ECB cuts key rate for first time since 2016 as recession fears grow

The European Central Bank (ECB) on Thursday chose to cut one of its key interest rates for the first time since early 2016, pushing it into record negative territory.

As part of a sweeping stimulus package designed to boost the eurozone’s ailing economy, the bank also announced that it plans to revive its controversial asset-purchasing programme from November.

The bank’s deposit rate, trimmed by 10 basis points, is now −0.50%, meaning that commercial banks must effectively pay the ECB to hold their excess cash balances overnight.

The bank left unchanged its two other key interest rates, on main refinancing operations (0%), and the marginal lending facility (0.25%).

The bank had widely signalled that it was planning to cut rates as part of a package of stimulus measures.

Under the asset-purchasing programme, the bank will from 1 November make €20bn (£18bn) in asset purchases each month in an attempt to pump money into eurozone banks and encourage lending.

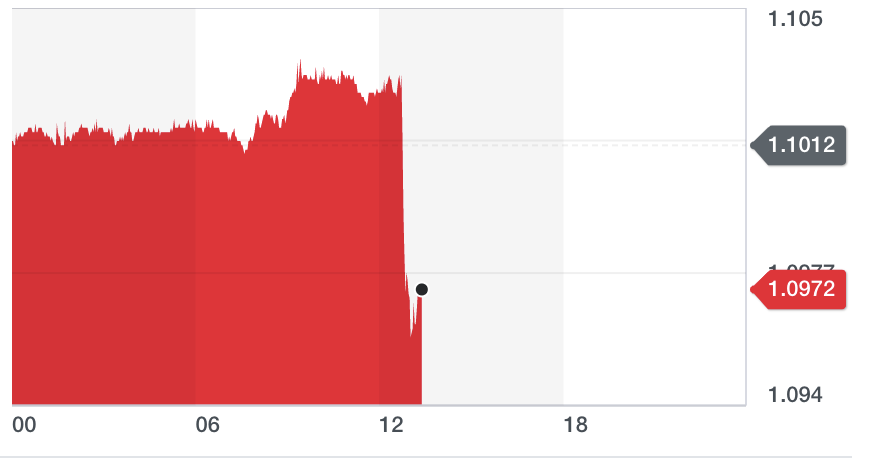

The euro on Thursday fell against the US dollar (EURUSD=X) — hitting a two-year low in large part because looser monetary policy typically devalues a currency.

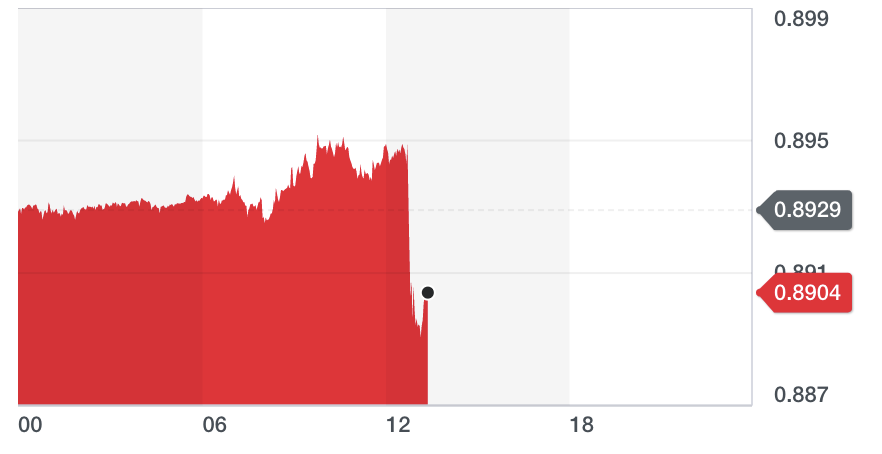

It also tumbled against the pound (EURGBP=X):

The governing council set no end date for the programme, but said in a statement that it expects purchases to run “for as long as necessary to reinforce the accommodative impact of its policy rates”.

They would end “shortly before [the bank] starts raising the key ECB interest rates,” it said.

Known as quantitative easing, the previous €2.6 trillion ($2.87tn) programme had only been phased out in December 2018, when it looked like the eurozone’s economy was picking up.

The ECB also moved to ease the terms of its long-term lending facility, meaning that some banks will be able to access lower rates on loans.

It also introduced a tiered system for its deposit interest rate, meaning that some struggling banks will be exempt from paying the ECB to hold their excess cash balances overnight.

While Carsten Brzeski, the chief economist of ING Germany (ING), said that Thursday’s moves were a “big bang,” he said it remained to be seen whether they would have the desired impact.

“Despite all the market excitement now, the question remains whether this will be enough to get growth and inflation back on track, as the real elephant in the room is fiscal policy,” he said.

As far back as June, the bank’s outgoing president, Mario Draghi, said that “additional stimulus” would be required if the eurozone’s flagging economy did not pick up.

At 1%, inflation within the 19-member currency union remains stubbornly below the bank’s “below, but close to, 2%” target.

READ MORE: Recession beckons for Germany as economy contracts

Meanwhile, Germany’s central bank warned in August that the country, which is considered the economic powerhouse of the bloc, could soon enter a recession.

But it was at the bank’s July policy meeting that the bank gave its strongest indication that it was planning to ease monetary policy.

Noting that it was “determined to act,” the ECB said that it was prepared to cut rates and ready to adjust all of its policy instruments to boost inflation within the bloc.

The governing council of the bank said that it had tasked committees with examining policy options, including the re-starting of the asset-purchasing programme.

READ MORE: Christine Lagarde a 'dangerous look' for ECB

Expectations of a significant change in policy were stoked in August when Olli Rehn, the head of Finland’s central bank, said it was “important” that the ECB introduced “a significant and impactful policy package in September.”

“In the world of ECB-watching, such a sequence of signals is as close as it gets to a pre-commitment to action,” said Claus Vistesen, the chief eurozone economist at Pantheon Macroeconomics, in a note.

Draghi, who steps down at the end of October, will be succeeded by the former managing director of the International Monetary Fund Christine Lagarde.

Lagarde has been broadly supportive of Draghi’s monetary policy path.

Yahoo Finance

Yahoo Finance