Huge pay rise for hedge fund boss who owns Waterstones

The hedge fund financier behind Waterstones saw their pay surge 175% last year, new accounts show.

The highest paid director of Elliott Advisors UK was paid £11.9m last year, according to accounts recently filed with Companies House. The top boss’ pay represents a huge rise from the £4.3m given to the highest paid director in 2017.

The big pay rise came in the same year that Elliott acquired Britain’s best-known bookseller Waterstones. The US money manager bought the chain for an undisclosed sum last April.

The highest paid director is not named but could be Gordon Singer, who runs the US hedge fund’s UK operation according to the Guardian and is the son of Elliott founder Paul Singer.

Elliott Advisors UK declined to comment when contacted by Yahoo Finance UK.

Elliott Advisors is the UK subsidiary of Elliott Management, which is one of the largest and best-known “activist investment” funds in the world. The New York-headquartered money manager, which has $38.2bn (£31bn) under management, buys stakes in businesses and then agitates for for changes in a bid to drive up the value of the company. Elliott successfully pressured UK-listed Whitbread to sell off its Costa Coffee chain last year and continues to push for changes at the business (WTB.L).

Despite its record of pushing for changes, Waterstones CEO James Daunt said at the time of the acquisition last year that Elliott had acquired the bookseller as a traditional investment. Earlier this year Elliott also bought US bookseller Barnes & Noble in a $683m deal.

The firm’s Waterstones investment is held through a separate vehicle and Elliott Advisors UK makes its money charging for advice and support to Waterstones and other investments. Revenue rose 3% to £135.9m last year and profits rose by 4% to £5m, accounts show.

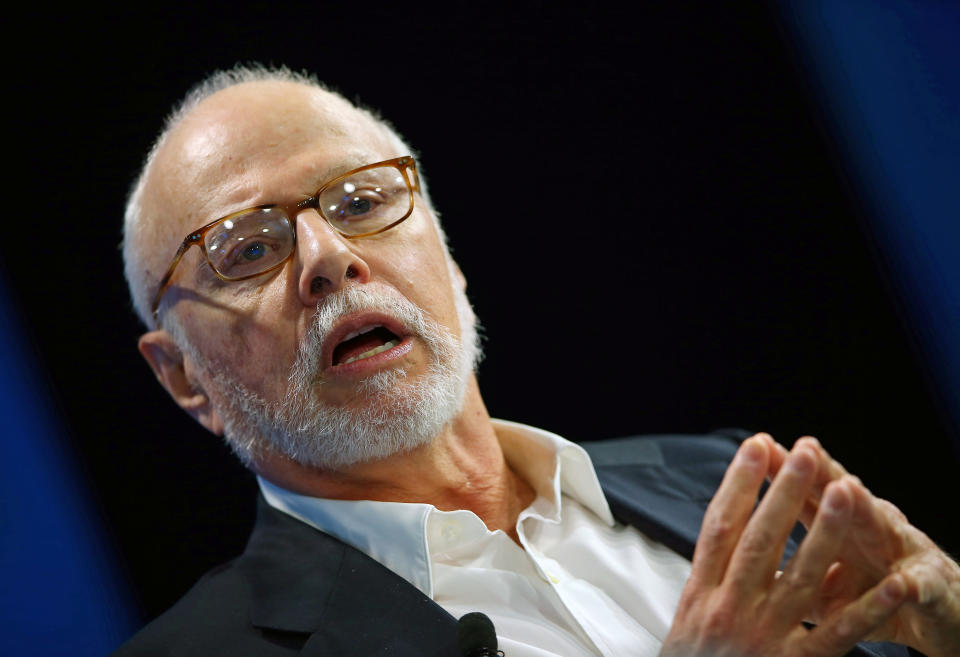

Elliott’s billionaire founder Paul Singer is one of the most well-known financiers in the world and Bloomberg dubbed him “the world’s most feared investor”. Singer has a “uniquely adversarial, and immensely profitable, way of doing business,” according to the New Yorker.

Singer is best-known for his controversial pursuit of Argentina over its unpaid debts in the early 2000s, which led critics to dub it a “vulture fund”. As Argentina looked likely to default on its debts, Elliott bought the country’s sovereign bonds at a steep discount. The fund then sued Argentina for full payment, rejecting the country’s attempts to restructure its debt. Singer fought a 15-year legal battle but eventually won. Argentina settled the case for $2.4bn, according to the New Yorker. Argentina’s former leader Cristina Fernández de Kirchner had called the case extortion.

Other Elliott investments in Europe include football club AC Milan, Telecom Italia, and British shopping centre operator Hammerson (HMSO.L).

————

Oscar Williams-Grut is Yahoo Finance UK’s City correspondent. He covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

'Unknown' new Tesco CEO must battle Brexit, German discounters, and changing tastes

Metro Bank founder to quit as chair in December after dreadful year

Yahoo Finance

Yahoo Finance