Enphase (ENPH) Extends Distribution Deal With Natec in Europe

Enphase Energy, Inc. ENPH recently extended its distribution agreement with Natec to boost its presence in the European solar market. This will assist Enphase in exploring new regions of the European solar market and strengthen its position in regions where it already enjoys a significant foothold.

Enphase has been expanding its footprint in Europe steadily, underpinned by different expansion strategies like acquisitions, expanding manufacturing capacity or a strong distribution deal, like the latest one. The extension of the Natec distribution agreement is part of its aim to bolster its business prospects in the region and boost its European customer base.

Enphase’s Positioning in the European Solar Market

The European region offers a compelling growth trajectory for Enphase as the region boasts strong demand for solar energy. As the region reshapes its energy generation ways and induces renewable sources of energy generation, this demand may fortify in the days ahead as solar continues to dominate the renewable space.

Per the report from Solar Power Europe, solar installation in the European region recorded 47% growth in 2022 to 41.4 gigawatts (GW). The report suggests solar deployments in the European region are likely to exceed 50 GW in 2023, with the capacity to record double-digit growth in installations to 85 GW by 2026.

In light of the above projection, it is prudent to say that solar adoption is gradually gaining momentum in Europe and exhibits substantial growth potential in the days ahead. This may benefit solar product manufacturers like Enphase, which have already established a sound position in the European solar market.

In the last reported quarter, in Europe, Enphase recorded an all-time high sell-through of microinverters, with revenues increasing 25% in the region sequentially and nearly tripling year over year.

For the upcoming quarter, Enphase continues to expect healthy returns from the region. With the introduction of state-of-the-art products, IQ8 microinverters and IQ batteries, in many countries in Europe throughout the year, the company will continue to build up steam in the region.

Peer Moves

Europe being an opportunistic market for solar players, other than Enphase, solar companies that have intruded the European solar market for a handful of returns are as follows:

Canadian Solar CSIQ boasts a solar project backlog of 936 megawatt-peak (MWp) in Europe as of Jan 31, 2023. In the latest development, in May, the company announced that six of its photovoltaic solar projects totaling 685 MW located in Spain received favorable Environmental Impact Assessments from the Spanish Ministry.

The Zacks Consensus Estimate for Canadian Solar’s 2023 earnings has been revised upward by 6.5% in the past 60 days. CSIQ shares have increased 34.5% in the past year.

Emeren SOL had mid-to-late-stage projects of 2,161 MW in Europe and operates 60 MW of IPP projects in Europe as of Dec 31, 2022. In May 2023, the company completed the sale of 58 MW solar projects in Poland to Spectris Energy.

The Zacks Consensus Estimate for Emeren’s 2023 sales suggests a growth rate of 85.6% from the prior-year reported figure. Its 2023 earnings estimate has been revised upward by 9.7% in the past 60 days.

In May, First Solar FSLR announced that it strengthened its global leadership in thin-film photovoltaics by acquiring Evolar AB, a European leader in perovskite technology.

The Zacks Consensus Estimate for First Solar’s 2023 earnings has been revised upward by 15.4% in the past 60 days. FSLR shares have recorded a stark improvement of 185.6% in returns in the past year.

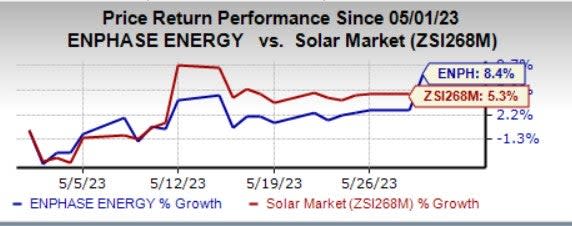

Price Movement

In the past month, shares of Enphase Energy have risen 8.4% compared with the industry’s growth of 5.3%.

Image Source: Zacks Investment Research

Zacks Rank

Enphase Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emeren Group Ltd. Sponsored ADR (SOL) : Free Stock Analysis Report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance