Energizer (ENR) Beats Earnings & Revenue Estimates in Q2

Energizer Holdings Inc. ENR reported strong second-quarter fiscal 2018 results. Maintaining the earnings beat streak, Energizer’s adjusted earnings per share (EPS) of 45 cents beat the Zacks Consensus Estimate of 42 cents. However, the figure was down 10% from the year-ago quarter.

Revenues of $374.4 million topped the consensus mark of $373.18 million and increased 4.3% on a year-over-year basis. Notably, this is the third-straight quarter of a revenue beat. The year-over-year revenue growth was boosted by increased organic net sales of 1.8% and favorable currency impact of 2.5%.

Despite better-than-expected results, shares of this battery maker fell 3.6% in yesterday’s trading session. Analysts believe a contraction in gross margin and year-over-year decline in earnings per share in the reported quarter may have hurt investors’ sentiments. Shares of Energizer have lost 6.2% in the past month, underperforming the industry’s decline of 4.2%.

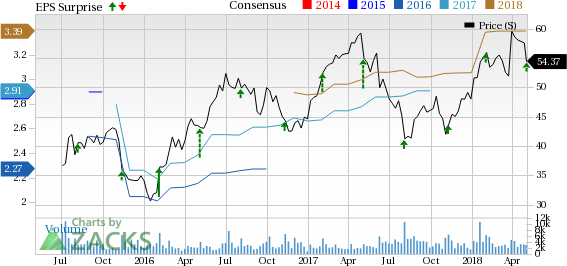

Energizer Holdings, Inc. Price, Consensus and EPS Surprise

Energizer Holdings, Inc. Price, Consensus and EPS Surprise | Energizer Holdings, Inc. Quote

Quarterly Details

Batteries revenues (88.2% of total revenues) grew 6.6% year over year to $330.3 million, while revenues from Other segment (11.8%) fell 10.2% to $44.1 million.

In Americas, the company recorded revenues of $224.1 million, up 2.6% from last-year quarter. Revenues from International were $150.3 million, up 7% from the year-ago quarter.

Margins

Gross margin contracted 180 basis points (bps) to 45% due to less favorable overhead absorption in the current quarter, unfavorable product mix driven by changes related to portfolio optimization and increased commodity costs. Selling, general and administrative expenses,excluding acquisition and integration costs, amounted to $87.7 million, reflecting a decrease of $3.5 million from the year-ago quarter.

Other Financial Details

Energizer, which carries a Zacks Rank #3 (Hold), ended the quarter with cash and cash equivalents of $490.3 million, long-term debt of $977.3 million and shareholders' equity of $44.7 million.

Year-to-date cash flow from operations in the quarter was $160.6 million. Free cash flow amounted to $149.3 million and adjusted free cash flow amounted to $152.8 million or 16.1% of net sales.

Further, on a year-to-date basis, the company repurchased shares worth $50 million.

Guidance

For fiscal 2018, Energizer continues to expect earnings per share in the band of $3.30-$3.40.

Organic revenues are expected to rise low-single digits. Moreover, favorable forex movement is likely to boost sales by 1-1.5%.

However, gross margin are now expected to be flat to up 25 bps, excluding acquisition and integration costs, from the year-ago quarter from the earlier announced increase of 50 bps. Per management, the change in the outlook reflects the impact of increased commodities costs and transportation expenses.

Capex is still expected in the range of $30-$35 million. Adjusted free cash flow is anticipated in the band of $240-$250 million.

Stocks to Consider

WD-40 Company WDFC has a long-term earnings growth rate of 10% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Inter Parfums, Inc. IPAR has a long-term earnings growth rate of 12.3% and a Zacks Rank #1.

Lamb Weston Holdings, Inc. LW has a long-term earnings growth rate of 12% and a Zacks Rank #1.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Energizer Holdings, Inc. (ENR) : Free Stock Analysis Report

WD-40 Company (WDFC) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance