Emerson Electric (EMR) Q2 Earnings & Revenues Beat Estimates

Emerson Electric Co.’s EMR second-quarter fiscal 2021 (ended Mar 31, 2021) adjusted earnings of 97 cents per share beat the Zacks Consensus Estimate of 90 cents. On a year-over-year basis, the bottom line improved 9%.

Inside the Headlines

Emerson’s net sales were $4,431 million in the quarter, reflecting an increase of 6% from the year-ago quarter. Underlying sales were up 2%, while acquired assets and currency translation had 1% and 3% of positive impacts on sales, respectively. Also, the top line beat the Zacks Consensus Estimate of $4,358 million.

The company reports net sales under two segments — Automation Solutions and Commercial & Residential Solutions. Fiscal second-quarter segmental results are briefly discussed below:

Automation Solutions’ net sales were $2,793 million, increasing 3% year over year. Underlying sales of the segment declined 2%. Commercial & Residential Solutions generated net sales of $1,645 million in the fiscal second quarter, up 13% year over year. Underlying sales were up 11%. Under the segment, Climate Technologies’ sales increased 13.1% to $1,160 million, and that from Tools & Home Products jumped 12.3% to $485 million.

Gross Margin

In the quarter under review, Emerson's cost of sales increased 6.5% year over year to $2,569 million. It represented 58% of net sales compared with 57.9% in the year-ago quarter. Gross margin was 42%, down 10 basis points. Selling, general and administrative (SG&A) expenses increased 7.2% to $1,054 million. As a percentage of sales, SG&A expenses were 23.8% compared with 23.6% in the year-ago quarter.

Balance Sheet and Cash Flow

Exiting second-quarter fiscal 2021, Emerson had cash and cash equivalents of $2,342 million, down from $2,583 million at the year-ago quarter. Long-term debt balance increased 47% to $5,823 million. During the first six months of fiscal 2021, the company repaid debts of $301 million.

In the first half of fiscal 2021, it generated net cash of $1,615 million from operating activities, reflecting an increase of 59.6% from the year ago period. Capital expenditure was $222 million, down from $225 million.

During the first six months of fiscal 2021, the company paid out dividends amounting to $606 million and repurchased shares worth $78 million.

Outlook

For fiscal 2021 (ending September 2021), it anticipates net sales growth of 6-9%. Underlying sales are expected to grow in the range of 3-6%.

Adjusted earnings per share are predicted to be $3.90 for fiscal 2021.

Emerson expects Automation Solutions’ net sales to grow in the range of 3-5%, while Commercial & Residential Solutions’ net sales are projected to increase 14-16%.

Notably, the company anticipates continued improvement in the demand environment in the fiscal third quarter and ahead.

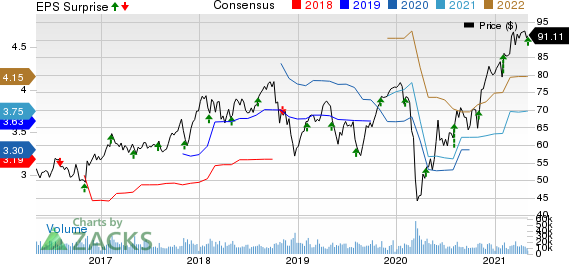

Emerson Electric Co. Price, Consensus and EPS Surprise

Emerson Electric Co. price-consensus-eps-surprise-chart | Emerson Electric Co. Quote

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks are Alcoa Corporation AA, Applied Industrial Technologies, Inc. AIT and Lakeland Industries, Inc. LAKE. While Alcoa currently sports a Zacks Rank #1 (Strong Buy), Applied Industrial and Lakeland Industries carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alcoa delivered an earnings surprise of 56.78%, on average, in the trailing four quarters.

Applied Industrial delivered an earnings surprise of 30.33%, on average, in the trailing four quarters.

Lakeland Industries delivered an earnings surprise of 230.73%, on average, in the trailing four quarters.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Alcoa Corp. (AA) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Lakeland Industries, Inc. (LAKE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance