Entergy (ETR) to Report Q1 Earnings: What's in the Offing?

Entergy Corporation ETR is set to release first-quarter 2023 results on Apr 26, before the opening bell.

In the last reported quarter, the company delivered an earnings surprise of 13.33%. Entergy’s earnings beat estimates in the trailing four quarters, the average surprise being 10.18%.

Factors to Consider

In the January-March 2023 quarter, territories served by Entergy witnessed warmer-than-normal weather pattern. This is likely to have resulted in lower electricity consumption for heating purposes by the company’s customers, thereby hurting its revenue growth in the first quarter.

However, tornadoes accompanied with flash floods affected Entergy’s service areas during some parts of the first quarter. This, in turn, is likely to have impacted the company’s overall top-line performance.

The Zacks Consensus Estimate for Entergy’s revenues is pegged at $2.81 billion, indicating a decline of 2.4% from the year-ago period.

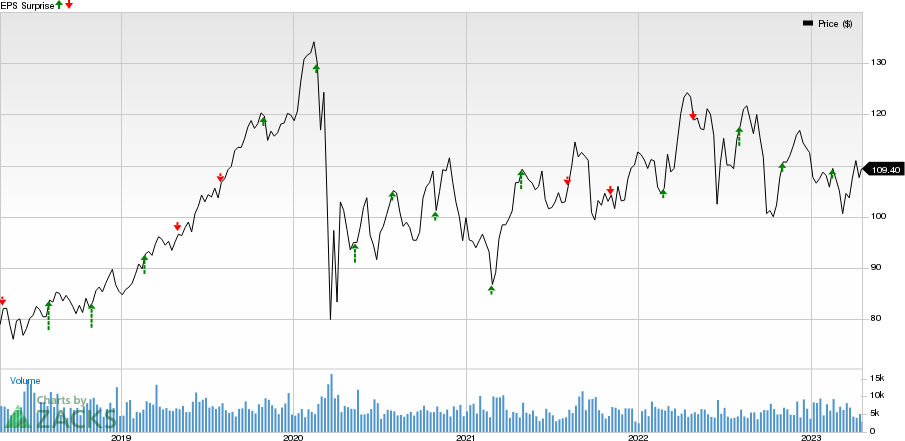

Entergy Corporation Price and EPS Surprise

Entergy Corporation price-eps-surprise | Entergy Corporation Quote

Several factors like increased power delivery expenses, higher nuclear and non-nuclear generation spending, higher depreciation expenses and increased interest expenses are expected to have pushed up the company’s operating expenses. This, along with dismal sales expectations, must have impacted Entergy’s overall earnings performance in the soon-to-be-reported quarter.

The Zacks Consensus Estimate for Entergy’s first-quarter earnings is pegged at $1.43 per share, indicating an 8.3% increase from the year-ago period.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Entergy this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here.

Earnings ESP: The company’s Earnings ESP is -2.11%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Entergy currently carries a Zacks Rank #3.

Stocks to Consider

Here are three Utility players that you may want to consider as these have the right combination of elements to come up with an earnings beat this season:

Consolidated Edison ED has an Earnings ESP of +4.95% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Consolidated Edison boasts a long-term earnings growth rate of 2%. The Zacks Consensus Estimate for ED’s first-quarter sales and earnings is pegged at $4.09 billion and $1.70 per share, respectively.

NextEra Energy NEE has an Earnings ESP of +3.75% and a Zacks Rank #2. The Zacks Consensus Estimate for its first-quarter earnings is pegged at 80 cents per share, implying an improvement of 8.1% from the prior-year quarter.

The same for NextEra Energy’s first-quarter sales is pegged at $5.89 billion. NEE has a four-quarter earnings surprise of 6.21%.

Xcel Energy XEL has an Earnings ESP of +1.50% and a Zacks Rank #3. The Zacks Consensus Estimate for first-quarter earnings is pegged at 73 cents per share, indicating a 4.3% improvement from the year-ago reported figure.

Xcel Energy boasts a four-quarter average earnings surprise of 0.32%. The consensus mark for XEL’s first-quarter sales stands at $3.87 billion, indicating growth of 3.1% from the prior-year quarter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Entergy Corporation (ETR) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance