Epizyme (EPZM) Q2 Earnings Beat Estimates, Revenues Up Y/Y

Epizyme, Inc. EPZM incurred a loss of 21 cents per share in second-quarter 2022, narrower than the Zacks Consensus Estimate of 36 cents and the year-ago quarter’s loss of 63 cents.

Total revenues in the second quarter were $27.5 million compared with $13 million in the prior-year quarter. Revenues beat the Zacks Consensus Estimate of $10 million.

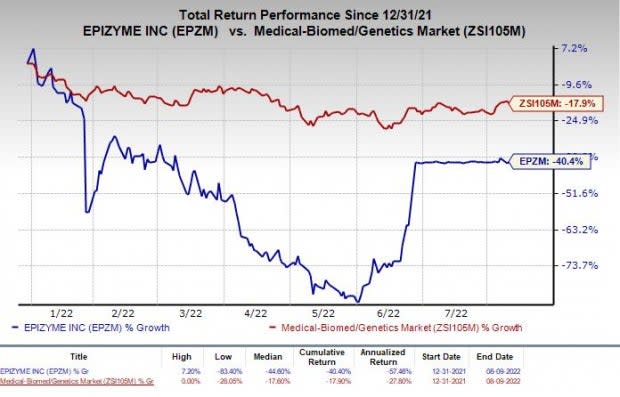

Shares of Epizyme have plunged 40.4% so far this year compared with the industry’s 17.9% decline.

Image Source: Zacks Investment Research

Quarter in Detail

Tazverik (tazemetostat) received accelerated approval from the FDA in January 2020 to treat metastatic or locally-advanced Epithelioid Sarcoma (ES). In June 2020, the regulatory body approved the supplemental new drug application for Tazverik for two distinct follicular lymphoma (FL) indications.

The drug generated net product revenues worth $11 million in the second quarter. Commercial sales of the drug were $8.9 million.

Adjusted research and development expenses declined 18.9%, to $26.5 million from $32.7 million in the year-ago quarter. Selling, general and administrative expenses also declined 27.9% to $21 million from $29.1 million in the prior-year quarter.

Epizyme had $144.4 million of cash, cash equivalents and marketable securities as of Jun 30, 2022, compared with $199.7 million on Mar 31, 2022.

Recent Updates

Epizyme entered into a definitive merger agreement with Europe-based Ipsen IPSEY in June, wherein the latter will acquire all the outstanding shares for an estimated aggregate consideration of $247 million. The transaction is expected to be completed by third-quarter 2022.

As a part of the agreement, IPSEY is also acquiring Epizyme’s investigational oral SETD2 inhibitor, EZM0414.

EZM0414 is currently being evaluated in phase I/Ib study (SET 101) for the treatment of adult patients with relapsed/refractory (R/R) MM and R/R diffuse large B-Cell lymphoma (DLBCL). The company recently completed dosing the first patient in the study.

Epizyme has only one marketed drug in its portfolio, Tazverik (tazemetostat). Since the FDA approval for Tazverik to treat both indications is under an accelerated pathway, Epizyme is also conducting confirmatory studies for epithelioid sarcoma (ES) and follicular lymphoma (FL) with Tazverik.

Epizyme completed enrollment in phase II randomized portion of the CELLO-1 study (EZH-1101), evaluating tazemetostat in combination with enzalutamide in patients with metastatic castration-resistant prostate cancer patients.

The company also completed enrollment in both the DBCL and FL arms of the Lymphoma Study Association (LYSA) phase I/II combination study evaluating tazemetostat with R-CHOP in high-risk, front-line FL and DLBCL patients. The results from the phase II portion are expected by the end of 2022.

EPZM initiated a phase Ib/II basket study, ARIA (EZH-1501), during fourth-quarter 2021 to evaluate the safety and efficacy of tazemetostat across multiple new types of hematological malignancies.

Epizyme, Inc. Price, Consensus and EPS Surprise

Epizyme, Inc. price-consensus-eps-surprise-chart | Epizyme, Inc. Quote

Zacks Rank and Stocks to Consider

Epizyme currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Novavax NVAX and Sesen Bio SESN, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Novavax’s earnings estimates for 2022 have remained steady at $27.23 over the past 30 days. Shares of NVAX have declined 71.8% year to date. Earnings of Novavax missed estimates in all of the last four quarters. NVAX delivered a negative earnings surprise of 184.49%, on average.

Sesen Bio’s loss estimates for 2022 have remained steady at 44 cents per share over the past 30 days. Shares of SESN have declined 13.4% year to date. Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark on one occasion. SESN delivered an earnings surprise of 69.94%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novavax, Inc. (NVAX) : Free Stock Analysis Report

Epizyme, Inc. (EPZM) : Free Stock Analysis Report

IPSEN (IPSEY) : Free Stock Analysis Report

SESEN BIO, INC. (SESN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance