Enterprise Communication Gains Steam: Watch MSFT, WORK, CSCO

Enterprises are increasingly adopting digital transformation techniques to automate and accelerate business processes, with primary focus on enhancing unified workspace communication to boost productivity.

Ongoing workspace trends of Bring Your Own Device (BYOD), rise in smartphone penetration and increasing number of mobile workers, are fueling the demand for efficient enterprise communication solutions.

Rise in utilization of AI and machine learning (ML) in the communications vertical has paved the way for team collaboration. This, in turn, is facilitating interaction between machines and humans. The infusion of AI within virtual assistants and chat bots, replacing enterprise voice calls, is quintessential in this regard.

Per Adroit Market Research data, global productivity software market is envisioned to hit $96.36 billion by 2025, at a CAGR of 16.5% from 2018 to 2025. According to Mordor Intelligence data, enterprise communication infrastructure market is anticipated to see a CAGR of 17.53% between 2020 and 2025.

Technology companies like Microsoft MSFT, Slack Technologies WORK, Cisco CSCO, Citrix Systems CTXS, Zoom Video Communications ZM, among others, are leaving no stone unturned to capitalize on evolving workspace demands for seamless enterprise communication tools.

Solid adoption of cloud-based services, increasing proliferation of IoT, AR/VR devices and accelerated deployment of 5G are expected to be tailwinds.

Microsoft Takes on Slack With Teams Ad Push

Microsoft recently unveiled a TV commercial, titled “The Power of Teams,” for Microsoft Teams. The 30-second ad slated to air during Sunday’s NFL playoffs, highlights how users can leverage Teams seamlessly on the go and do away with conventional boring business meetings.

The latest ad, targeted at users across the United States, the U.K., Germany and France, is aimed at expanding Teams user base, taking the fight to Slack.

Markedly, the company offers Teams as part of Office 365 subscription. Recent enhancements to Teams comprise integration with Outlook, and workflow consolidation changes.

Integration of Yammer, Office, tasks, and other Microsoft-focused solutions into Teams, is enabling the company to make workspace communication more efficient, and boost user base.

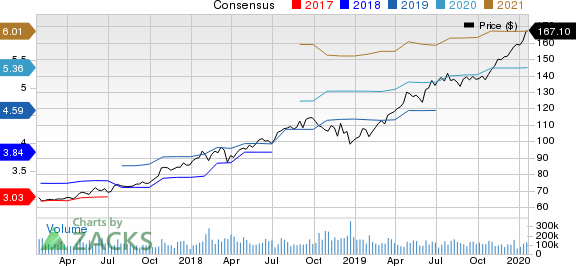

Microsoft Corporation Price and Consensus

Microsoft Corporation price-consensus-chart | Microsoft Corporation Quote

These initiatives are aiding the Zacks Rank #3 (Hold) company to thwart Slack competition. Teams’ 20 million daily active users (DAU) dwarfs Slack’s 12 million count. Moreover, per reports, out of Fortune 100 companies, 91 have implemented Microsoft Teams.

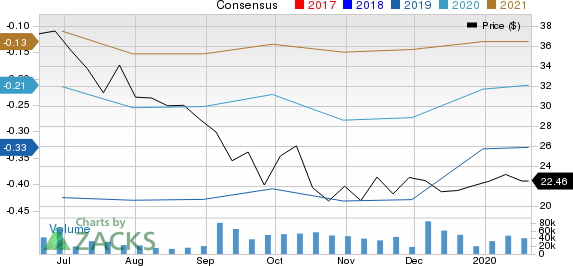

Nonetheless, Slack is bringing up new features to strengthen its platform. Third-party app integration is a key differentiator from Microsoft Teams.

Moreover, Slack, which carries a Zacks Rank #2 (Buy), supports unlimited users and channels. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

On the other hand, Microsoft Teams supports a maximum of 30 private channels per team, with each private channel having a maximum of 250 members.

Slack Technologies, Inc. Price and Consensus

Slack Technologies, Inc. price-consensus-chart | Slack Technologies, Inc. Quote

Cisco’s Webex Meetings Deserve a Special Mention

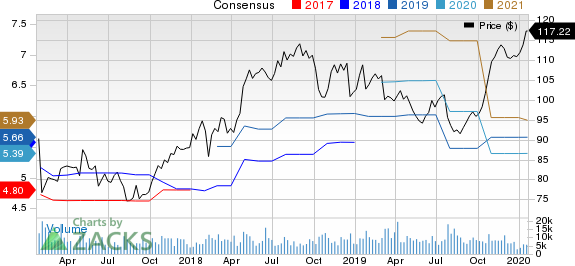

Cisco has integrated Cisco Spark with Webex Platform, which enhanced Webex Meeting and enabled it to introduce Webex Teams, thereby strengthening its collaboration portfolio.

Moreover, the company aims to enrich Webex Assistant service with AI-based voice-recognition and transcription capabilities from the Voicea acquisition.

Further, integration of AI and ML capabilities into enterprise collaboration solutions is anticipated to increase productivity of users, and improve engagement. This, in turn, is expected to bolster adoption of Webex Meetings, Webex Devices and Webex Teams, among others.

Cisco Systems, Inc. Price and Consensus

Cisco Systems, Inc. price-consensus-chart | Cisco Systems, Inc. Quote

Notably, Gartner’s positioning of this Zacks Rank #3 company, in the Leader’s Quadrant in the latest “2019 Gartner Magic Quadrant for Meeting Solutions” is a testament to the growing influence of Cisco’s enterprise communications solutions.

Citrix Undertaking Initiatives to Keep Pace

Citrix is gaining from solid adoption of unified workspace solutions and hybrid cloud offerings. Furthermore, traction witnessed by ShareFile deserves a special mention.

The company recently introduced Citrix Analytics for Performance, with an aim to aid IT administrators to assess and address system performance concerns to boost employee efficiency.

Citrix Systems, Inc. Price and Consensus

Citrix Systems, Inc. price-consensus-chart | Citrix Systems, Inc. Quote

Moreover, this Zacks Rank #3 company has collaborated with Palo Alto Networks, a notable cybersecurity company, to facilitate deployment of firewalls in Citrix SD-WAN, empowering customers with robust security capabilities.

Additionally, acquisitions of Cedexis and Sapho remain noteworthy. The buyouts are expected to aid Citrix in enhancing Workspace suite with guided work capabilities and traffic management functionalities.

Other Notable Names in the Space

Zoom and Dropbox DBX are also leaving no stone unturned to enhance their enterprise communication offerings with marketing and third-party app integrations. Moreover, Alphabet’s GOOGL Google is also striving to enhance its enterprise G-Suite with advanced AI and ML-powered capabilities.

While Zoom and Alphabet currently have a Zacks Rank #2, Dropbox carries a Zacks Rank of #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Citrix Systems, Inc. (CTXS) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

Slack Technologies, Inc. (WORK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance