Elfun Trusts Amplifies Portfolio with Strategic Exxon Mobil Acquisition

Insight into Elfun Trusts (Trades, Portfolio)' Q2 2024 Investment Moves and Strategic Positioning

Elfun Trusts (Trades, Portfolio), a fund exclusively for General Electric's U.S. employees and trustees, managed by William Sandow and Christopher Sierakowski, focuses on investing in U.S. companies with potential for future dividends. The fund's recent N-PORT filing for the second quarter of 2024 reveals significant portfolio adjustments, including new acquisitions and adjustments in existing holdings, emphasizing a strategic approach to equity investments.

Summary of New Buys

Elfun Trusts (Trades, Portfolio) expanded its portfolio by adding four new stocks. Notably:

Exxon Mobil Corp (NYSE:XOM) was the largest new addition with 794,537 shares, making up 2.19% of the portfolio, valued at $91.47 million.

The Home Depot Inc (NYSE:HD) followed, comprising 1.88% of the portfolio with 227,400 shares, valued at $78.28 million.

Becton Dickinson & Co (NYSE:BDX) was also significant, with 325,800 shares accounting for 1.83% of the portfolio, valued at $76.14 million.

Key Position Increases

Elfun Trusts (Trades, Portfolio) also strategically increased its stakes in nine stocks, with significant boosts in:

American Water Works Co Inc (NYSE:AWK), which saw an addition of 285,039 shares, a 413.93% increase, impacting the portfolio by 0.89% and valued at $45.71 million.

Martin Marietta Materials Inc (NYSE:MLM) increased by 45,700 shares, a 70.74% rise, now valued at $59.76 million.

Summary of Sold Out Positions

The fund completely exited four positions during the quarter:

Pioneer Natural Resources Co (PXD) was completely sold off, impacting the portfolio by -1.81%.

Boston Scientific Corp (NYSE:BSX) was also liquidated, with a -1.32% impact on the portfolio.

Key Position Reductions

Elfun Trusts (Trades, Portfolio) reduced its holdings in 21 stocks. Notable reductions include:

ConocoPhillips (NYSE:COP) saw a reduction of 135,600 shares, decreasing by 18.93% and impacting the portfolio by -0.43%.

Ross Stores Inc (NASDAQ:ROST) was reduced by 91,800 shares, a 24.2% decrease, impacting the portfolio by -0.34%.

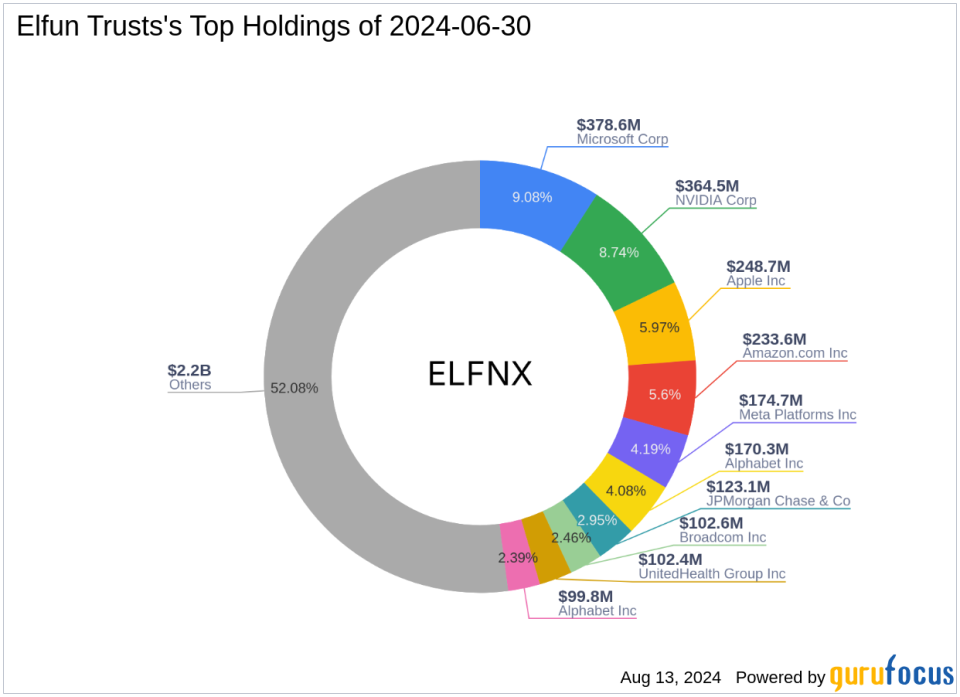

Portfolio Overview

As of the second quarter of 2024, Elfun Trusts (Trades, Portfolio)'s portfolio included 44 stocks. The top holdings were:

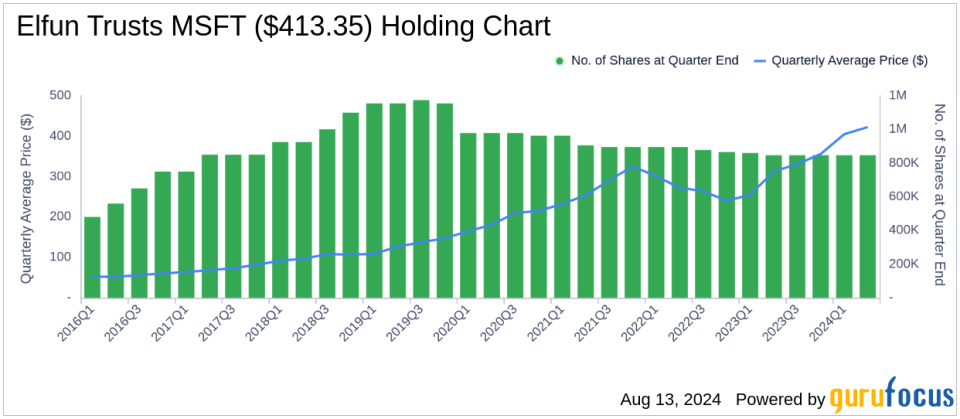

9.08% in Microsoft Corp (NASDAQ:MSFT)

8.74% in NVIDIA Corp (NASDAQ:NVDA)

5.97% in Apple Inc (NASDAQ:AAPL)

5.6% in Amazon.com Inc (NASDAQ:AMZN)

4.19% in Meta Platforms Inc (NASDAQ:META)

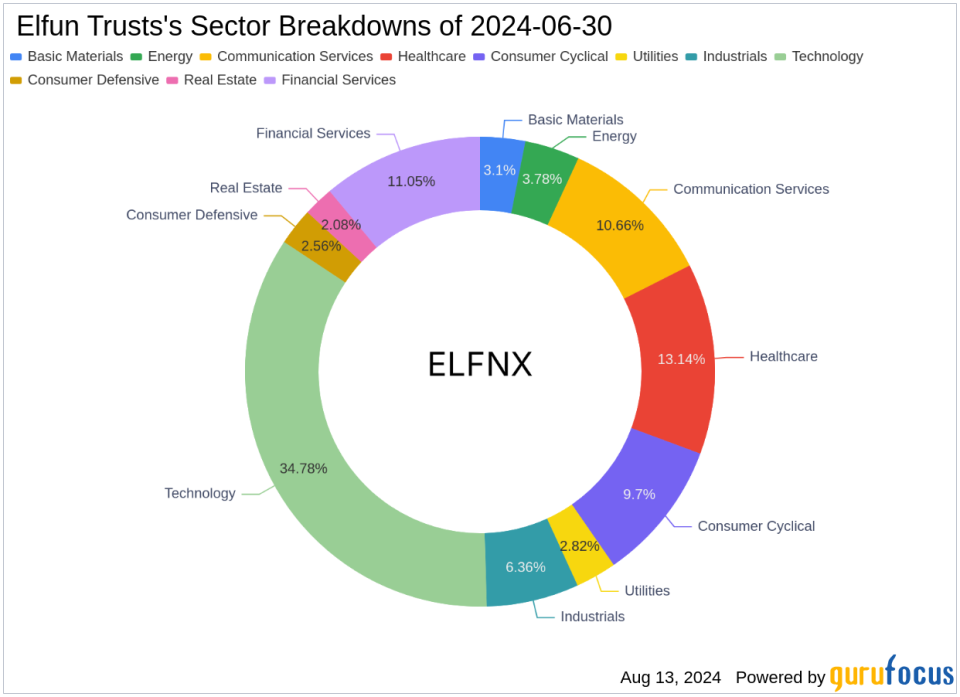

The portfolio is well-diversified across 11 industries, with significant concentrations in Technology, Healthcare, and Financial Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.