Emerald Holding Inc (EEX) Reports Revenue Growth Amidst Net Loss in 2023

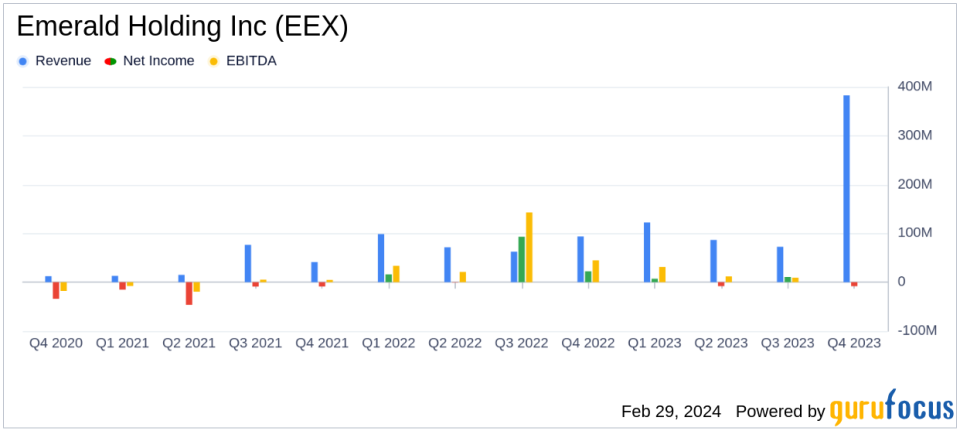

Revenue Increase: Emerald Holding Inc (NYSE:EEX) reported a 17.5% year-over-year revenue growth for 2023.

Net Loss Reported: The company experienced a net loss of $8.2 million in 2023, compared to a net income of $130.8 million in 2022.

Adjusted EBITDA: Adjusted EBITDA stood at $97.8 million for 2023, with a notable increase excluding insurance proceeds.

Operational Expansion: Emerald expanded its portfolio with new acquisitions and event launches, including the Overland Expo and NBA Con.

2024 Outlook: Revenue projections for 2024 are between $415 million and $425 million, with Adjusted EBITDA expected to be between $110 million and $115 million.

Liquidity Position: The company ended the year with $204.2 million in cash and full availability of its $110.0 million revolving credit facility.

On February 29, 2024, Emerald Holding Inc (NYSE:EEX) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading operator of B2B trade shows in the United States, saw a significant increase in revenue, attributing the growth to the expansion of events, new launches, and strategic acquisitions. Despite this, Emerald reported a net loss for the year, a stark contrast to the net income achieved in the previous year.

Financial Performance and Challenges

Emerald's revenue increase is a testament to the company's robust core trade show business and its strategic expansion into the consumer live events market. The acquisition of Lodestone Events and the launch of NBA Con highlight the company's commitment to diversifying its portfolio and enhancing value for exhibitors, attendees, and shareholders. However, the net loss recorded for 2023 underscores the challenges faced, including muted performance in the media content business due to cautious advertising spend by tech companies.

Key Financial Metrics

The company's financial achievements, particularly in revenue growth and Adjusted EBITDA, are critical for a company in the Media - Diversified industry, where the ability to adapt and scale is vital for long-term success. The increase in Adjusted EBITDA, excluding insurance proceeds, indicates a strong underlying operational performance.

Key details from the financial statements include:

Financial Metric | 2023 Value | Change from 2022 |

|---|---|---|

Revenue | $382.8 million | 17.5% increase |

Net Loss | $(8.2 million) | NM |

Adjusted EBITDA | $97.8 million | (59.2)% decrease |

Free Cash Flow | $28.8 million | (82.5)% decrease |

"We delivered another year of strong results in 2023. As a highly diversified and scaled platform, Emerald continues to benefit from the extended post-Covid recovery with strong demand from exhibitors and attendees alike," said Herve Sedky, Emeralds President and Chief Executive Officer.

"We achieved substantial top and bottom line growth in 2023 on the back of positive attendance and pricing trends as our customers continue to see our trade shows as instrumental in growing their own businesses," added David Doft, Emeralds Chief Financial Officer.

Analysis of Company's Performance

Emerald's performance in 2023 reflects the company's resilience and strategic initiatives to grow its event portfolio and enhance its offerings. The revenue growth, driven by organic increases and acquisitions, demonstrates the company's ability to capitalize on market opportunities and recover post-pandemic. However, the net loss indicates that despite revenue growth, the company faces challenges in translating top-line gains into net profitability, which will be an area of focus for investors and management alike.

Emerald's outlook for 2024 suggests confidence in continued revenue growth and an improvement in Adjusted EBITDA. The company's strong liquidity position, with significant cash reserves and credit facility availability, provides a solid foundation for future investments and operational flexibility.

For more detailed information and to stay updated on Emerald Holding Inc's financial developments, visit Emerald's website and stay tuned to GuruFocus.com for insightful financial analysis and news.

Explore the complete 8-K earnings release (here) from Emerald Holding Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance