Ecolab (ECL) Earnings and Revenues Miss Estimates in Q3

Ecolab Inc. ECL reported third-quarter 2019 adjusted earnings per share (EPS) of $1.71, missing the Zacks Consensus Estimate by a penny. Adjusted EPS rose 11.8% on a year-over-year basis.

This Zacks Rank #3 (Hold) company’s quarterly net sales amounted to $3.82 billion, up 1.9% from the year-ago quarter number. However, net sales lagged the Zacks Consensus Estimate of $3.89 billion.

Segmental Analysis

Global Industrial

Sales at the segment grew 5.2% year over year to $1.42 billion, driven by major growth in the Water, Food & Beverage and Life Sciences units. Geographically, all regions showed impressive sales growth in the quarter.

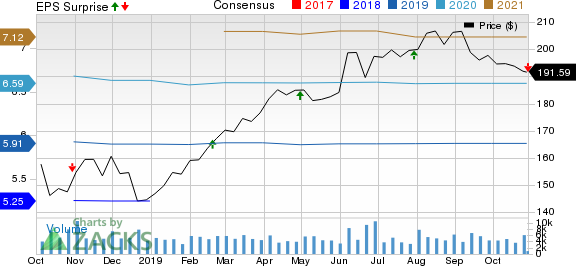

Ecolab Inc. Price, Consensus and EPS Surprise

Ecolab Inc. price-consensus-eps-surprise-chart | Ecolab Inc. Quote

Global Institutional

Sales improved 4% year over year to $1.36 billion, led by robust growth in the Specialty business. Sales at the segment showed solid growth across all geographies.

Global Energy

Sales at the segment dropped 2.7% year over year to $836.5 million. Per management, upstream sales dropped slightly owing to a significant decline in well-stimulation business. However, the decline was offset by impressive growth in production sales. Downstream sales were soft in the quarter as well.

Other

Sales rose 6.8% year over year to $242.8 million, reflecting strong gains in both Pest Elimination and Colloidal Technologies across all geographies.

Margin Analysis

Ecolab registered adjusted gross profit of $1.62 billion, up 4% year over year. As a percentage of revenues, adjusted gross margin in the third quarter was 42.5%, up 90 basis points (bps).

Adjusted operating income in the quarter was $659.3 million, up 10.7% year over year. Adjusted operating margin in the quarter was 17.3%, which expanded 140 bps year over year. Per management, the upside in margins was led by double-digit Industrial and Energy segment income growth.

Guidance

For 2019, Ecolab expects adjusted EPS within $5.80-$5.90, calling for 10-12% growth over 2018. The projected band is lower than the previously communicated range of $5.80-$6.00. The mid-point of the updated range is slightly below the Zacks Consensus Estimate of $5.91.

Foreign currency translation is expected to have a 13-cent unfavorable impact on adjusted EPS.

Adjusted gross margin is expected to be 42% of net sales.

For the fourth quarter of 2019, Ecolab expects adjusted EPS within $1.64-$1.74, mirroring year-over-year growth of 6-13%.

Foreign currency translation is expected to have a 2-cent unfavorable impact on adjusted EPS.

Adjusted gross margin is expected to be 42% of quarterly sales.

Our Take

Ecolab ended the third quarter on a weak note. However, the company continues to gain from its core Global Industrial and Global Institutional segments. It also benefited from strength in Pest Control and Colloidal technologies in the quarter, which drove its Other segment. Management is optimistic about the spin-off of its Upstream Energy business as a stand-alone publicly-traded company and acquisitions, which are likely to drive segmental gains in the quarters ahead. Expansion in gross and operating margins is encouraging as well.

On the flip side, softness in the Global Energy arm raises concern. Quarterly EPS was negatively impacted by unfavorable currency movement. In fact, management expects foreign exchange to mar EPS in the quarters ahead. A slashed EPS view for 2019 also raises concern.

Earnings of Other MedTech Majors at a Glance

Some better-ranked companies, which posted solid results this earnings season, are Edwards Lifesciences EW, Thermo Fisher Scientific Inc. TMO and ResMed Inc. RMD, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Edwards Lifesciences delivered third-quarter 2019 adjusted EPS of $1.41, outpacing the Zacks Consensus Estimate by 15.6%. Third-quarter net sales of $1.09 billion surpassed the Zacks Consensus Estimate by 5.5%.

Thermo Fisher delivered third-quarter 2019 adjusted EPS of $2.94, which surpassed the Zacks Consensus Estimate by 2.1%. Revenues of $6.27 billion outpaced the Zacks Consensus Estimate by 1.3%.

ResMed reported third-quarter 2019 adjusted EPS of 93 cents, which beat the Zacks Consensus Estimate of 87 cents by 6.9%. Revenues were $681.1 million, surpassing the Zacks Consensus Estimate by 3.6%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance