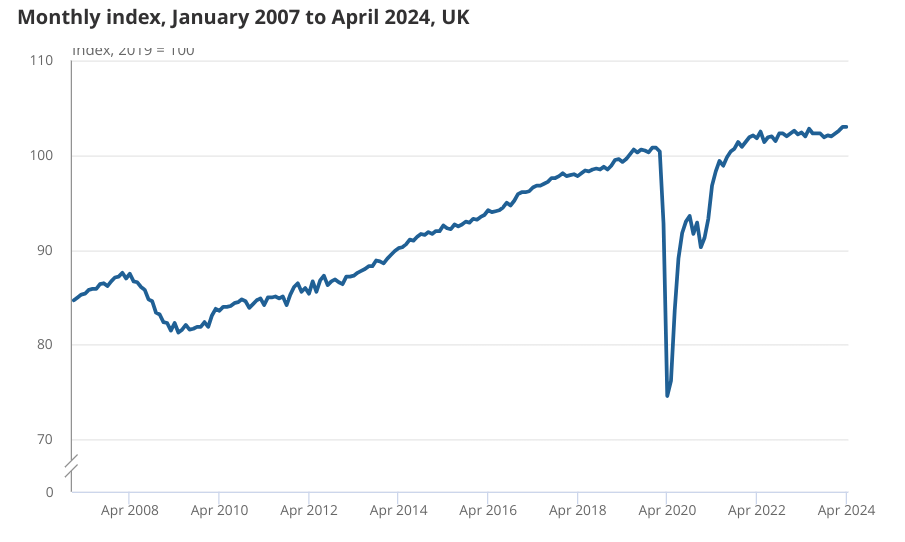

Economy stagnant in April thanks to wet weather as recovery falters

The UK’s economic recovery faltered in April, revealing the challenges facing the next government in generating sustainable growth.

According to figures from the Office for National Statistics (ONS), the UK economy was stagnant in April after the surprisingly strong expansion in the first quarter of the year.

This was in line with economists’ expectations, but will not make good reading for Prime Minister Rishi Sunak amid an election campaign in which the performance of the economy is a crucial issue.

The all-important services sector grew 0.2 per cent, helping the economy avoid shrinking in April. Nevertheless, output in consumer-facing services remained very weak, falling 0.7 per cent. This was partly due to April’s poor weather, but also reflects the lingering effects of the cost-of-living crisis.

“After one of the wettest Aprils since records began it’s no surprise that rain dampened consumer spending, with many households also feeling the pinch from higher prices and bills,” Ben Jones, lead economist at the Confederation of British Industry said.

Output in the production sector fell 0.9 per cent, with manufacturing recording a poor month.

Construction recorded an even weaker performance, contracting 1.4 per cent, largely as a result of the weather. The UK received about 155 per cent of the average rainfall for April, according to the Met Office’s Monthly Climate Summary.

April’s stagnation followed a 0.6 per cent expansion in the first quarter of the year, which took the economy out of last year’s shallow recession.

Paul Dales, chief UK economist at Capital Economics, said today’s figures are “unlikely to suggest the economy is on the precipice again”.

The UK barely registered any growth in 2023 as it struggled with a cocktail of higher interest rates and stubborn inflation. However, most economists think a combination of falling inflation, strong wage growth and lower borrowing costs should provide a healthy tailwind for household spending during the remainder of the year.

Yael Selfin, chief economist at KPMG UK, said the “recovery remains on track” despite April’s figures, pointing to the “adverse weather conditions” as a major contributor to the poor performance.

Forward looking business surveys suggest that the economy is still growing, albeit at a slower pace than earlier in the year.

Over recent weeks a few economic forecasters, including the Confederation of British Industry (CBI) and the British Chambers of Commerce, upgraded their projections for the UK economy on the back of anticipated consumer strength.

Getting the economy firing again is a crucial election pledge for both Keir Starmer and Rishi Sunak. Since the pandemic, it has grown just 1.7 per cent whereas the US economy has grown 8.7 per cent.

Sluggish growth has had a big impact on living standards. The Office for Budget Responsibility (OBR) forecast that disposable incomes won’t recover to pre-pandemic levels until 2025-26.

Yahoo Finance

Yahoo Finance