Emergent (EBS) Beat Earnings in Q3, Vaccines Drive Sales

Emergent BioSolutions Inc. EBS reported third-quarter 2019 earnings of $1.21 cents per share, comprehensively beating the Zacks Consensus Estimate of 63 cents and also the year-ago quarter’s 55 cents.

Moreover, revenues in the reported quarter soared 80% from the prior-year period to $311.8 million, primarily backed by high product sales owing to the company’s recent acquisitions and better contracts plus grants revenues. The top line substantially beat the Zacks Consensus Estimate of $281 million.

Shares of Emergent were up 4.3% in after-hours trading following the earnings announcement on Wednesday Nov 6. However, the stock has lost 1.5% so far this year against the industry’s rise of 0.9%.

Quarter in Detail

Total product sales surged 92% to $256.2 million from the year-earlier quarter. This revenue uptick was mainly on the back of contribution from Narcan nasal spray, acquired from Adapt Pharma in October 2018, and higher sales of small pox vaccine ACAM2000. In fact, this newly acquired product Narcan (naloxone HCl) nasal spray added $75 million to product sales.

ACAM2000, which was acquired from Sanofi SNY in the fourth quarter of 2017, added $112.1 million to product sales in the reported quarter, reflecting a significant increase year over year.

However, anthrax vaccines (BioThrax and AV7909) sales declined 12% to $40.3 million in the reported quarter. Other product sales also plunged 41% on a year-over-year basis to $28.8 million.

Emergent markets anthrax monoclonal antibody raxibacumab, also bought during the fourth quarter of 2017 from GlaxoSmithkline GSK.

Revenues from contracts and grants skyrocketed 95.6% year over year to $35.6 million, primarily owing to greater R&D activities associated with certain development funding programs, most notably, the anthrax vaccine AV7909.

Contract manufacturing revenues decreased 10% to $20 million from the year-ago figure. This downside was primarily due to the contracted service work that took place in third-quarter 2018 but did not recur in the same period this year.

The company recorded adjusted EBITDA of $106.4 million in the reported quarter compared with $39.1 million in 2018, reflecting an increase of 172.1%.

2019 Outlook

Emergent retained its previously issued guidance for earnings and sales. It expects revenues in the range of $1.06-$1.14 billion for 2019. The Zacks Consensus Estimate for the metric is pegged at $1.10 billion.

The company anticipates adjusted net income in the band of $150-$180 million and adjusted EBITDA in the bracket of $280-$310 million.

Other Updates

Last month, the European Medicines Agency's (EMA) Committee for Medicinal Products for Human Use (CHMP) granted PRIority Medicines (PRIME) designation to Emergent’s chikungunya vaccine candidate CHIKV VLP.

Emergent plans to initiate a pivotal study on CHIKV VLP in 2020.

Also, in September 2019, Emergent received a contract award of approximately $2-billion spread over a 10-year period for the continued delivery of ACAM2000 to the United States, Strategic National Stockpile (SNS) as a preparedness stance against the threat of smallpox.

Meanwhile, in July 2019, Emergent announced that the Biomedical Advanced Research and Development Authority (BARDA) exercised its first contract option for $261 million to procure up to 10 million doses of AV7909 (anthrax vaccine adsorbed with adjuvant) for delivery into the Strategic National Stockpile over a period 12 months.

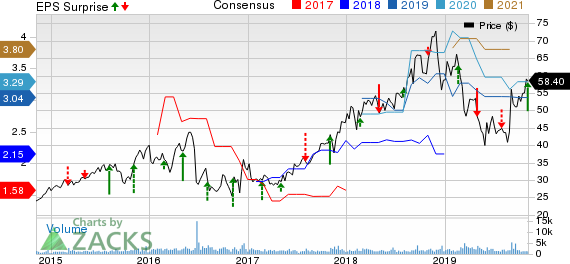

Emergent Biosolutions Inc. Price, Consensus and EPS Surprise

Emergent Biosolutions Inc. price-consensus-eps-surprise-chart | Emergent Biosolutions Inc. Quote

Zacks Rank & Key Pick

Emergent currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the healthcare sector is Anika Therapeutics Inc. ANIK, which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Anika’s earnings estimates have been revised 16% upward for 2019 and 19.1% for 2020 over the past 60 days. The stock has jumped 80% year to date.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

Emergent Biosolutions Inc. (EBS) : Free Stock Analysis Report

Anika Therapeutics Inc. (ANIK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance