Economists warn 'way back will be much slower' for UK economy

Economists may be paid to worry, but on Friday they reacted particularly gloomily to April’s unprecedented collapse in UK economic activity, suggesting that the country could be facing a protracted and uncertain recovery.

“The way back will be much slower than the descent,” said Samuel Tombs, the chief UK economist at Pantheon Macroeconomics.

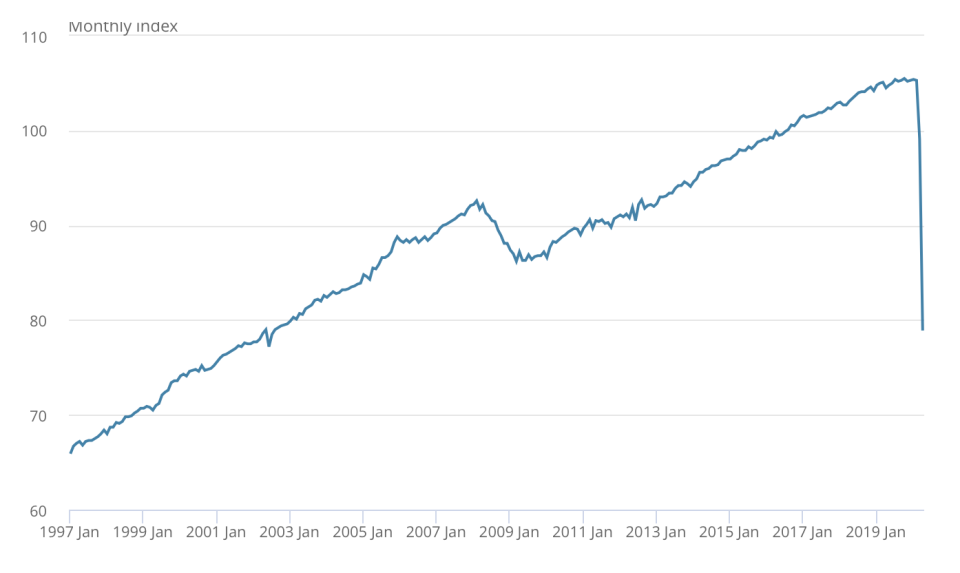

The UK economy shrank by 20.4% in April — more than three times the previous record of 5.8%, which had only been set in March.

“The economy will take a long time to recover from the pummelling inflicted by the COVID-19 pandemic,” Tombs said, noting that the contraction in gross domestic product (GDP) since January now exceeded 25%.

It typically takes three or four years for GDP to return to its pre-recession peak, Tombs said, writing that he expected a “relatively sluggish” rebound, even if April represents a low-point.

READ MORE: UK economy saw historic 20% crash in April lockdown

“Falls in employment and investment, accompanied by a persistent rise in saving by households, likely will ensure that the economy remains a shadow of its former self later this year, even if most restrictions are removed,” he said.

Tomb’s views were echoed across the board.

Calling the collapse in economic output “truly brutal,” Ulas Akincilar of online trading platform Infinox said that the latest data was “record-breakingly bad by virtually every possible metric.”

“The OECD predicts that Britain’s recession will be the worst of any major economy. On this evidence, the cheque is in the post,” he said, referring to Wednesday’s forecast that the UK economy will experience a contraction larger than that of Spain, France, Italy, the US, and Germany.

Though there was considerable disagreement among analysts about the potential scale of the April downturn, the 20.4% decline was larger than the consensus estimate of 18.4%.

Noting that the Office for National Statistics (ONS) data still did not come as much of a surprise to markets, James Smith, an economist at Dutch lender ING, said that the figures were “nevertheless shocking.”

“It goes without saying that this kind of fall in activity is virtually unprecedented, either in scale or speed,” Smith said.

“We’ll probably see a more pronounced rebound during the third quarter as a broader range of businesses are expected to reopen. But even then, the economy will remain well below its pre-virus size,” he noted.

Smith cited the fact that social distancing contracts were here to say, noting that many firms will be operating at “below normal” levels for the foreseeable future.

The services sector — which makes up around 80% of the UK’s economic output — fell by 19% in April, while industrial output plunged by 20.3%.

READ MORE: UK recession to be worse than France, Italy, Spain, and Germany, warns OECD

The manufacturing and construction sectors, were even worse hit, falling by 24.3% and 40.1%, respectively.

Calling for further government measures to limit the long-term economic damage, the British Chambers of Commerce said the prospect of a fast — or V-shaped — recovery remained “unlikely.”

The collapse in economic activity came despite unprecedented fiscal and monetary stimulus measures from the UK government and Bank of England.

Economists are now concerned about a spike in unemployment once the government’s wage-subsidy scheme is phased out closer to the end of the year.

“It will be a long time before this growth is made up, though, and unemployment is poised to start rising as the furlough scheme is phased out,” said Melissa Davies, the chief Economist at Redburn.

“There is a clear case for further monetary and fiscal easing, including negative interest rates to help management government funding costs,” she said.

Yahoo Finance

Yahoo Finance