Emeren Group Ltd (SOL) Earnings: A Mixed Outcome Compared to Analyst Expectations

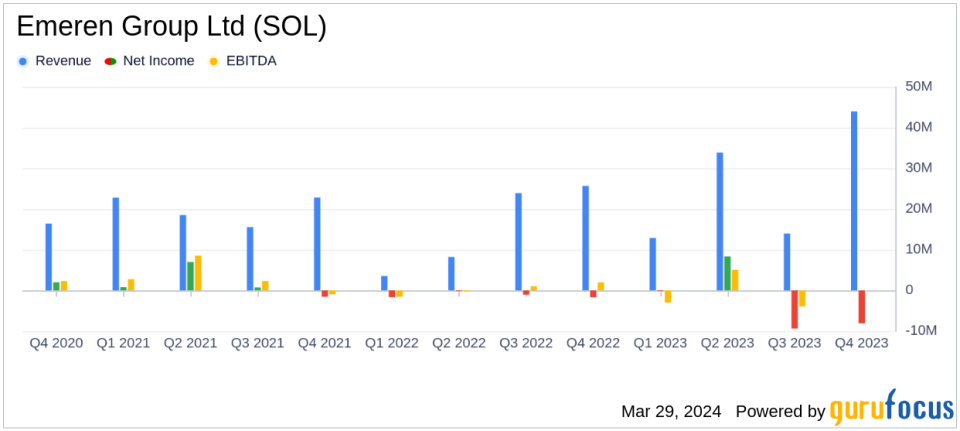

Revenue: $104.7 million in 2023, a 71% increase year-over-year, although below full-year guidance.

Gross Margin: Gross profit rose 52% to $23.3 million with a gross margin of 22.2%.

Net Loss: Net loss widened to $9.3 million in 2023 from $4.7 million in 2022, impacted by project delays and one-time adjustments.

Q4 Performance: Q4 revenue surged 215% quarter-over-quarter to $44.0 million, but the company registered an $8.1 million net loss.

2024 Outlook: Emeren Group Ltd (NYSE:SOL) anticipates 2024 full-year revenue between $150 million and $160 million, with a projected net income of at least $26 million.

Emeren Group Ltd (NYSE:SOL) released its 8-K filing on March 29, 2024, detailing its financial performance for the fourth quarter and full year of 2023. The results present a complex picture, with the company achieving a significant year-over-year revenue increase but also facing a widened net loss. This performance fell short of the company's own full-year guidance, primarily due to project sales delays in the U.S. and Europe.

Emeren Group Ltd is a global leader in solar project development, ownership, and operation, with a robust pipeline of projects and IPP assets across key regions. Despite the challenges faced in 2023, the company is poised to adapt and capitalize on the growing demand for clean energy and supportive government policies.

Financial Performance and Challenges

The company's revenue for the full year 2023 reached $104.7 million, marking a 71% increase from the previous year. However, the net loss expanded to $9.3 million, compared to a $4.7 million net loss in 2022. The gross margin stood at 22.2%, with a gross profit of $23.3 million, up 52% year-over-year. These figures were influenced by a combination of rising interest rates, utility-scale project delays, and regulatory uncertainties.

Emeren Group Ltd (NYSE:SOL) also faced several one-time items that affected its Q4 results, including a $4.1 million adjustment to earnout revenue and $5.0 million in project cancellations and bad debt reserves. The Q4 revenue surged to $44.0 million, a significant increase from the previous quarter, but the gross margin was lower than expected at 7.6%, reflecting a higher mix of EPC project revenue and the impact of project delays.

Looking Ahead

Looking forward to 2024, Emeren Group Ltd (NYSE:SOL) remains optimistic, expecting full-year revenue to fall between $150 million and $160 million, with an anticipated gross margin of approximately 30% and net income of at least $26 million. The company's pipeline includes around 3.1 GW of advanced-stage projects and a substantial storage project pipeline, with expectations to monetize approximately 400 MW to 450 MW in 2024.

The company's financial position at the end of Q4 2023 included $70.2 million in cash and cash equivalents, with a debt-to-asset ratio of 9.44%. Emeren Group Ltd (NYSE:SOL) also continued its share buyback program, purchasing approximately $3.4 million ADS during the quarter.

Despite the setbacks, the company's leadership remains committed to delivering value to shareholders and capitalizing on the solar industry's positive long-term outlook. Emeren Group Ltd (NYSE:SOL) is focused on maintaining its position as a leading global renewable energy company and is poised to benefit from the increasing integration of AI technologies and the electrification of transportation.

Investors and interested parties can gain further insights into Emeren Group Ltd (NYSE:SOL)'s performance and future prospects by joining the conference call scheduled for 5:00 p.m. U.S. Eastern Time on Thursday, March 28, 2024, or by visiting the Investor Relations section of the company's website.

Explore the complete 8-K earnings release (here) from Emeren Group Ltd for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance