The end of the French gîte dream

Buy a cheap property in France, do it up and rent it out – while cashing in: for decades this has been the retirement dream of many British people.

The advent of gîte holidays in the 1950s offered a great way for many Francophiles to have an adventure, hosting paying guests in self-contained houses on the property.

You could run a gîte to top up your pension, while living a low-cost life in “la France profonde”. And you could even manage to do it without speaking fluent French, as many of the tourists were British – plus, there were better tax allowances for gîtes than for long-term lets.

But in the past four years, Brexit, Covid and the cost of living crisis have hit British gîte owners with a series of challenges. With the French government introducing some tax changes to holiday rentals too – is this the end of the gîte dream?

Boosting your pension with a gîte

The golden age for British gîte ownership was during the 1990s to 2010s – when low-cost airlines opened up locations such as Bergerac and Limoges, and Airbnb began to transform the way many people booked holidays.

A lot of owners bought in the 1970s and 1980s, says Tim Forster, who works for agent Leggett in the Languedoc.

“The original concept was for early retirees like me to buy a property at great comparative value and boost an index-linked pension with a gîte or two.”

These were often furnished with family hand-me-downs from the attic and advertised in Dalton’s Weekly, bookings made by phone.

Gîtes have come a long way from rehabilitated old farm buildings and now include all sorts of furnished cottages, barns and small chateaux, with many classified (and called Meublés de tourisme) on a five-point grading system (classification brings extra tax benefits).

It seems hard to find a British estate agent in France who doesn’t own a gîte.

“Earning a little on the side is a quintessential English fantasy,” says Edward Slark-Hughes, a gîte-owning property finder in the Dordogne. “But few rely on it to make a living. Many have other jobs such as English language teachers or handymen.”

Post-Brexit realities

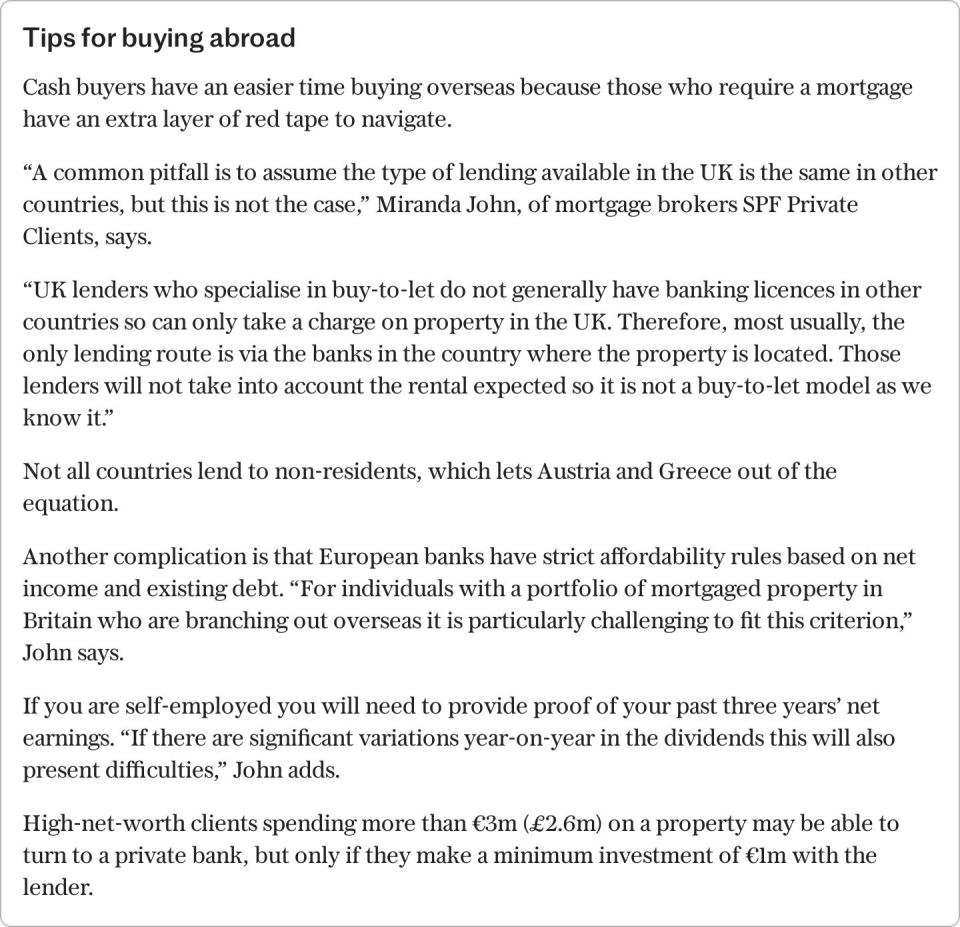

There are many British gîte owners in France still flourishing and making good money. But the challenges facing British gîte owners have been stacking up, from new visa rules – which require a business plan – to new tax laws.

The challenges facing British gîte owners have been stacking up, from new visa rules – which require a business plan – to new tax laws.

Many are now selling up – estate agent websites targeting the UK market show there are over 1,300 properties for sale with gîtes – and a good few price reductions – although that’s a fraction of the near 55,000 gîtes for rent, according to Gîtes de France, the body set up in the 1950s to grow rural tourism.

Gîtes are far from a dying breed. While it reports a “steady decline” in the number of B&Bs (chambre d’hotes), there were 7,000 new gîtes added to its network in 2023.

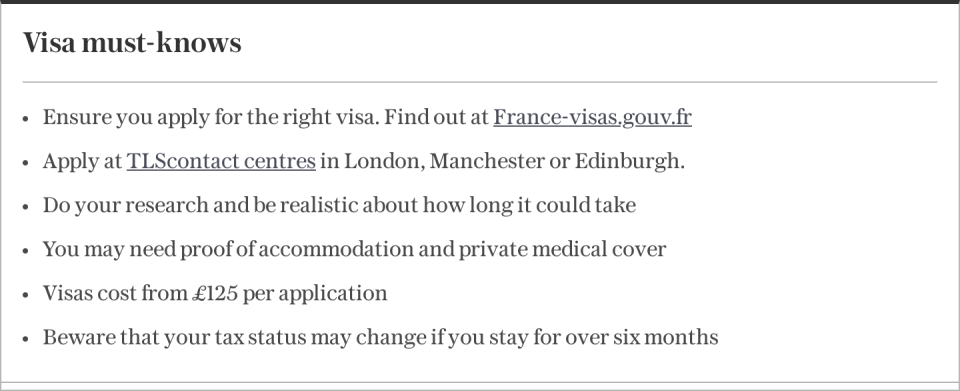

Before Brexit, it was easy to move over and get your carte de sejour residency permit. Now, it’s necessary for British owners to get a visa if they want to relocate or spend the summer in France running their gîtes.

“Back then it was easy to wing it, renovate affordably and know every year what to expect,” says Rupert Springfield of Gîte Guru, a company that advises owners on strategy.

He sees very few retirees taking on gîtes now.

“Brexit has presented many little obstacles, such as British guests being turned away at customs with passport [expiry date] issues, or the much higher cost of taking pets abroad. Now so many people book at the last minute too. Many owners are questioning whether they are still living the gîte dream.”

In the nearby Charente, Leggett’s Hugh McSheffrey says the usual flurry of British gîte owners arriving at Easter in their expensive cars to open up the gîtes for the summer season was noticeably absent this year.

“Some have sold up, not wanting the hassle of getting a visa,” he says.

Charles Hodson of Beaux Villages in the Tarn says he’s seeing more French people looking to buy gîtes than British. He also now markets his own gîtes towards the French.

“We are making around €20,000 a year but a big disadvantage is not being able to have our family over to stay during the summer as we’re fully booked.”

Valerie Aston, of advisory service Start Business in France, is busier this year than last – she says new gîte clients are going for bigger or higher-quality projects, in Aquitaine or Occitanie. She suggests that British people who want to embrace the gîte dream should “apply for a carte de séjour profession libérale/entrepreneur as it’s the easiest [visa] to get”.

This visa is the popular option for self-employed Britons moving to France, and it requires a business plan projecting your income based on local rates and occupancy levels – with a net income of at least €17,000 net a year.

“Show a strategy of how you will reach customers and extra commercial activities you can offer,” she adds.

On top of a visa, you also need to choose between the micro-bic or regime reel – tax regimes that have different expense allowances.

Charles Cramailh, of Leggett Property Management, says you need expert advice including from a chartered accountant in the light of changes being introduced (they also impact your capital gains tax burden when you sell).

“These tax changes are forcing the owners of short-term rentals in France to take a more professional approach. They won’t necessarily mean that owners lose out, but could mean higher accounting costs.”

He warns more regulatory changes are coming post-Paris Olympics to help reduce the short-term rental stock in favour of long-term lets, amid the housing crisis in France.

Overestimating income

There’s now fierce competition from platforms such as Airbnb. Last year there were 1.2 million short-term lets available in France, according to AirDNA, the analyst. That number is growing, with 21pc more listings in the first three months of this year compared to the same period last year.

In the Dordogne there’s a lot of competition, but some owners who are raising their game are thriving. It’s less seasonal than areas such as the Charente or Brittany, says Andrew Nicholson of agent Beaux Villages – who is also a gîte owner.

“We’ve been successful after realising the importance of getting great reviews based on the service you provide: giving local food and wine on arrival, using good bed linen and towels.” Kingsize beds are now expected, adds Cramailh.

Tony and Natasha Crawley moved to France from Essex a month ago and are aiming to offer high-end gîtes, sleeping 10 for €8,000 a week in the Dordogne’s Castelnau-la-Chapelle.

“We wanted to do something together and it will be my pension,” says Tony, 58, an electrician and entrepreneur. “We’re taking lots of advice… The tax regime changes are a minefield.”

Gîte owners often overestimate how much income they can make – and underestimate how much work it takes

Zoe Lowther Moll, with her Dutch husband Robert, owns two gîtes in the Charente. They take the rough with the smooth after four years of running a gîte.

“It was a romantic dream of reclaiming some work-life balance, but the flipside was being a cleaner, laundry maid and loads of admin syncing booking platforms,” says Zoe, 49, from Marlow, Bucks, who runs a business consultancy and is a yoga teacher.

“Last year we had 84 nights booked in one gîte, 80 in the other; this year [so far] it’s 89 and 44. Around 60pc to 70pc of what we make is eaten up in costs. Practical skills are essential: we couldn’t afford to get tradesmen in the early days.”

Don’t expect hefty capital appreciation on rural properties – prices have fallen by 1.1pc in both the Dordogne and the Charente over the past year, according to Meilleurs Agents.

Bob Greatbanks, 52, who with his wife Geraldine, are heading back to the UK having just sold their property with four gîtes (to French buyers) in Aubeterre-sur-Dronne in the Charente.

“We’ve done okay, making €50,000 to €60,000 a year in income. It’s been a fun and rewarding 14 years but we’d have earnt a lot more if we’d invested back home in Manchester.”

Rental returns aside, the average property in Manchester has increased by 195pc in a decade, according to the Land Registry, compared to only 20pc in the Charente found Meilleurs Agents.

‘The business is healthy but we’re selling at a loss’

Valerie and Ian Wright from Shropshire are also selling up – after buying a near-derelict property with gîtes in the Charente 12 years ago which they renovated.

According to Valerie, 59, it always was a “10-year plan” to supplement their pensions by around £30,000 a year.

She says: “For Ian [now 66] it was a retirement dream while I commuted back to the UK with my job in global facility management.

“With both gîtes 2023 was our first really full year. I think Brexit has had an impact on British visiting and buying here – we’ve had more French bookings now.”

The cost of building materials sky-rocketed post-Covid and they are selling the property “at a loss” – it’s for sale at €520,000 (Leggett).

“We’ve had property viewings, but I think Brexit has made it harder to sell to Britons. We now have grandchildren in the UK too and want to retire properly.”

‘If we’d spent the money in the UK it would have been a better investment’

Former Somerset farmers Metford and Angela Briggs have been running gîtes for 26 years – and not put their rates up during that time. Finally, they have had enough. They are selling their property with four gîtes in the Dordogne’s Saint-Saud Lacoussien.

“We sold our cows and bought gîtes,” says Metford, 72. “Back then we advertised on eBay, we had the whole lot booked in January for June. Every year we’d go to France in May to prepare for the summer season and stay there for five months – until Brexit.”

Now they have to get a new long-stay visa each year, but you’re not supposed to work on it so they put their property up for sale last year (for €499,500, through Leggett).

“We enjoyed it and the property paid for itself, but if we spent the money in the UK it would have been a much better investment,” he adds.

‘The winters are isolating, and running a gîte is all-consuming’

Noel and Christine Richardson bought a five-bedroom gîte complex in the Gers “as a massive gamble”, according to Noel, 56. After both working for Tesco for more than 30 years the couple, from Rochdale, had never been to France but spotted the property online and bought it three years ago.

“We wanted a challenge,” he says. “But what we’d done came into sharp focus quite quickly when Christine fell off a ladder, broke 25 bones and we had to close for six months. Yet 2022 was a good year, we were able to live off the income.”

They planned to do it for five to seven years but are now selling up (at €470,000, via Leggett).

“The winters were very quiet and isolating, and running a gîte is all-consuming and hard work,” says Christine, 64. “We can’t leave the property during the summer so we cannot travel ourselves. Missing grandchildren is another factor.”

‘It’s a wonderful job, but you need ideas and six gites to make a living’

Running a gîte for 22 years has been a “wonderful job”, but Chris and Alison Burns are ready to hand over their 17-bedroom property in the Occitanie to a new family full of ideas.

The couple, from Woodbridge in Suffolk, moved over with their four children – now aged 29 to 34 – with a renovation dream.

“We ploughed the money we earned back into the property and we were never short of funds,” says Alison, 60, who supplemented their income working as a teacher and astrologer.

“The key was creating a unique selling point or having regulars – we host ecology students from nearby field centres, did yoga retreats. You need at least six gîtes to make a living, but we are getting out as we want another project, not because it’s all gone wrong.”

Chateau du Fraissinet is for sale at €1.495m (via Leggett).

Recommended

Want a dream home abroad? Here's what you could actually afford

Yahoo Finance

Yahoo Finance