Electric tanks and warships with lasers: QinetiQ boss on the battles of the future

Russia’s war in Ukraine has shattered age-old assumptions about warfare. Vladimir Putin’s tanks have been repeatedly blasted by the likes of Javelin anti-tank missile launchers, that have gained cult status in Ukraine, which is fighting with a comparatively small military.

Increasingly, it is becoming clear that new technology is needed in the modern age of fighting.

One company at the forefront of that shift is Hampshire-based defence tech company, QinetiQ. As far as chief executive Steve Wadey is concerned, the battles of the future will not be won with old-fashioned Cold War artillery, but equipment such as electric-powered tanks or lasers that can destroy from a distance.

The war, he says, could prove an opportunity to push Britain’s defence industry into an age of fast-paced research not seen in decades, allowing for bold opportunities.

“There's going to be a technological shift, but not just the technology in its own right, for the way that that technology will be applied,” says Wadey. “The nature of warfare and how it is changing, it does demand a different way of working.”

Russia’s war on Ukraine, meanwhile, demonstrates “the need to deliver with greater agility and pace”.

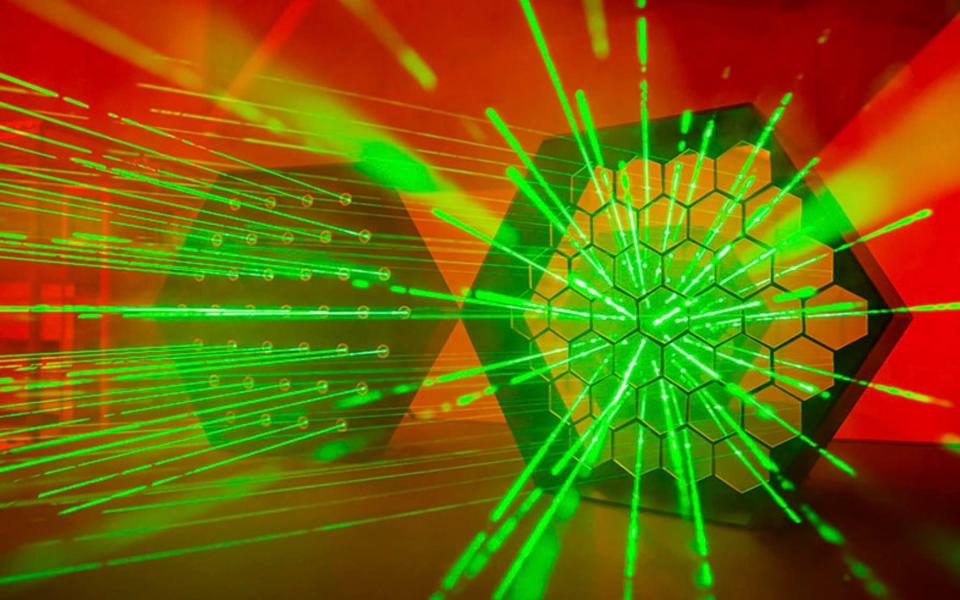

While a laser that can punch through steel is something more associated with James Bond’s nemesis Goldfinger, QinetiQ is making it a reality, among a plethora of other smart developments.

The company is also developing hybrid systems for the American Humvee - a light military truck - and electric motors for armoured vehicles. Each armoured vehicle will have two to four motors, meaning it can continue operating for longer periods of time if some break.

The most famous of its arms is robotics, made for reconnaissance and bomb disposal, while it is also developing models to operate with drones for surveillance.

QinetiQ was formed in 2006 from Britain’s top-secret defence laboratories - when the Ministry of Defence’s Defence Evaluation and Research Agency (Dera) was split in two. The majority privatised as QinetiQ, while the remainder became the Defence Science and Technology Laboratory (Dstl).

Now, the FTSE 250 firm operates out of the UK, the US and Australia and, under the stewardship of Wadey, has built up an order book of more than £1bn.

The 52-year-old joined the company as chief executive in 2015 from Europe’s missile specialist MBDA, co-owned by the UK’s BAE Systems, Franco-German aerospace giant Airbus and Italy’s Leonardo. There, he was appointed UK boss at the age of just 33.

Since Wadey joined QinetiQ, sales have almost doubled from £764m in 2015 to a predicted £1.3bn for 2022, according to City estimates.

Short term demand is up, he says, which should push sales 5pc higher this year. He is very bullish about the resilience of the industry, based partly on how it coped in the wake of the pandemic.

“The UK defence industry has done exceptionally well in recent decades. It did an incredible job through the pandemic and it's doing an incredible job now,” says Wadey. “I think today's environment that we're facing is reinforcing the need for sovereign skills, sovereign capabilities, and ongoing investments.”

Wadey argues that companies like QinetiQ, which make self-contained products or add-ons to larger projects, can move quickly to keep up with the newest threats from Russia and China.

While European defence chiefs are concerned about Russia’s ongoing war on Ukraine, China’s ramping up of military power in the East and more displays of force from North Korea’s Kim Jong-un have countries worldwide promising to boost military spending.

Last week Japan hinted that it would double its defence budget to the equivalent of £86bn as it faces a more aggressive Russia, taking spending to about 2pc of gross national spending and joining Germany in a weakening pacifist stance.

Total global military expenditure rose 0.7pc in 2021 to reach $2.1 trillion (£1.7 trillion), the highest ever, with the US, China, India, the UK and Russia contributing 62pc of the figure, according to figures from the Stockholm International Peace Research Institute.

It’s a slight drop in spending to 2.2pc as a percentage of individual national output, but a rockier global security outlook is likely to increase spending, with Germany having already committed to an increase.

While US military spending has dropped a shade to $810bn, research spending has risen 24pc in the decade to 2021 as it seeks to maintain its technological edge, an area in QinetiQ’s ballpark.

QinetiQ also tests equipment for its customers, makes software for training and cyber security, operates MoD firing ranges, makes armour for the wings of planes and vehicles and has even designed space rockets.

Wadey says the company predicts £20bn of opportunities in the next five years, which could be even higher if more countries join Germany and Japan’s increases.

“I think it's entirely possible that other nations will follow with some levels of increment,” he says. “The value of defence and the importance of defence to society, is definitely being elevated through this conflict.”

As the world builds up its armour, Wadey argues that slashing carbon should not be forgotten. While he concedes that performance will always be the top concern when creating warfighting equipment, the chief executive insists the industry can hit its net zero targets.

Discussions around sustainability are not new for QinetiQ, since decarbonisation strategies are being led by governments worldwide - the defence company’s customers.

“The fact is that our customers are driving their own sustainability agenda,” he says.

When it comes to new tech, QinetiQ’s Dragonfire laser, which it is developing with competitors including Italy’s Leonardo and Britain's BAE Systems, is designed to be mounted on a ship. It will focus high powered lasers on missiles, drones and other targets, offering a high-tech and cheap defence.

The challenge is that the weapon must be able to “dwell” on the target for a few seconds to destroy it, a tall order when targeting a threat at speed. Only a slight deviation of the path of faster weapons, such as hypersonic missiles being developed by Russia and China, is needed to put them in a spin, however.

There are cost advantages, too. Missiles are expensive to make, sometimes costing millions of dollars apiece, and are also part of programmes that can take years to restart if more are needed. For a laser, only power is needed.

Going forward, QinetiQ’s plan is to focus on the UK, Australia and the US. America, with its vast and fairly open defence market, is an obvious place to be, and this is where QinetiQ makes its robots.

Australia, as well as being part of the newly minted alliance between the US and UK, AUKUS, is also increasing its spending.

Prime Minister Scott Morrison has said he wants to increase its standing military by 30pc by 2040, to the highest level since Vietnam. It plans a 7.4pc boost for the 2023 financial year to 48.6bn Australian Dollars (£27.7bn).

The country also has a smaller defence industry, allowing opportunities for entrants like QinetiQ. Rivals such as Raytheon and BAE Systems also have a presence there, showing the level of demand worldwide.

“We're a company with a real clear purpose, which is about protecting lives and securing the vital interests of our customers,” he says. “I think that mission appeals to our employees.”

Yahoo Finance

Yahoo Finance