Easy Come, Easy Go: How Trevena (NASDAQ:TRVN) Shareholders Got Unlucky And Saw 84% Of Their Cash Evaporate

As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of Trevena, Inc. (NASDAQ:TRVN), who have seen the share price tank a massive 84% over a three year period. That would be a disturbing experience. It's down 2.0% in the last seven days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Trevena

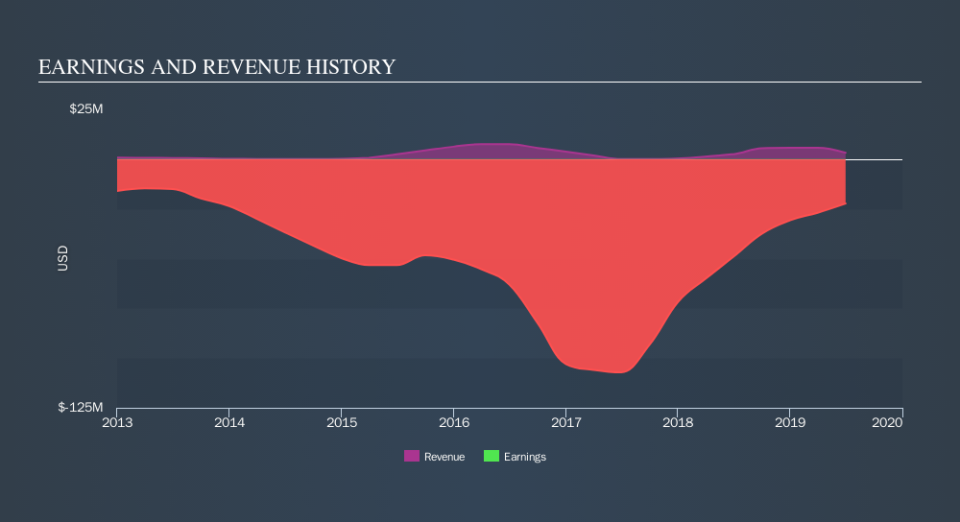

Because Trevena is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Trevena saw its revenue grow by 1.5% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. But the share price crash at 45% per year does seem a bit harsh! We generally don't try to 'catch the falling knife'. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Trevena

A Different Perspective

It's good to see that Trevena has rewarded shareholders with a total shareholder return of 17% in the last twelve months. That certainly beats the loss of about 30% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance