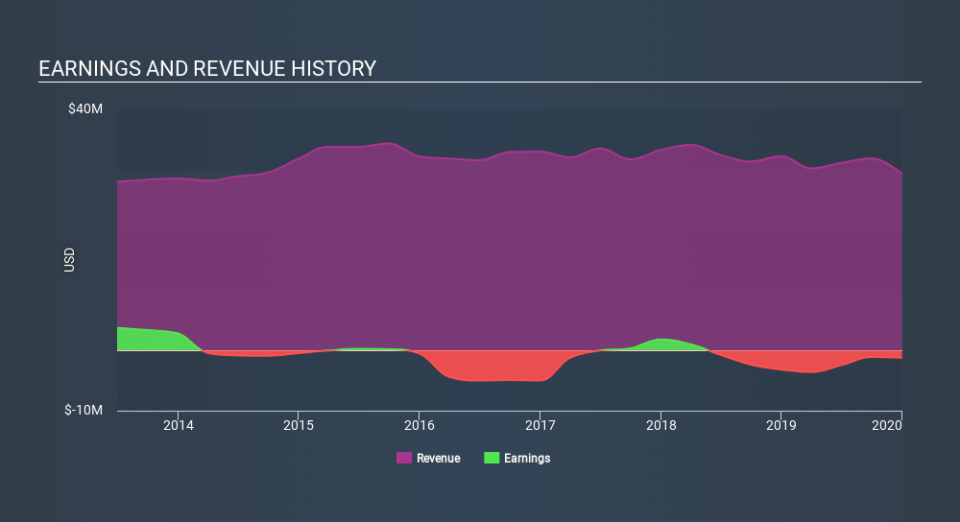

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Cyanotech's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 8.1% in the twelve months, Cyanotech shareholders did even worse, losing 32%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 25% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 5 warning signs for Cyanotech (2 are potentially serious!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance