Ecolab (ECL) Earnings and Revenues Lag Estimates in Q2

Ecolab Inc. ECL reported second-quarter 2020 adjusted earnings per share of 65 cents, missing the Zacks Consensus Estimate of 83 cents by 21.7%. Further, the figure declined 48.8% on a year-over-year basis.

This Zacks Rank #5 (Strong Sell) company’s quarterly net sales were 2.69 billion, down 15.3% from the year-ago figure. Moreover, net sales missed the Zacks Consensus Estimate by 5.5%.

Segmental Analysis

With effect from the first quarter, the company has made modifications to the way it reports its segments, as discussed below.

Global Industrial

Sales at the segment fell 1.8% year over year to $1.48 billion. Lower volumes in other Industrial businesses more than offset modest growth in Food & Beverage.

Global Institutional

Sales plunged 35.1% year over year to $722.4, owing to a steep decline in the Institutional business, which more than negated solid growth in Specialty business.

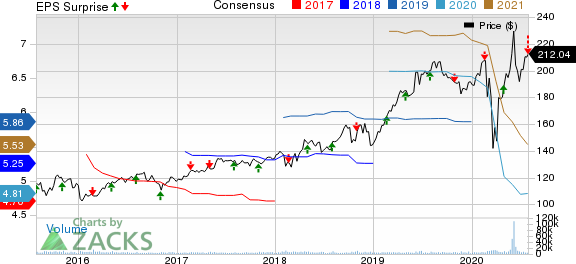

Ecolab Inc. Price, Consensus and EPS Surprise

Ecolab Inc. price-consensus-eps-surprise-chart | Ecolab Inc. Quote

Global Healthcare and Life Sciences

Sales at the segment improved 21.7% year over year to $307.6 million, courtesy of strong performance that gained from higher sales owing to the COVID-19 related demand in both the Healthcare and Life Sciences business lines.

Other

Sales declined 19.3% year over year to $247.1 million.

Margin Analysis

Ecolab registered adjusted gross profit of $1.16 billion, down 17.4% year over year. As a percentage of revenues, adjusted gross margin in the second quarter was 40.1%, down 400 basis points (bps).

Adjusted operating income in the quarter was $300.3 million, down 39.7% year over year. Adjusted operating margin in the quarter was 11%, which contracted 470 bps year over year.

Guidance

The company has not issued either quarterly or full-year 2020 outlook due to the continued uncertainty surrounding the COVID-19 pandemic and the full scope of its impact on the global economy and duration of the same.

On the basis of a gradual, although uneven, recovery from the first half of the impact of the pandemic, full-year 2020 sales in Healthcare & Life Sciences segment are anticipated to improve from the previous year. Modest pressure is estimated on Industrial segment businesses, while lowering but still substantial amount of pressure is expected on sales, in Institutional and Other segments.

The pandemic’s impact on restaurant, hospitality, and entertainment is expected to result in a noticeable decrease for the Institutional division within the Institutional unit and Pest Elimination for the year.

Nonetheless, the company anticipates to see gradual sequential improvement from second-quarter levels in the second half with product and service innovation, investments in new hygiene and digital technologies, and successful sales initiatives driving a sustainable recovery in customer activity.

Wrapping Up

Ecolab exited the second quarter on a weak note. The company witnessed weak performance across Global Industrial and Global Institutional business segments in the quarter under review. Contraction in both gross and operating margins raises concern.

Nonetheless, the company witnessed growth in its Specialty business in the second quarter. Moreover, Ecolab’s Global Healthcare and Life Sciences segment exhibited solid performance.

Key Picks

Some better-ranked stocks in the broader medical space are ViewRay, Inc. VRAY, Opko Health OPK and ResMed Inc. RMD, each carrying a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for ViewRay’s second-quarter 2020 bottom line is pegged at a loss of 16 cents per share, indicating 50% narrower loss than the year-ago reported quarter figure.

The Zacks Consensus Estimate for Opko Health’s second-quarter 2020 bottom line stands at a loss of 7 cents per share, suggesting an improvement of 30% from the year-ago period. The same for revenues is pegged at $234.6 million, indicating growth of 3.6% from the year-earlier reported figure.

The Zacks Consensus Estimate for ResMed’s fourth-quarter fiscal 2020 revenues is pegged at $710.9 million, suggesting growth of 0.9% from the year-earlier reported figure. The same for adjusted earnings per share stands at 99 cents, indicating an improvement of 4.2% from the year-ago quarter.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

OPKO Health, Inc. (OPK) : Free Stock Analysis Report

ViewRay, Inc. (VRAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance