Editas (EDIT) Misses on Q4 Earnings, Beats on Revenues

Editas Medicine, Inc. EDIT incurred a loss of $1 per share in the fourth quarter of 2020, which was wider than the Zacks Consensus Estimate of a loss of 82 cents per share and also the year-ago quarter’s loss of 74 cents.

Collaboration, and other research and development revenues comprising the company’s top line came in at $11.4 million in the reported quarter, down 7.3% year over year. However, the top line beat the Zacks Consensus Estimate of $7 million.

Per the company, the decline in revenues was owing to revenues recognized under the Allergan collaboration recorded in the fourth quarter of 2019, but the same did not happen for the three months ended Dec 31, 2020 as a result of terminating the Allergan collaboration.

We remind investors that in August 2020, Editas terminated its agreement with Allergan [now part of AbbVie ABBV], and regained the full global rights to develop, manufacture and commercialize its ocular medicines including the lead pipeline candidate, EDIT-101.

In the fourth quarter, research and development expenses were $61.5 million, up 76.7% from the year-ago figure due to increased expenses related to the development of EDIT-101. General and administrative expenses decreased 6.5% to $15.8 million owing to lower performance bonus expenses due to employee turnover in the reported quarter.

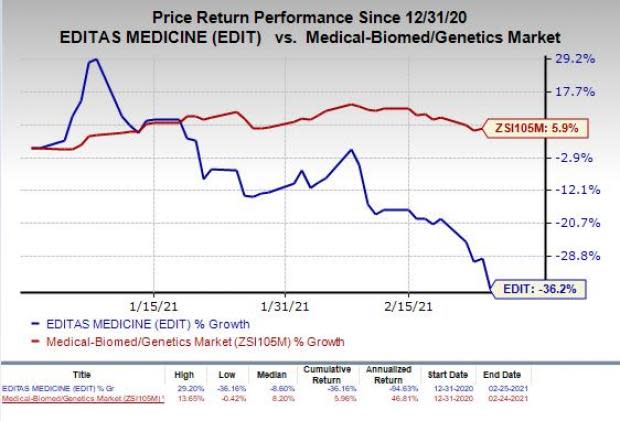

Shares of Editas were down 9.9% following the earnings release on Thursday. In fact, the stock has declined 36.2% in the year so far against the industry’s increase of 5.9%.

Notably, Editas appointed James C. Mullen as the company’s new president and chief executive officer, with effect from Feb 15, 2021.

Full-Year Results

For 2020, Editas generated revenues of $90.7 million, reflecting a significant increase year over year.

For the same period, the company reported loss of $1.98 per share compared with the year-ago loss of $2.68 per share.

Pipeline & Other Updates

Editas has no approved product in its portfolio at the moment. Therefore, its pipeline development remains in key focus for the company.

EDIT-101, which uses CRISPR gene-editing technology, is being developed for treating Leber congenital amaurosis type 10 (LCA10), a rare genetic illness that causes blindness. The company has initiated dosing in the adult mid-dose cohort of the BRILLIANCE study which is evaluating EDIT-101 for LCA10, with initial data from the same being expected later in the ongoing year.

Meanwhile, In January 2020, the FDA cleared the initiation of the safety phase of Editas’ clinical study on EDIT-301 for treating sickle cell disease (“SCD”). The company has initiated the phase I/II RUBY study to assess the safety and efficacy of EDIT-301 for SCD.

Also, Editas plans to submit an investigational new drug filing to the FDA for using EDIT-301 in the treatment of beta-thalassemia by 2021-end.

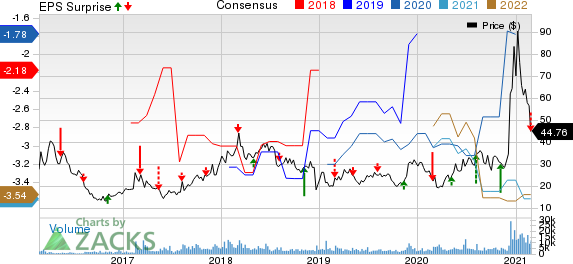

Editas Medicine, Inc. Price, Consensus and EPS Surprise

Editas Medicine, Inc. price-consensus-eps-surprise-chart | Editas Medicine, Inc. Quote

Zacks Rank & Stocks to Consider

Editas currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector include Lexicon Pharmaceuticals, Inc. LXRX and Nabriva Therapeutics AG NBRV, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Lexicon’s loss per share estimates have narrowed 74.2% for 2021 over the past 60 days. The stock has skyrocketed 118.7% year to date.

Nabriva’s loss per share estimates have narrowed 8.9% for 2021 over the past 60 days.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lexicon Pharmaceuticals, Inc. (LXRX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance