EchoStar Gets FCC Approval for 5G Buildout Framework for Boost Mobile

EchoStar Corporation SATS has received the Federal Communications Commission’s (“FCC”) approval for its 5G network buildout framework, allowing optimized coast-to-coast expansion of the world’s first cloud-native Open RAN Boost Mobile Network, as noted in the FCC's Universal Licensing System.

By the end of the year, EchoStar's Boost Mobile Network is expected to cover 80% of the U.S. population, adding 30 million more people under its coverage. The company will accelerate its final buildout across more than 500 license areas simultaneously. Through its partnerships with AT&T and T-Mobile, SATS will ensure access to its Boost Mobile services in regions lacking direct coverage.

EchoStar plans to offer a low-cost wireless plan and 5G devices, regardless of local deployment, across the country. The targeted extensions will streamline construction timelines, aligning with EchoStar's 3.45 GHz spectrum licenses and enabling small carriers and Tribal nations to lease spectrum in underserved areas.

EchoStar is a global provider of satellite service operations, video delivery services, broadband satellite technologies and broadband Internet services for home and small office customers.

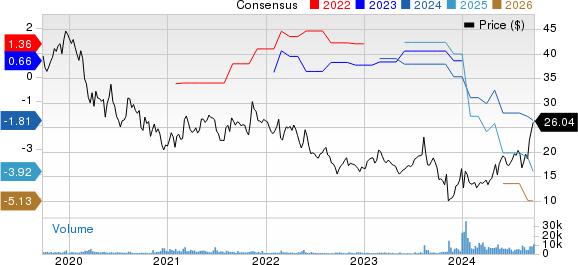

EchoStar Corporation Price and Consensus

EchoStar Corporation price-consensus-chart | EchoStar Corporation Quote

SATS’ Focus on 5G Network

It highlighted its achievements in deploying a next-generation cloud-native Open RAN network that supports innovations like artificial intelligence, noting that the FCC's new framework will enhance the efficiency of its ongoing efforts. In August 2024, EchoStar’s subsidiaries, Hughes Network Systems and Boost Mobile, jointly demonstrated optimized, multi-transport network management for the U.S. Navy. The demo established that the EchoStar Private 5G ORAN network can sustain safe connectivity for devices and applications when users move from the naval base.

The company also received an indefinite delivery, indefinite quantity contract worth $2.7 billion from the U.S. Naval Supply Systems Command Spiral 4 wireless products and services purchasing program. Under this contract, it will provide 5G wireless services and devices to support the Department of Defense across all 50 states and U.S. territories and for international travel on temporary duty.

As a result, net sales from 5G Network Deployment increased to $35.5 million from $19 million a year ago in the second quarter of 2024. However, the Retail Wireless segment was adversely impacted by net losses from government-subsidized subscribers due to the closure of the Affordable Connectivity Program funding on June 1, 2024.

Additionally, net subscriber losses in Pay-TV, Retail Wireless, Broadband and satellite services resulted in a 9% year-over-year decline in revenues, which totaled $3.96 billion. The top line also missed the consensus mark by 0.6%. Soft revenues generated from Pay-TV, Retail Wireless and Broadband and satellite services businesses further dampened its results.

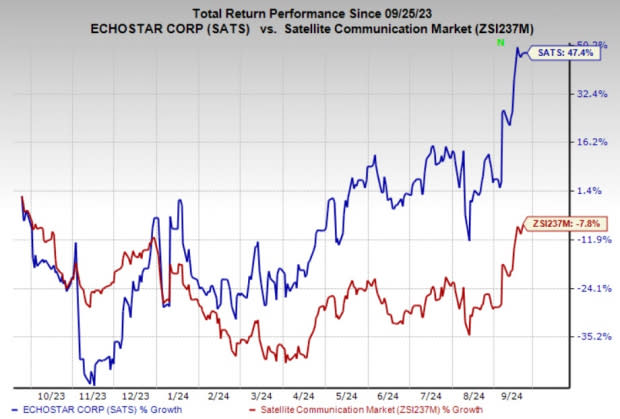

SATS’ Zacks Rank & Stock Price Performance

SATS currently carries a Zacks Rank #5 (Strong Sell). Shares of the company have gained 47.4% in the past year against the sub-industry's decline of 7.8%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Manhattan Associates, Inc. MANH, ANSYS, Inc. ANSS and American Software, Inc. AMSWA. MANH presently sports a Zacks Rank #1 (Strong Buy), whereas ANSS & AMSWA carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Manhattan Associates delivered an earnings surprise of 26.6%, on average, in the trailing four quarters. In the last reported quarter, MANH pulled off an earnings surprise of 22.9%. The Zacks Consensus Estimate for MANH has increased 9.2% to $4.26 in the past 60 days.

ANSYS delivered an earnings surprise of 4.8%, on average, in three of the trailing four quarters. In the last reported quarter, ANSS pulled off an earnings surprise of 28.9%. It has a long-term earnings growth expectation of 6.4%.

American Software delivered an earnings surprise of 84.5%, on average, in the trailing four quarters. In the last reported quarter, AMSWA pulled off an earnings surprise of 71.4%. The Zacks Consensus Estimate for AMSWA has increased 8.6% to 38 cents in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EchoStar Corporation (SATS) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

ANSYS, Inc. (ANSS) : Free Stock Analysis Report

American Software, Inc. (AMSWA) : Free Stock Analysis Report