Enphase Energy (ENPH) Acquires ClipperCreek, Stock Up 2.8%

Shares of Enphase Energy, Inc. ENPH jumped 2.8% on Nov 16 following the company’s announcement to acquire ClipperCreek, a provider of electric vehicle (“EV”) charging solutions. The acquisition is in sync with Enphase Energy’s strategy to expand in the booming clean energy space, thus capitalizing on the growing demand for EVs.

The acquisition, which is subject to regulatory approval and customary closing conditions, is expected to reach completion by Dec 31, 2021. If approved, it will provide Enphase Energy an edge to penetrate the EV segment more effectively.

Benefits from the Acquisition

Factors like intensified apprehensions about CO2 emission, various government policies supporting EV adoption and significant investments in the EV segment by auto manufacturers have collectively provided a platform for the global EV market to expand in the near future. This, in turn, has contributed to the growth of EV-charging facilities in many areas.

With EV sales anticipated to witness an excess of 40% growth in the United States over the next five years, the latest buyout is expected to offer Enphase Energy a competitive edge in the booming EV market. The deal also provides Enphase’s global distributors and installers with EV-charging solutions that can be sold alongside solar and battery systems.

Additionally, Enphase Energy is also looking into adding smart features such as cloud connectivity, integration into the Ensemble OS platform and bi-directional charging in the future. We believe such enhancements are likely to boost Enphase Energy’s top line.

Growth Prospects of EVs

President Biden has allotted $174 billion in government spending to EVs while the Senate infrastructure bill has allotted $7.5 billion for EV-charging stations. This provides ample growth opportunities for charging infrastructure and battery technology.

This also highlights abundant growth opportunities for solar companies like Enphase, encouraging them to expand their realm in to the EV-charging space. Consequently, other solar companies are also investing aggressively in the EV arena.

For instance, SolarEdge Technologies’ SEDG EV-charging single-phase inverter enables homeowners to charge their electric vehicles directly using solar energy, maximizing their solar usage and thus reducing their electricity bills. Its customers also gets the benefit to charge EVs up to 2.5 times faster than a standard EV charger through an innovative solar boost mode that utilizes grid and photovoltaic (PV) charging simultaneously.

Also, SolarEdge Technologies’ EV-charging single-phase inverter supports full network connectivity and integrates seamlessly with the SolarEdge monitoring platform. Moreover, it provides an option to homeowners to track their charging status, control vehicle charging, and set charging schedules. The SEDG stock has gained 54.8% in the past year.

Similarly, Sunnova Energy International’s NOVA ChargePoint Home Flex is a 240V, Level 2 EV charger, which is faster and smarter than standard wall-plug chargers and can charge any EV. It offers the flexibility to charge EV at home up to 9X faster than the standard wall plug in, delivering up to 50 amps of power.

Additionally, Sunnova’s ChargePoint Home Flex comes with a mobile app that helps customers to schedule charging, find public chargers and stay notified about their vehicles’ charging status. The Sunnova stock has returned 24.4% in the past year.

Likewise, SunPower SPWR recently joined hands with Wallbox, through which SunPower’s customers can opt to install a Wallbox home EV charger. Wallbox's Pulsar Plus chargers come with a standard J1772 EV plug and an app that will allow SunPower customers to schedule charging, besides enabling power sharing for two or more chargers with adjustable current output. This, in turn, makes them a fit for all EV models.

SunPower has already begun installing EV chargers for new customers in Southern California this fall. The company expects to expand its offering to additional regions and states throughout 2021. The SunPower stock has provided returns of 24.4% to its investors’ in the past year.

Price Movement

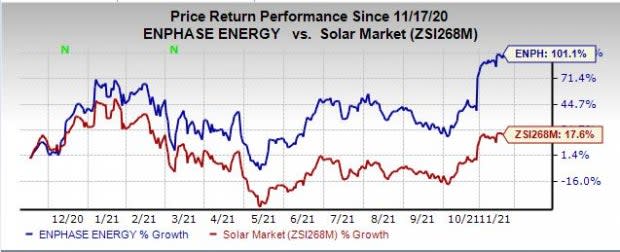

In the past year, the shares of Enphase Energy have gained 101.1% compared with the industry’s 17.6% growth.

Image Source: Zacks Investment Research

Zacks Rank

Enphase Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SunPower Corporation (SPWR) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Sunnova Energy International Inc. (NOVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance