Epizyme (EPZM) Stock Surges on Acquisition Offer From Ipsen

Shares of Epizyme EPZM surged 60% in pre-market trading on Jun 27 after management announced that it has signed a definitive merger agreement with Europe-based Ipsen IPSEY, wherein the latter will acquire all the outstanding shares for an estimated aggregate consideration of $247 million.

Per the agreement terms, Ipsen will pay upfront cash of $1.45 per share to current Epizyme shareholders, representing a premium of 52% to EPZM’s closing price on Jun 24.

In addition, the existing shareholders will also be eligible to receive one contingent value right (“CVR”) per share. A CVR of $0.30 per share will be paid by IPSEY if, by Dec 31, 2026, the aggregate sales of Tazverik (excluding sales in Japan and Greater China) in any four consecutive quarters cross the $250 million threshold. A further $0.70 per share will also be payable by Ipsen if the combination of Tazverik with R2 (rituximab and lenalidomide) receives FDA approval for use in second-line follicular lymphoma by Jan 1, 2028.

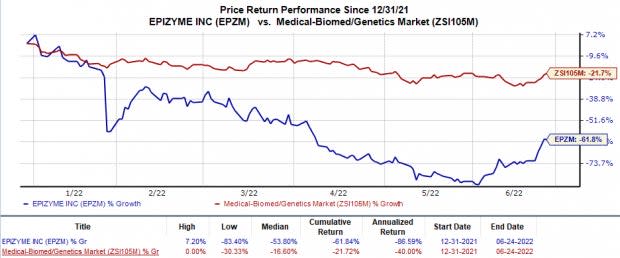

Shares of Epizyme have plunged 61.8% in the year so far in comparison with the industry’s 21.7% decline.

Image Source: Zacks Investment Research

Currently, Epizyme has only one marketed drug in its portfolio, Tazverik (tazemetostat). A methyltransferase inhibitor, Tazverik was approved by the FDA in January 2020, to treat adults and pediatric patients aged 16 years and above with metastatic or locally advanced epithelioid sarcoma (ES) not eligible for complete resection. The drug also approved the label expansion for Tazverik in June 2020 to treat two distinct follicular lymphoma (FL) indications in adult patients. Both indications are approved by the FDA under the accelerated pathway.

As part of the accelerated approval for ES & FL, the company is evaluating Tazverik in separate ES & FL confirmatory studies. The ES confirmatory study is evaluating Tazverik in combination with doxorubicin compared with doxorubicin plus placebo as a front-line treatment for ES. Additionally, the FL confirmatory study is evaluating Tazverik in combination with R2, compared with R2 plus placebo for treating relapsed/refractory FL patients.

Epizyme has a marketed product in its portfolio, which was approved recently. Hence, the sales of the drug have not been substantial. During the commencement of the year, EPZM floated a secondary issue of shares of its common stock to the public at an issue price of $1.50 per share (excluding underwriting discounts), approximately amounting to $85 million. This $1.50 share price was at a 21% discount to the previous day’s closing price of $1.90 when this announcement was made. One of the main reasons for this equity raise was to avoid the problem of facing a cash crunch.

The acquisition by a big pharma company like Ipsen, which has a steady stream of cash, would give a small but growing company like Epizyme the opportunity to expand its pipeline development and access IPSEY’s larger and well-established commercial supply chain and network distribution.

The addition of an already approved drug like Tazverik is expected to expand Ipsen’s pipeline in oncology. Tazemetostat is also being evaluated across multiple cancer indications. A phase I/IIb study evaluating the drug in metastatic castration-resistant prostate cancer patients (mCRPC) is currently underway.

IPSEY is also acquiring Epizyme’s investigational oral SETD2 inhibitor, EZM0414, which is currently being evaluated in a phase I/Ib study (SET-101) across relapsed/refractory multiple myeloma and diffuse large B-cell lymphoma (DLBCL).

The acquisition deal was unanimously approved by the board of directors of both companies. The transaction, expected to be completed by third-quarter 2022, is subject to customary closing conditions and clearance from the regulatory authorities.The transaction will be fully financed by Ipsen’s existing cash and lines of credit.

Epizyme, Inc. Price

Epizyme, Inc. price | Epizyme, Inc. Quote

Zacks Rank & Stocks to Consider

Epizyme currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the overall healthcare sector are Alkermes ALKS and Sesen Bio SESN. While Alkermes sports a Zacks Rank #1 (Strong Buy) at present, Sesen Bio carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Alkermes’ 2022 bottom line have narrowed from a loss of 10 cents to 3 cents in the past 60 days. Shares of Alkermes have risen 27.7% year to date.

Earnings of Alkermes beat estimates in each of the trailing four quarters, with the average surprise being 350.5%. In the last reported quarter, Alkermes delivered an earnings surprise of 1,100%.

Estimates for Sesen Bio’s 2022 bottom line have declined from a loss of 46 cents to 44 cents in the past 60 days. Shares of Sesen Bio have risen 0.3% in the year-to-date period.

Earnings of Sesen Bio beat estimates in three of the last four quarters and missed the mark once, with the average surprise being 69.9%. In the last reported quarter, Sesen Bio delivered an earnings surprise of 100%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Epizyme, Inc. (EPZM) : Free Stock Analysis Report

IPSEN (IPSEY) : Free Stock Analysis Report

SESEN BIO, INC. (SESN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance