Edward Lifesciences (EW) Gains From New Products Amid Cost Woe

Edwards Lifesciences EW is gaining from the huge untapped potential in emerging markets’ cardiovascular device space. The company’s bullish long-term growth strategy buoys optimism. However, stiff competition in Edwards Lifesciences’ Transcatheter Aortic Valve Replacement (TAVR) business continues to ail the company. Persistent forex woes also do not bode well. The company currently carries a Zacks Rank #3 (Hold).

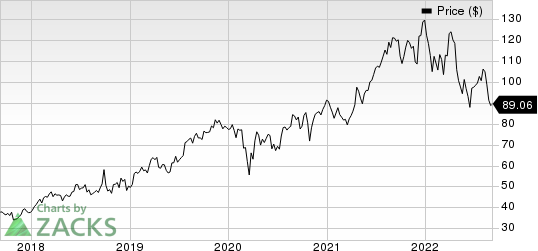

In the past year, Edwards Lifesciences has outperformed its industry. The stock has lost 26.8% compared with the 33.7% fall of the industry.

Edwards Lifesciences' second-quarter 2022 earnings matched the Zacks Consensus Estimate. The company registered strong year-over-year sales growth across TAVR and TMTT product groups, instilling optimism. The strong adoption of the company’s newly-launched MITRIS RESILIA mitral valve across the United States looks encouraging. The continued strength of the HemoSphere monitoring platform is impressive too.

Critical Care sales were up 2.7% on an underlying basis in the second quarter of 2022. The revenue uptick resulted from the increased adoption of the company's Hypotension Prediction Index (“HPI”) algorithm and its broad portfolio of sensors. Further, the company continued enrollment in the HPI Smart BP trial focused on generating additional clinical evidence to support further adoption. The company also continued to see robust demand for the HemoSphere monitoring platform with a healthy pipeline of future opportunities.

Edwards Lifesciences Corporation Price

Edwards Lifesciences Corporation price | Edwards Lifesciences Corporation Quote

Edwards Lifesciences expects full-year 2022 underlying sales growth in the mid-single-digit range on the back of strength in demand for products used in more intense surgeries.

The expansion of margins seems promising. Strong growth prospects in emerging economies and strong solvency and capital structure are added benefits.

On the flip side, Edwards Lifesciences’ revenues for the second quarter missed the consensus mark. U.S. TAVR sales were impacted by slower-than-expected improvement in hospital staffing and temporary contrast agent shortages.

The company’s research and development expenditures were up 11.3% year over year. This increase was driven by continued investments in the company's transcatheter innovations, including increased clinical trial activity. Selling, general and administrative expenses rose 9.2% year over year, driven by the resumption of in-person commercial activities. These developments drove operating costs by 10%, building pressure on the company’s bottom line.

The choppy market conditions due to continued foreign exchange impact and COVID-related hospital staffing issues are concerning. The company has lowered its sales outlook for full-year 2022, taking these macroeconomic challenges into account.

Key Picks

A few better-ranked stocks in the broader medical space that investors can consider are AMN Healthcare Services, Inc. AMN, ShockWave Medical, Inc. SWAV and McKesson Corporation MCK.

AMN Healthcare has a long-term earnings growth rate of 3.2%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 15.7%, on average. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry in the past year. AMN has lost 17.4% against the industry’s 30.7% fall.

ShockWave Medical, sporting a Zacks Rank #1 at present, has an estimated growth rate of 33.1% for 2023. The company’s earnings surpassed estimates in all the trailing four quarters, the average beat being 180.1%.

ShockWave Medical has outperformed its industry in the past year. SWAV has gained 63.8% against the industry’s 32.3% fall over the past year.

McKesson has an estimated long-term growth rate of 9.9%. The company surpassed earnings estimates in the trailing three quarters and missed in one, delivering a surprise of 13%, on average. It currently carries a Zacks Rank #2 (Buy).

McKesson has outperformed its industry in the past year. MCK has gained 46.4% against the industry’s 13.3% fall.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance