Enphase Energy's (ENPH) Q1 Earnings Beat, Revenues Rise Y/Y

Enphase Energy, Inc. ENPH reported first-quarter 2023 adjusted earnings of $1.37 per share, which indicates a solid 73.4% improvement from 79 cents reported in the prior-year quarter. The bottom line also beat the Zacks Consensus Estimate of $1.21 by 13.2%.

Including one-time adjustments, the company posted GAAP earnings of $1.02 per share, up 175.7% from 37 cents in the year-ago quarter.

Revenues

Enphase Energy’s first-quarter revenues of $726 million beat the Zacks Consensus Estimate of $723 million by 0.4%. The top line soared 64.5% from the prior-year quarter’s reported figure of $441.3 million.

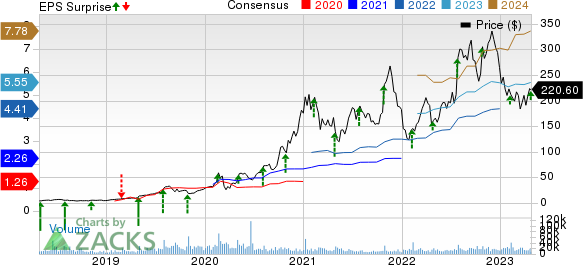

Enphase Energy, Inc. Price, Consensus and EPS Surprise

Enphase Energy, Inc. price-consensus-eps-surprise-chart | Enphase Energy, Inc. Quote

Operational Highlights

The company’s total shipments amounted to approximately 1,957.2 megawatts (MW) or 4,830,589 microinverters and 102.4 MW hours of Enphase IQ Batteries.

Adjusted gross margin expanded 470 basis points year over year to 45.7%.

Adjusted operating expenses escalated 48.5% year over year to $98.4 million.

Adjusted operating income totaled $233.6 million, up 103.9% from $114.5 million reported in the year-ago quarter.

Financial Performance

Enphase Energy had $286 million in cash and cash equivalents as of Mar 31, 2023, compared with $473.2 million as of Dec 31, 2022.

Cash flow from operating activities amounted to $246.2 million compared with $102.4 million in the first quarter of 2022.

Q2 Guidance

For the second quarter of 2023, ENPH expects revenues in the range of $700-$750 million. The Zacks Consensus Estimate for the same is pegged at $760.1 million, which comes in higher than the company’s guided range.

Adjusted operating expenses are expected between $98 million and $102 million. This excludes approximately $57 million estimated for stock-based compensation expenses and acquisition-related costs and amortization.

Adjusted gross margin is expected in the range of 42-45%, excluding stock-based compensation expenses.

Zacks Rank

Enphase Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Solar Releases

SolarEdge Technologies SEDG is slated to release first-quarter 2023 results on May 5. SolarEdge boasts a long-term earnings growth rate of 30.1%.

The Zacks Consensus Estimate for SEDG’s earnings is pegged at $1.95 per share, implying a 62.5% improvement from the year-ago quarter’s reported figure. The same for the company’s sales stands at $928.2 million, indicating a 41.7% increase from that reported in the comparable period of 2022.

SunPower Corporation SPWR is scheduled to release first-quarter 2023 results on May 5. SunPower has a four-quarter average negative earnings surprise of 9.05%.

The stock boasts a long-term earnings growth rate of 38.7%. The Zacks Consensus Estimate for SunPower’s sales is pinned at $428.7 million, indicating a 27.6% improvement from the year-ago quarter’s reported number.

First Solar, Inc. FSLR is slated to report first-quarter 2023 results on Apr 27. First Solar has a trailing four-quarter average earnings surprise of 8.61%.

The Zacks Consensus Estimate for revenues is pegged at $718.7 million, indicating an increase of 95.8% from the prior-year quarter’s reported figure. The same for earnings stands at $1.01 per share, implying a solid improvement from the year-ago quarter’s loss of 41 cents per share.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

SunPower Corporation (SPWR) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance