Enterprise Financial Services Corp Reports Q1 2024 Earnings: A Detailed Review

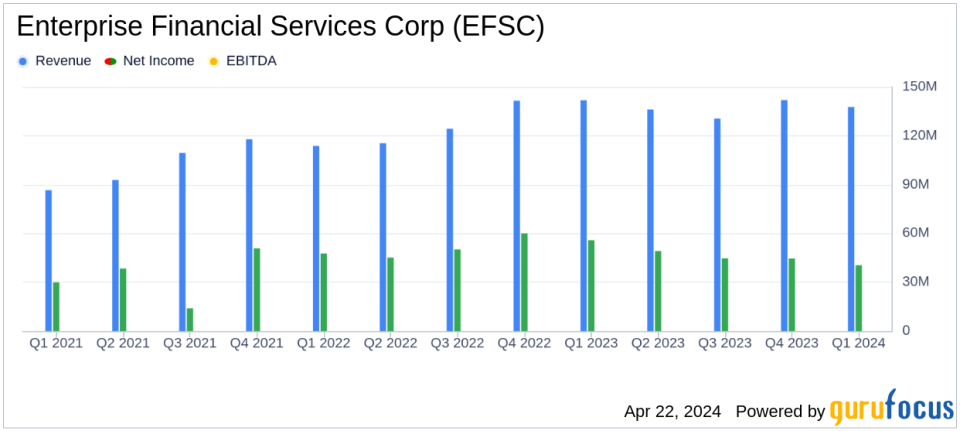

Net Income: Reported at $40.4 million, falling short of the estimated $41.94 million.

Earnings Per Share (EPS): Achieved $1.05 per diluted share, below the estimate of $1.11.

Revenue: Net interest income totaled $137.7 million, a decrease from previous quarters and below the estimated $157.34 million.

Loan Growth: Total loans reached $11.0 billion, marking a quarterly increase of $144.4 million.

Deposits: Total deposits grew to $12.3 billion, with a quarterly increase of $77.3 million.

Net Interest Margin (NIM): Decreased to 4.13%, reflecting a compression from both the linked and prior year quarters.

Asset Quality: Nonperforming assets to total assets ratio stood at 0.30%, showing a slight improvement from the linked quarter.

On April 22, 2024, Enterprise Financial Services Corp (NASDAQ:EFSC) disclosed its first-quarter financial results through an 8-K filing. The company reported a net income of $40.4 million, or $1.05 per diluted common share, which did not meet the analyst's estimated earnings per share of $1.11. This performance marks a decline from both the linked quarter and the same period last year, where EPS stood at $1.16 and $1.46 respectively.

Enterprise Financial Services Corp, a financial holding company, provides a variety of banking and wealth management services across several states including Arizona, California, Florida, Kansas, Missouri, Nevada, and New Mexico. The company's services cater to both individual and business clients, offering an array of banking solutions alongside wealth management.

Financial Performance Insights

The reported net interest income for the quarter was $137.7 million, a decrease from previous periods, attributed to higher interest expenses and fewer days in the quarter. The net interest margin also saw a reduction to 4.13%, continuing the downward trend from previous quarters. Total loans showed a modest increase to $11.0 billion, indicating a continued expansion in EFSC's lending activities.

Noninterest income was reported at $12.2 million, a significant drop due to decreased tax credit income and lower fair value of certain tax credits. Noninterest expenses were up slightly at $93.5 million, driven by increases in employee compensation and other operational costs.

Challenges and Market Conditions

EFSC's performance this quarter reflects the challenging interest rate environment which has increased the cost of deposits significantly, impacting the net interest margin. The financial sector is also experiencing a high competitive pressure that affects pricing and cost structures. Despite these challenges, EFSC maintains a strong liquidity position with significant on- and off-balance-sheet resources, ensuring operational stability.

Strategic Achievements and Outlook

EFSC has managed to grow its loan and deposit portfolios, a positive indicator of underlying business strength. The company's strategic focus on maintaining a diversified loan portfolio and robust credit quality continues to be a cornerstone of its business model. Looking forward, EFSC is poised to leverage its strong market positions to capture growth opportunities as economic conditions evolve.

Analysis of Key Financial Metrics

The company's return on average assets was 1.12%, and the return on average tangible common equity stood at 12.31%, both showing decreases from previous periods but reflecting solid profitability metrics in a tough market. The tangible common equity to tangible assets ratio improved slightly, indicating a stronger balance sheet.

EFSC's management remains optimistic about the future, citing strong customer activity and robust pipelines for loans and deposits. However, the current financial results and the challenges posed by the economic environment suggest a cautious outlook is warranted.

In conclusion, while EFSC faces headwinds from rising interest costs and market competition, its strategic initiatives and solid financial positioning bode well for its ability to navigate the complexities of the current financial landscape. Investors and stakeholders will likely watch closely how EFSC adapts to these challenges in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Enterprise Financial Services Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance