Embecta (EMBC) to Report Q2 Earnings: What's in Store?

Embecta Corp. EMBC is scheduled to report second-quarter fiscal 2023 results on May 12.

In the last reported quarter, the company’s adjusted earnings per share of 96 cents surpassed the Zacks Consensus Estimate by 84.6%. Earnings surpassed estimates in the trailing three reported quarters, the average beat being 38.86%.

Let’s take a look at how things have shaped up prior to this announcement.

Factors at Play

The company’s diabetes care business is expected to have progressed in the fiscal second quarter banking on strong execution of its three strategic pillars. As far as the first pillar of strengthening base business is concerned, Embecta recently got included in the Express Scripts National Preferred Formulary as well as won pen, needle and insulin syringe contracts from the U.S. Department of Veterans Affairs. These are expected to have contributed to the company’s fiscal Q2 performance.

Second, Embecta has been working on building its systems, processes and procedures so that it can achieve a timely separation from Becton, Dickinson and Company or BD. During the fiscal second quarter, the company is expected to have made progress in this area by exiting several transition service agreements.

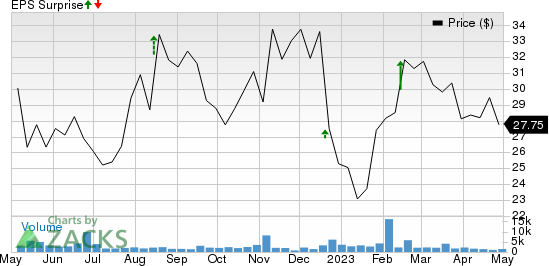

Embecta Corp. Price and EPS Surprise

Embecta Corp. price-eps-surprise | Embecta Corp. Quote

Third, it has been investing in research and development. The company recently developed a patch pump for the type 2 diabetes market. This too might have contributed to the fiscal Q2 performance.

In the fiscal first quarter, U.S. revenues were dull due to unfavorable volume dynamics, the majority of which was offset by the favorable timing of certain distributor purchases that occurred late in the quarter as well as contract manufacturing and sales of certain non-diabetes products to BD. However, the company expects the timing benefit associated with distributor purchasing to be largely reversed in the second quarter.

International revenues might have benefited from favorable volumes, augmented by a competitor product supply shortage in certain regions.

However, overall, a strong commercial performance in fiscal Q2 might have been largely dented by a challenging macro-operating environment.

Q2 Estimates

The Zacks Consensus Estimate for the company’s second-quarter fiscal 2023 revenues is pegged at $263.9 million.

The Zacks Consensus Estimate for the company’s second-quarter fiscal 2023 earnings per share is 50 cents.

What Our Model Suggests

Per our proven model, a stock with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) along with a positive Earnings ESP has higher chances of beating estimates. However, this is not the case here, as you can see:

Earnings ESP: The company has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #3.

Stocks Worth a Look

Here are some medical stocks worth considering as these have the right combination of elements to post an earnings beat this quarter, per our model.

Bio-Rad Laboratories BIO has an Earnings ESP of +0.16% and sports a Zacks Rank #1 at present. It is slated to release first-quarter 2023 results on May 4. You can see the complete list of today’s Zacks #1 Rank stocks here.

Bio-Rad has a 2023 expected earnings growth rate of 10.3%. BIO’s earnings yield of 3.38% compares favorably with the industry’s (2.78%).

Henry Schein, Inc. HSIC has an Earnings ESP of +0.99% and flaunts a Zacks Rank of #1. Henry Schien is expected to release first-quarter fiscal 2023 results on May 2.

HSIC’s earnings surpassed estimates in three of the trailing four quarters and matched once, the average beat being 2.9%. HSIC’s 2024 growth rate is estimated to be 7.7%.

Teva Pharmaceutical Industries Limited TEVA currently has an Earnings ESP of +14.97% and a Zacks Rank of #2. TEVA is expected to release first-quarter 2023 results on May 2.

TEVA’s 2024 growth rate is estimated to be 4.4%. TEVA’s earnings yield of 28.74% compares favorably with the industry’s (34.35%).

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Bio-Rad Laboratories, Inc. (BIO) : Free Stock Analysis Report

Embecta Corp. (EMBC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance