Enlivex (ENLV) Stock Plummets 51% in a Week: Here's Why

Enlivex Therapeutics ENLV is a clinical-stage pharmaceutical company focused on developing its lead pipeline candidate, Allocetra, an off-the-shelf cell therapy.

Enlivex designed Allocetra to reprogram macrophages into their homeostatic state. The therapy is being evaluated in a mid-stage study for treating organ failure associated with sepsis.

In the past week, the company’s stock lost 51.2%. This downside came after management came out with mixed results from the phase II study evaluating Allocetra over 28 days in patients with sepsis caused by pneumonia, biliary, urinary tract, or peritoneal infections.

A stand-alone analysis of Allocetra-treated patients demonstrated substantial reductions in sequential organ failure assessment (SOFA) scores, the primary endpoint of the study. Per management, the treatment appeared most effective in the urinary tract infection (UTI) cohort, resulting in a 90% reduction in SOFA scores, compared to 68% for pneumonia-associated sepsis patients and 36% in patients whose infection source was internal abdomen.

Data from the study also showed a reduction in overall mortality rate by 65% in patients treated with Allocetra when compared to expected mortality. Per management, the therapy exhibited an acceptable safety profile.

However, on a relative basis the data was difficult to assess. This was mainly due to the imbalances between the Allocetra and placebo groups. Per management, randomizing patients across the two groups led to Allocetra-treated cohorts having a 20% higher frequency of septic shock and a 35% higher frequency of invasive ventilation prior to treatment compared with the control group. Due to this imbalance in cohorts, management found it ‘challenging to deduce the relative effect’ of Allocetra in other patient subgroups.

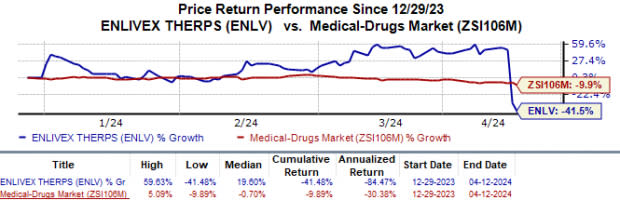

Year to date, Enlivex’s shares have plunged 41.5% compared with the industry’s 9.9% rise.

Image Source: Zacks Investment Research

CEO Oren Hershkovitz did claim that the relative analysis showed a ‘potential indication of effect’ in high-risk, severe sepsis patients in the UTI cohort who were treated with Allocetra.

Based on the above results, Enlivex is now considering a potential follow-on study focused only on high-risk UTI patients. Per management estimates, up to 31% of sepsis cases start as UTIs and lead to as many as 1.6 million deaths across the U.S. and Europe.

Enlivex is also evaluating Allocetra in two separate phase I/II studies for moderate knee osteoarthritis (OA) and end-stage knee OA indications, respectively. Management expects to report topline data from the end-stage knee OA study later this year during the third quarter while the data from the moderate knee OA study is expected next year.

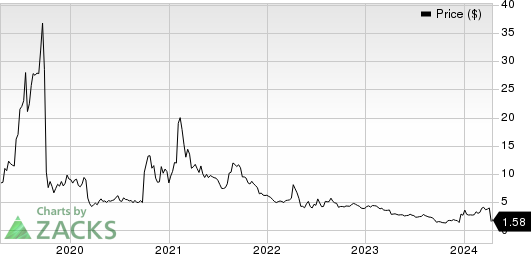

Enlivex Therapeutics Ltd. Price

Enlivex Therapeutics Ltd. price | Enlivex Therapeutics Ltd. Quote

Zacks Rank & Other Key Picks

Enlivex currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the overall healthcare sector include ADMA Biologics ADMA, ANI Pharmaceuticals ANIP and Ligand Pharmaceuticals LGND, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 22 cents to 30 cents. During the same period, EPS estimates for 2025 have improved from 32 cents to 50 cents. Year to date, shares of ADMA have surged 33.2%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 EPS have risen from $4.06 to $4.43. Meanwhile, during the same period, EPS estimates for 2025 have improved from $4.80 to $5.04. Year to date, shares of ANIP have risen 21.3%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

In the past 60 days, Ligand Pharmaceuticals’ earnings estimates per share for 2024 have increased from $4.42 to $4.56. During the same period, earnings estimates for 2025 have risen from $5.11 to $5.27. Year to date, shares of Ligand Pharmaceuticals have gained 13.9%.

Ligand Pharmaceuticals’ earnings beat estimates in each of the trailing four quarters. On average, LGND’s four-quarter earnings surprise was 84.81%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Enlivex Therapeutics Ltd. (ENLV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance